Backed By CZ, Aster Token Ignites With 1,650% First-Day Rally

Aster’s native token, ASTER , surged 1,650% in its first 24 hours of trading and reached $0.528, according to platform reports.

Trading volume for the token in that window was listed at $345 million, and the launch reportedly drew 330,000 new wallets.

Rapid User Growth And Liquidity

According to on-chain data and platform disclosures, Aster’s total value locked jumped from $660 million to $1 billion shortly after launch.

The platform claims total users of 1.848 million, with seven-day new user additions hitting 617,379. Reports show daily figures of 53,332 new users and $1.50 billion in 24-hour trading volume.

The debut also included a Binance Alpha listing within hours and new perpetual markets introduced with up to 50x exposure across four assets. Platform income was reported at $466,838 for a day and $49.2 million in total earnings to date.

A significant first step for $ASTER on BNB Chain.

• $345M traded in 24h • Price reached $0.528 (~1,650%) • 330K new wallets joined • TVL $660M → $1.005B • Platform volume near $1.5B

Thanks to our community for the trust and support. We’ll keep focusing on building an open… pic.twitter.com/cgPlwb2FVh

— Aster (@Aster_DEX) September 18, 2025

Feature Rollouts And Trading Tools

Based on reports, Aster moved quickly to enable spot withdrawals earlier than planned, using BNB Chain with a quoted 30-second processing time.

The team activated ASTER/USDT perpetuals with four-times margin and hourly funding rate settlements. The platform also introduced a Genesis Stage 2 scoring program that rewards more than just raw trading volume, aiming to favor what it calls “smart traders.”

Top users have been reported to show realized gains greater than $645,000 in early trading sessions.

Technical Features And Security

Technical Features And Security

Aster has positioned itself as a multi-chain protocol with native support across BNB Chain, Ethereum, Solana, and Arbitrum, removing the need for manual bridging for many flows, according to technical notes.

The protocol uses zero-knowledge proofs on its own Aster Chain for trade validation and taps Pyth Network oracles for price feeds.

Reports show the platform uses collateral tokens like asBNB and USDF that can be staked to earn yield while remaining active in trading.

Strong EndorsementMeanwhile, platform data listed $517 trillion in cumulative trading volume and close to $450 million in total TVL .

Much of Aster’s surge can be tied to the strong backing of former Binance CEO Changpeng Zhao. His public endorsements, where he compared the platform’s liquidity to “Binance level” and praised the team’s execution, have played a major role in drawing attention and capital to the project.

Featured image from Unsplash, chart from TradingView

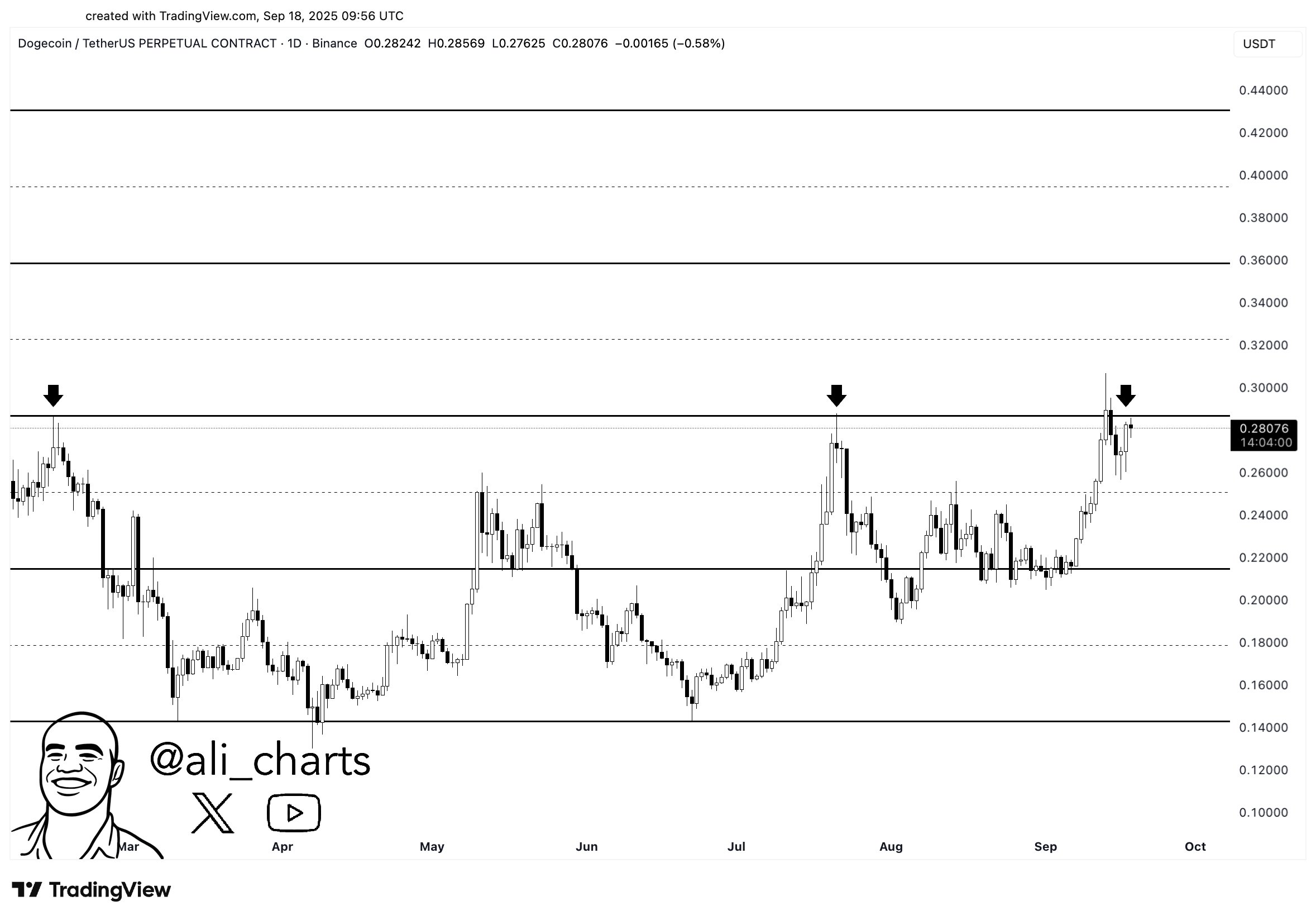

Dogecoin Ready To Bark Again? Analyst Sees Path To $0.45

An analyst has pointed out how Dogecoin could see a rally to $0.36 or even $0.45 if its price can ma...

Countdown To ‘Bitcoin Bottom Day’: Why September 21 Could Change Everything

Bitcoin (BTC), the leading cryptocurrency, has experienced a notable decline, erasing the gains it a...

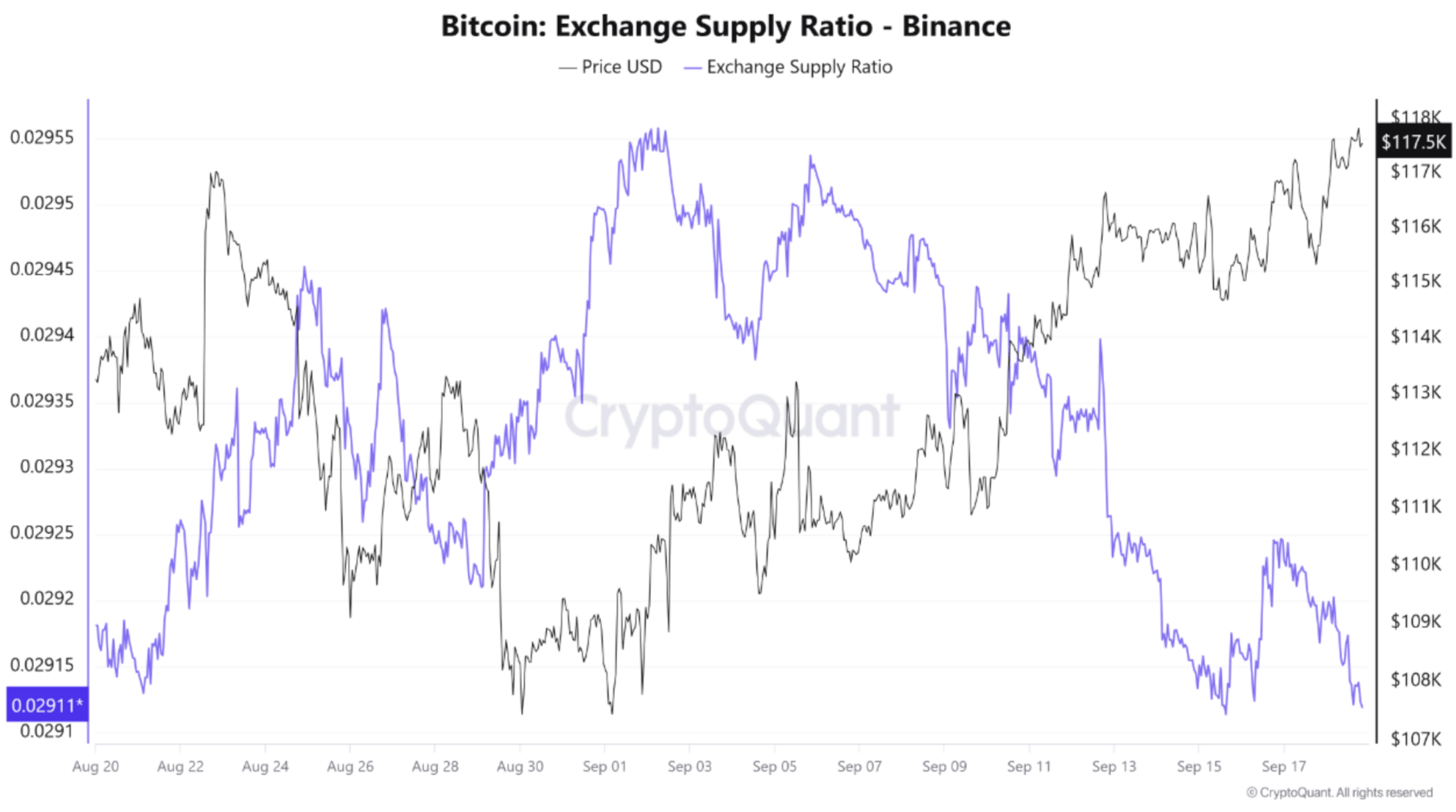

Bitcoin Exchange Supply Ratio Declines After Fed Cut, Setting Stage For $120,000 Test

Earlier this week, the US Federal Reserve (Fed) cut interest rates by 25 basis points, providing the...