Ethereum Price Pressure Mounts With $10B Staking Withdrawals and Meme Coin Buzz Rising

Ethereum’s Proof-of-Stake (PoS) network is facing a liquidity crunch after a surge of withdrawals totaling 2.369 million ETH ($10.2B) entered the exit queue in September 2025. The withdrawal queue has expanded 327% in a week, underscoring a shift as staking yields fall to 2.84%, the lowest since Ethereum’s move to PoS in 2022.

A significant portion of the capital is flowing into decentralized finance (DeFi) protocols, which offer better rewards. Pendle’s stETH pools currently pay 5.4% APR, drawing roughly 40% of exit ETH into higher-yield opportunities. This is weighing on short-term sentiment and creating congestion, with exit processing times stretching to 43 days.

At the same time, retail-focused speculation remains active, particularly around the BullZilla ($BZIL) presale. The project’s “Whale Signal Detected” stage has already raised more than $ 580,000, sold 28 billion tokens, and attracted over 1,900 holders, a clear snapshot of retail energy contrasting with Ethereum’s institutional capital rotation.

Ethereum Breaking News: Kiln Exit and DeFi Migration

A single driver accounts for much of the exodus: staking provider Kiln withdrew 1.6M ETH, nearly 61% of the total exit queue, following the July 2025 SwissBorg hack. Analysts note this represents rotational capital rather than permanent exits.

Ethereum’s validator entry queue has shrunk to 320,000 ETH, confirming that fewer new participants are joining staking under current conditions. Meanwhile, Ethereum TVS (Total Value Staked) has fallen to 36M ETH, declining by 150,000 ETH weekly. In parallel, Ethereum DeFi TVL reached a record $97B, showing that yield competitiveness is reshaping the ETH ecosystem.

Institutional Patience, Retail Shifts

Despite liquidity stress, institutional investors remain engaged. Bitcoin Immersion, a major treasury management firm, has accumulated 1.52M ETH ($6.6B), signaling that Ethereum remains a strategic asset.

Retail traders, however, are chasing alternative narratives. Meme coin presales like BullZilla are gaining momentum, showing how Ethereum ROI trends extend beyond staking and DeFi into high-risk, high-reward speculation.

ETH Price Prediction September 2025

With more than $10B queued for withdrawal, Ethereum price stability is being tested. Analysts warn that persistent exit delays and declining yields could create near-term sell pressure.

Still, ETH September 2025 forecasts remain cautiously optimistic. Rising DeFi adoption, institutional treasury demand, and Ethereum’s dominance in smart contracts and Layer 2 scaling underpin long-term strength. In short, while withdrawals dominate crypto news today ETH, the bigger picture still favors Ethereum’s role as a cornerstone blockchain.

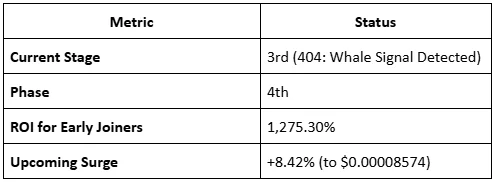

Whale Signal Detected: BullZilla Presale Tracker

While Metaplanet captures headlines with its billion-dollar treasury play, retail energy is surging in presales like BullZilla ($BZIL). The project is now in Stage 3: Whale Signal Detected, and its numbers are drawing attention.

| Metric | Status |

|---|---|

| Current Stage | 3rd (404: Whale Signal Detected) |

| Phase | 4th |

| Current Price | $0.00007908 |

| Tokens Sold | 28 Billion |

| Presale Raised | $580,000+ |

| Holders | 1,900+ |

| ROI (Stage 3D → Listing $0.00527) | 6,565.92% |

This presale snapshot highlights how grassroots investors are finding opportunities outside Ethereum staking, reflecting the same ETH vs altcoins narrative where speculative bets compete with network-level yields.

Conclusion

Ethereum’s PoS network is undergoing one of its most significant liquidity shifts since the Merge, with $10.2B queued for withdrawal and validators migrating to higher-yield DeFi platforms. The congestion, driven largely by Kiln’s massive exit, reflects a competitive market for yield rather than systemic weakness.

At the same time, Bull Zilla ‘s presale tracker shows how retail speculation thrives alongside Ethereum’s institutional story. Together, these developments illustrate how capital in 2025 is diversifying, with staking, DeFi, and presales all competing for investor attention.

For More Information:

BZIL Official Website

Join BZIL Telegram Channel

Follow BZIL on X (Formerly Twitter)

Frequently Asked Questions About Ethereum and BullZilla Presale

Why are ETH staking withdrawals rising?

Declining staking yields and better DeFi APRs are driving funds out of Ethereum staking pools.

How much ETH is currently in the exit queue?

2.369M ETH, valued at $10.2B.

What caused the surge in September 2025?

Kiln’s 1.6M ETH withdrawal after the SwissBorg hack triggered most of the activity.

How long does it take to withdraw ETH?

On average, 43 days plus 9.1 days for settlement.

Where is the ETH going?

Around 40% is being reallocated to DeFi protocols like Pendle.

What is BullZilla’s presale status?

It has raised $580K+, sold 28B tokens, and reached 1,900+ holders.

What is the ETH price outlook for September 2025?

Short-term volatility remains, but long-term adoption continues to strengthen Ethereum’s case.

Glossary of Key Terms

- Ethereum PoS : Ethereum’s Proof-of-Stake consensus mechanism.

- Exit Queue : Validator backlog for unstaking ETH.

- TVS (Total Value Staked) : ETH locked in staking.

- TVL (Total Value Locked) : Assets locked in DeFi protocols.

- APR : Annual Percentage Rate on staked or pooled assets.

- Kiln : Staking provider responsible for a major ETH withdrawal.

- SwissBorg Hack : July 2025 breach influencing ETH exits.

- Pendle : DeFi protocol offering tokenized yield strategies.

- BullZilla : Meme coin presale project attracting retail traders.

- ETH vs Altcoins : Comparative view of Ethereum against other cryptocurrencies.

Article Summary

Ethereum’s PoS network is witnessing record outflows, with 2.369M ETH ($10.2B) queued for withdrawal in September 2025. The sharp increase, driven by Kiln’s 1.6M ETH exit after the SwissBorg hack, reflects falling staking yields of 2.84% and rising DeFi APRs like Pendle’s 5.4% pools. Exit times now average 43 days, cutting Ethereum’s TVS by 150K ETH weekly, while DeFi TVL has reached $97B. Institutions like Bitcoin Immersion continue to accumulate ETH, reinforcing long-term strength. On the retail side, BullZilla’s presale tracker shows $580K raised and 28B tokens sold, illustrating how speculation balances Ethereum’s institutional story. Together, these dynamics define Ethereum’s dual-track adoption in September 2025.

Disclaimer

The paper is a piece of information, and it is not financial advice. Ethereium and presale tokens such as BullZilla are both volatile and speculative. Their due diligence should be applied by the reader who must seek the services of licensed professionals before investing.

Moonbirds and Azuki IP Coming to Verse8 as AI-Native Game Platform Integrates with Story

Seoul, South Korea, 23rd September 2025, Chainwire...

Pop Social Taps CryptoPay to Redefine Web3 Social Empowerment and Payments

The partnership between Pop Social and CryptoPay aims to revolutionize the payment and AI-led social...

ETH-Based Little Pepe Raises $26M in Presale

Dubai, UAE, 23rd September 2025, Chainwire...