SoftBank, Ark Invest Among Potential Investors In Tether’s $15 Billion Funding Round

The industry’s largest stablecoin issuer, Tether (USDT), is reportedly in discussions with a series of leading firms including SoftBank Group and Ark Investment Management, for a significant funding round aimed at raising between $15 billion and $20 billion.

This capital influx could potentially value the company at an astonishing $500 billion. Bloomberg News first reported these developments, indicating that Tether is exploring private placement opportunities to solidify its position in the market.

SoftBank And Ark Invest’s Potential Involvement

Per the report , the involvement of SoftBank and Ark could significantly enhance Tether’s credibility in the eyes of mainstream investors, particularly as the company seeks to overcome previous scrutiny regarding its role in the cryptocurrency ecosystem.

Amidst this search for funding, Tether is also expanding its investment horizons beyond digital assets, venturing into sectors such as artificial intelligence (AI), telecommunications, cloud computing, and real estate.

Adding to the momentum, Tether recently appointed Bo Hines, a former advisor to President Trump on cryptocurrency matters, as CEO of its US division.

This move aligns with Tether’s vision to establish a new operation in the US, adhering to the new regulatory environment, particularly following the introduction of a new dollar-pegged cryptocurrency aimed at businesses and institutions, dubbed “USAT.”

Tether And US Regulatory Standards

As NewsBTC reported recently, the new token adheres to the regulatory framework established by the GENIUS Act, the first stablecoin legislation signed into law by President Trump, highlighting Tether’s focus on aligning with US regulatory standards.

Paolo Ardoino, Tether’s CEO, noted that the firm’s USDT stablecoin serves as a crucial financial tool for millions in emerging markets, showcasing how digital assets can foster trust, resilience, and financial freedom on a global scale.

Featured image from DALL-E, chart from TradingView.com

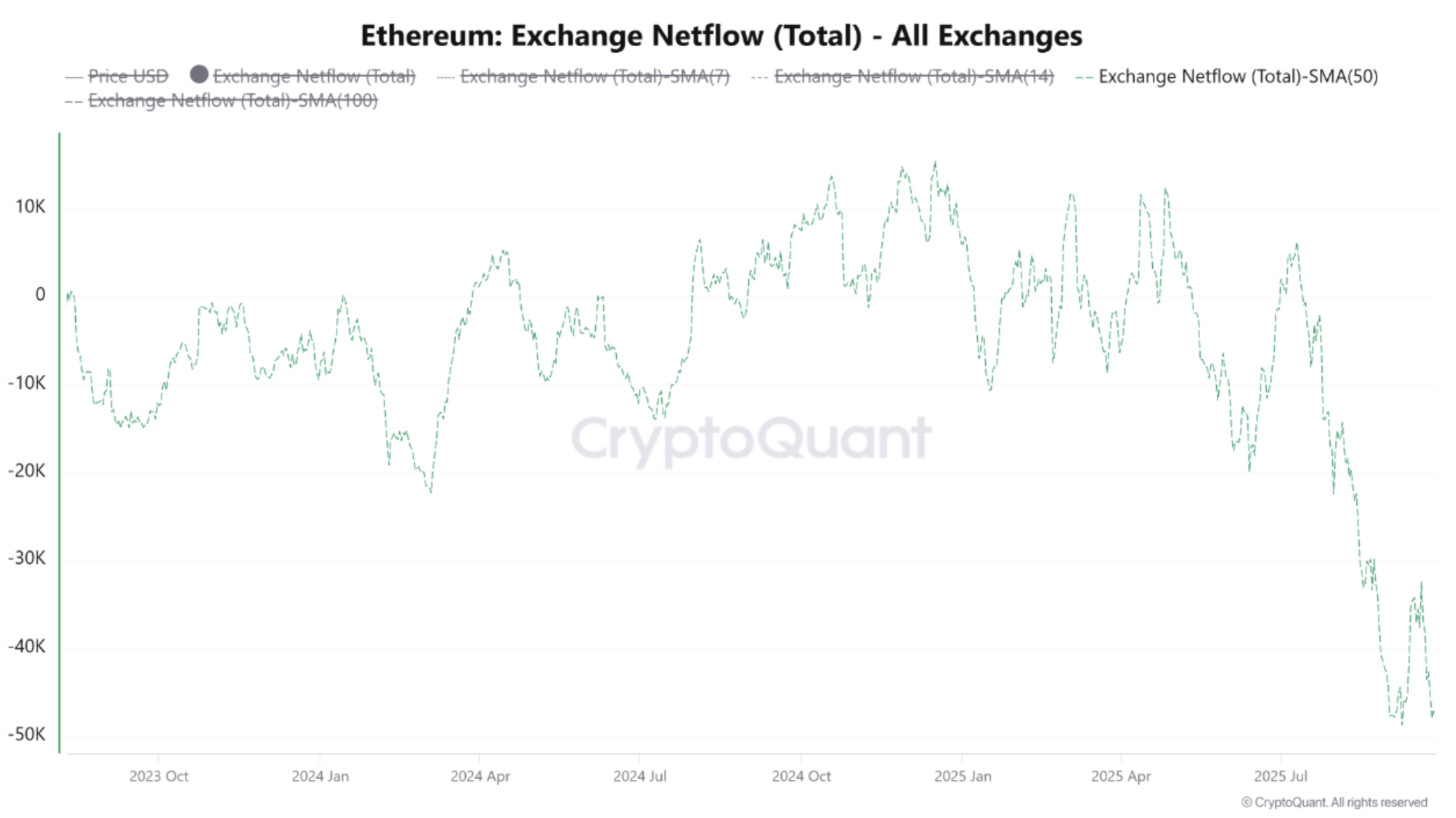

Ethereum Supply On Exchanges Shrinks: Multi-Year Lows Signal Bullish Setup

As Ethereum (ETH) fell below $4,000 for the first time since August 8, amid a market-wide pullback, ...

Ethereum Stuck Below $4,060: A Fakeout Or Fresh Leg Down To $3,600?

Ethereum finds itself at a crossroads after tapping the $3,800 liquidity level and bouncing back, on...

Bitcoin Bull Run Is Over? These Signals Show Where The Market Is At

Bitcoin (BTC) has entered a critical phase in its cycle, prompting analysts to debate whether the lo...