SWIFT Is Planning To Launch Its Own Blockchain Amid Trillion-Dollar Battle, But It’s Not With Ripple

SWIFT, the global network that handles most of the world’s cross-border payments, is preparing to launch its own blockchain as rumors about an ongoing payments battle with Ripple circulate. While many often compare SWIFT’s role to Ripple due to its XRP-linked payment solutions, this new plan is not a direct challenge to the fintech company, but rather part of a much larger trillion-dollar race to define the future of digital money.

SWIFT Partners With Consensys To Build Blockchain Network

According to the announcement, SWIFT is collaborating with Consensys, the Ethereum development company founded by Joe Lubin, to create a shared digital ledger that supports faster, cheaper, and more efficient international transactions.

SWIFT is still keeping its blockchain ledger in the prototype stage, but leading banks are already testing it. JP Morgan in the United States and Deutsche Bank in Europe are among the major institutions participating in these early trials.

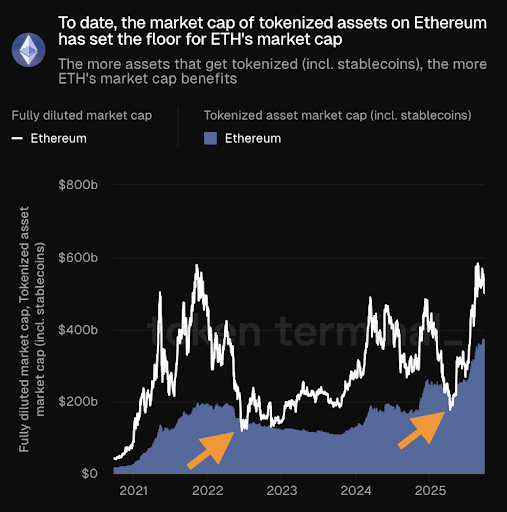

SWIFT and its partners design the new infrastructure to support regulated stablecoins as well as tokenized assets. The shared ledger links directly to private blockchains that organizations use internally and to public blockchains open to the general public. By connecting the two, banks and financial companies in different regions will be able to join the platform without having to abandon the systems they already use.

Ripple, long known for linking its XRP token with cross-border solutions, has been in this space for years. However, the announcement notes that SWIFT’s strategy differs. Instead of relying on a single cryptocurrency, it is creating a network that works directly with banks and established institutions.

Trillion-Dollar Stablecoin Threat Pushes SWIFT Into Blockchain Race

SWIFT’s move to launch its own blockchain could be part of a much bigger trillion-dollar battle in the payments world. Stablecoins, which are digital assets tied to fiat currencies, are now used in transactions worth trillions of dollars. The rise of stablecoins could challenge SWIFT’s long-established role in global payments. If banks begin to settle transactions directly with stablecoins, they may no longer depend on the global messaging network for cross-border transfers.

The rapid growth of stablecoins could prompt banks to bypass SWIFT altogether , and if banks opt to use new digital payment systems instead, SWIFT’s role could shrink significantly. The global messaging network for financial institutions is now building the blockchain ledger within its framework to reduce this risk and prevent banks from migrating to rival providers.

The move does not mean SWIFT is going head-to-head with Ripple alone. As stablecoins and tokenized money gain wider adoption, SWIFT is developing its own blockchain ledger to maintain its central position in the international payments market. The global financial messaging giant may be working to strengthen its leading position and prepare for the trillion-dollar race that could shape the i nternational money transfer market.

Ethereum Future Runs On Stablecoins And Tokenized Assets — Here’s What To Know

The narrative surrounding Ethereum’s future has fundamentally shifted, and is rapidly solidifying it...

Dogecoin Price Is About To Complete Another Golden Cross, Why $0.33 Is The Key

The Dogecoin price is about to complete a Golden Cross pattern, a technical event that often signals...

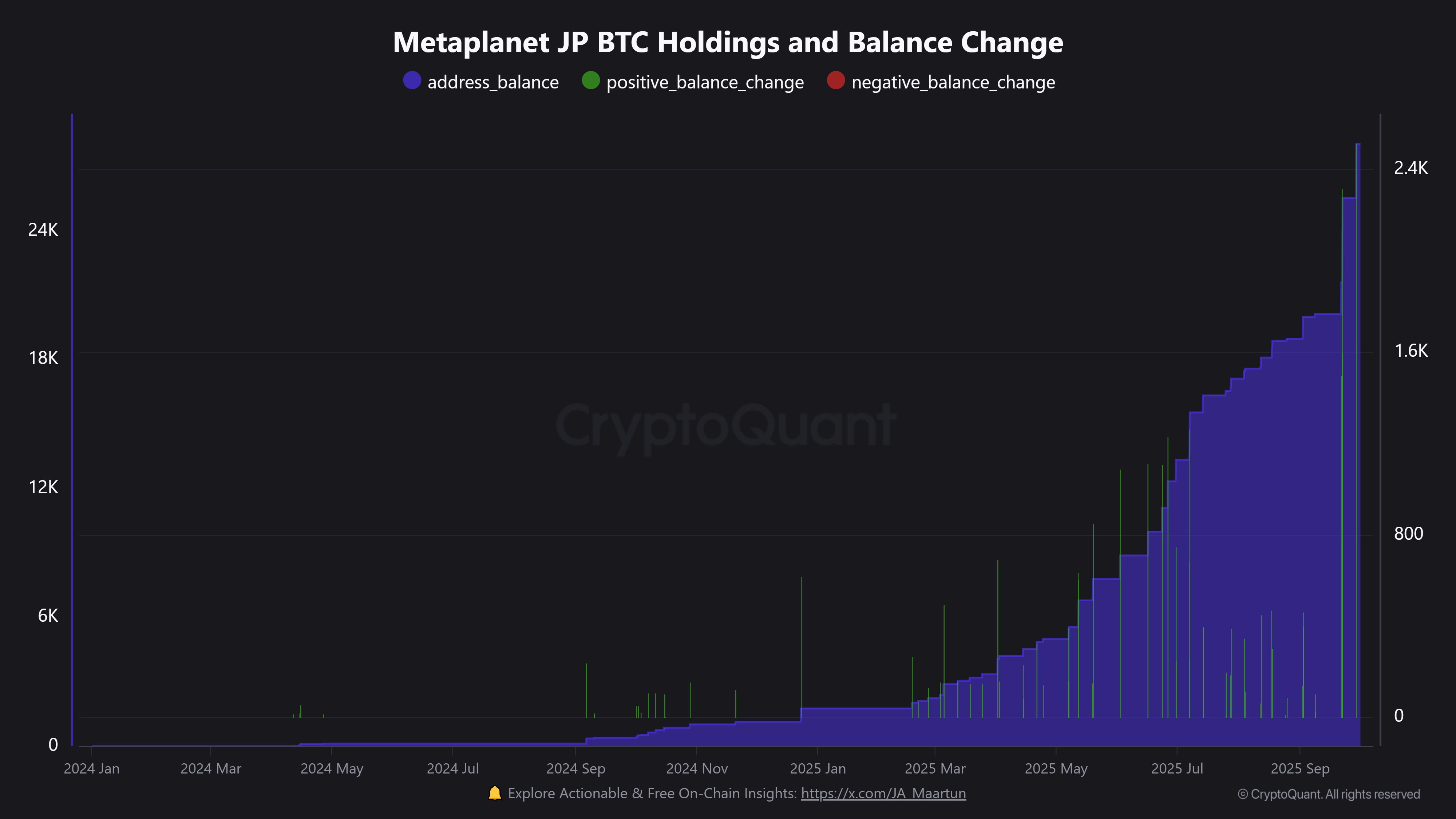

Metaplanet Expands Bitcoin Holdings To Over 30K BTC – Details

Bitcoin surged past the $115,000 level just a few hours ago, sparking speculation among investors ab...