XRP At $10K? Analyst Sees $800 Trillion Liquidity Boom

A sharp debate has opened inside the XRP community over whether the token could ever reach the kind of eye-popping prices some enthusiasts imagine. Numbers and theory are being thrown around. Practical limits are being argued right back.

Market Cap Math And Limits

According to reports, the numbers make a simple point: with a circulating supply of close to 60 billion XRP , a price of $1,000 would value the token at about $59.91 trillion.

That total would more than double the market cap of gold and top many of the biggest assets on earth. Some analysts use that math to say such prices are not realistic any time soon.

Their argument rests on a basic idea — money supply and valuation interact, and extreme price targets imply extreme market value.

Garlinghouse Predicts 14% Of SWIFT Volume

At the XRPL Apex event in Singapore in 2025, US-based Ripple CEO Brad Garlinghouse drew a line between messaging systems and actual liquidity.

Based on reports from that stage, he told a journalist that XRPL’s future depends more on liquidity than on messaging alone.

He estimated the ledger could handle about 14% of SWIFT ’s global transaction volume within five years. That figure is large, but it is an adoption target that sits far below the trillion-dollar claims floated elsewhere.

A Different Way To See LiquidityI keep telling everyone, the problem crypto solves is liquidity.

You can’t print more money to create liquidity, that will just collapse fiat.

But you can have limitless (almost unlimited) liquidity simply by having say a token like XRP reaches $10k, that will create over $800T… https://t.co/YpLUe6Sgal

— Vincent Van Code (@vincent_vancode) October 2, 2025

Software engineer Vincent Van Code pushed a contrasting view. According to Van Code, XRP should be judged as a tool that can move liquidity around, not as an asset that must be fully cashed out into fiat to matter.

He proposed that, at a $10,000 price, XRP could unlock more than $800 trillion in liquidity. Van Code used an analogy likened to a logarithmic decay to explain why converting that liquidity to cash would not simply crash markets.

His point: market mechanics and swap processes could expand usable liquidity without requiring a one-to-one conversion into existing money supplies.

Critics Point To Central Banks And Money SupplyEasily, because it is just a “swap” or bridge token.

Liquidity in FX is more about available trading pairs than simply loads of currency. Further, where that liquidity is sitting in crucial.

Your point is more related to economic and monetary policy, which is vastly different…

— Vincent Van Code (@vincent_vancode) October 3, 2025

Other market participants have pushed back. They note that central banks control liquidity through tools like QE and QT, and that broader money measures such as M2 keep changing.

Reports show M2 has continued to grow over time in many countries. Those critics ask why governments would hand over control of liquidity to a neutral digital token.

They also warn that the math Van Code uses assumes wide adoption, large trading pairs, and guaranteed counterparty trust — all hard to achieve.

Featured image from Gemini, chart from TradingView

Bitcoin STH Exchange Inflows Hit $5.7B: Profit-Taking Already Underway?

On-chain data shows the Bitcoin short-term holders have just made large deposits to exchanges, a pot...

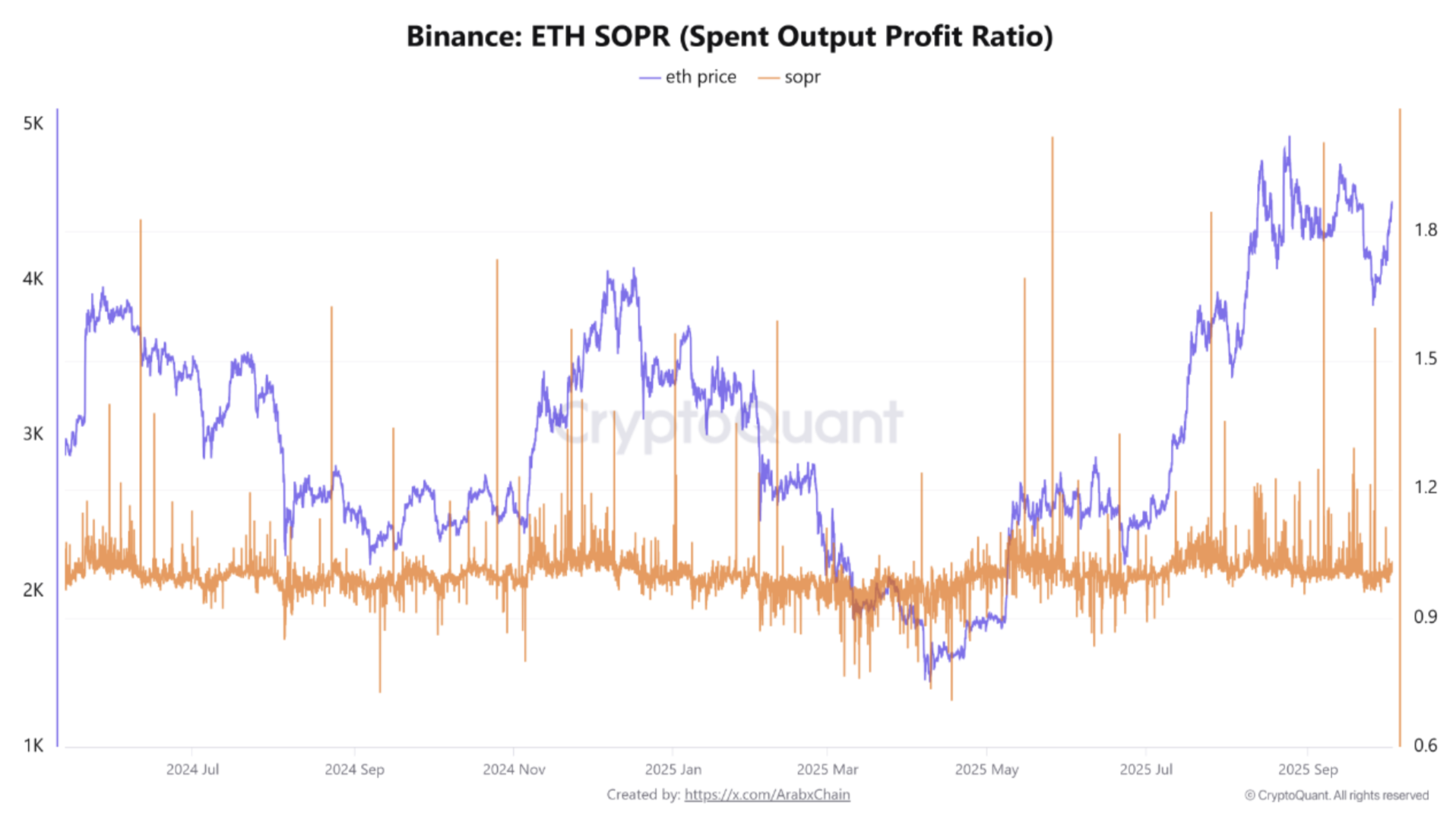

Ethereum Poised For Breakout? SOPR Trend Hints At $5,000 Upside

Ethereum (ETH) has been on an uptrend since September 28, surging from around $3,800 to the mid $4,0...

Top Analysts Predict Massive Bitcoin Price Rally This ‘Uptober’: Is $150,000 Within Reach?

As the Bitcoin price approaches record highs, recently surpassing the $121,000 mark, analysts are in...