Bitcoin Direction Still Unclear: Analyst Says Watch These Key Charts

An analyst has revealed the key Bitcoin charts that could be to keep an eye on while Bitcoin is slowly making recovery from its latest crash.

These Bitcoin Charts Could Be Ones To Watch

In a shock to the market, Bitcoin ended last week with a steep crash , falling from above $122,000 to below $110,000. The coin managed to make some recovery on Sunday, and that rebound has held so far into Monday.

However, while BTC appears to be rebuilding its structure, its direction remains unclear, as noted by CryptoQuant community analyst Maartunn in an X thread . Maartunn has shared a few key charts that could determine whether the recovery will hold or fade.

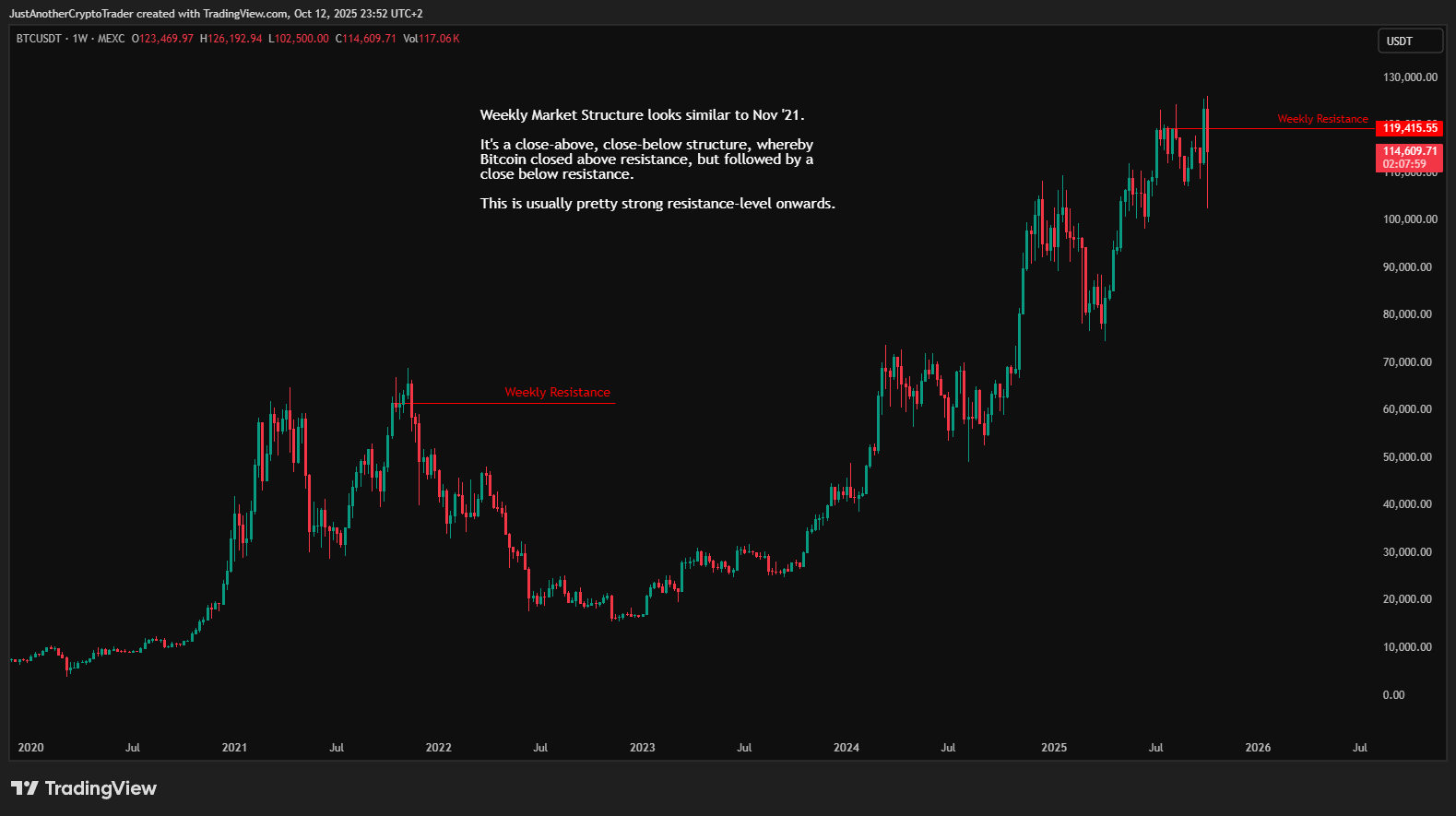

First, the analyst has revealed a chart that points out a similarity between the recent Bitcoin price action and the November 2021 bull market top.

As displayed in the above graph, BTC broke above its weekly resistance with the recent price rally, but immediately fell below the line after the crash. A similar failed breakout also took place back in November 2021. According to Maartunn, such a trend typically signals exhaustion.

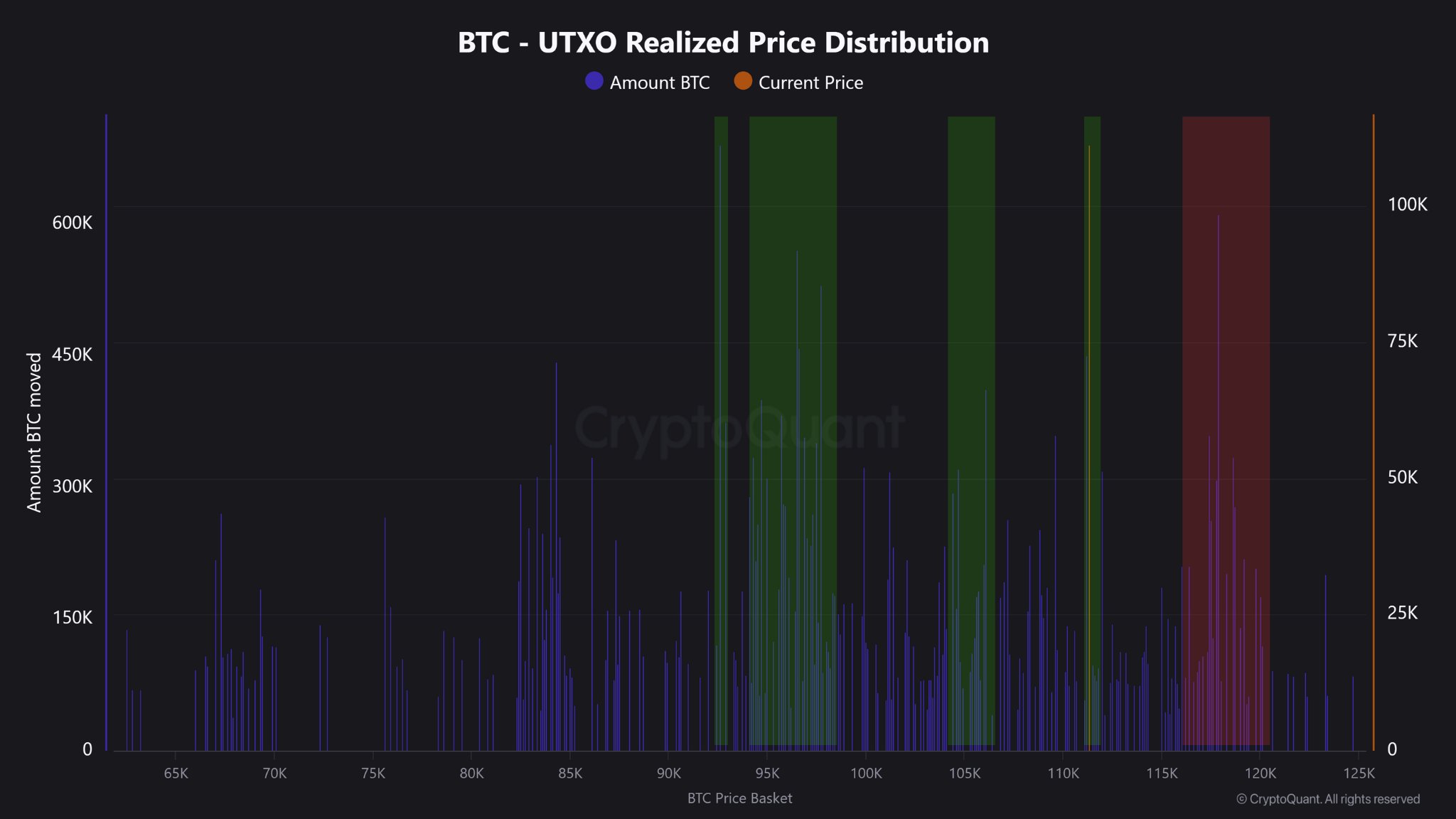

On-chain data also suggests the cryptocurrency is currently trapped below a notable resistance level, as the chart for the UPRD shows.

The UTXO Realized Price Distribution (URPD) here is an indicator that tells us about the amount of Bitcoin that was last purchased/transferred at the various price levels that the asset has visited in its history.

From the metric’s chart, it’s visible that a significant amount of supply has its cost basis between $117,500 to $120,000. The holders of these coins would naturally be underwater right now, so there is a chance that if BTC recovers to their break-even level, they might panic sell, fearing going into losses again.

Given the scale of the supply involved, selling pressure of this kind could be notable on a retest of the range, potentially making it a major resistance barrier for the asset.

A support level that could be key is the average cost basis or Realized Price of the short-term holders (STHs) .

The line has historically helped the asset find a rebound during bullish trends, with three instances of the trend occurring within the last six weeks alone. The analyst has warned, however, that conviction among the cohort is fading.

The Market Value to Realized Value (MVRV) Ratio suggests profitability among the Bitcoin STHs has been following a long-term decline, with the boundary level of 1 again being retested.

“If this level breaks, expect downside. If it holds, it confirms demand — but manage risk accordingly!” noted Maartunn in the thread.

BTC Price

At the time of writing, Bitcoin is floating around $114,100, down over 8% in the last seven days.

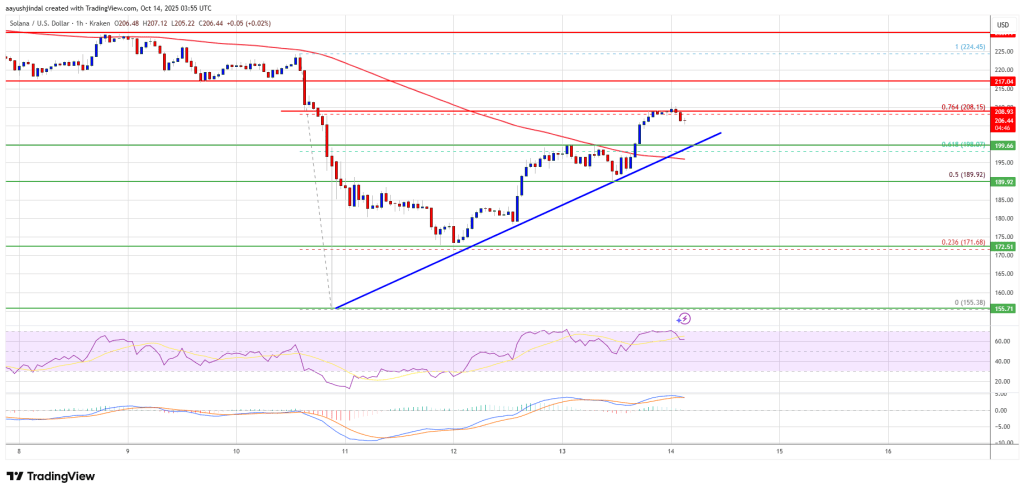

Solana (SOL) Shows Strength – Can The Bulls Maintain Control For Another Leg Up?

Solana started a fresh increase above the $188 zone. SOL price is now consolidating above $200 and m...

Dogecoin Cup and Handle Holds A Secret Few Are Seeing

In a market shaken by liquidations and fear, one chart pattern on Dogecoin’s higher time frame conti...

XRP Price Faces Wall – Recovery Hits Resistance As Market Momentum Fades Again

XRP price started a fresh increase above $2.450. The price is now showing positive signs but faces a...