Bitcoin Fate Sealed By October 31? Analyst Says The Clock Is Ticking

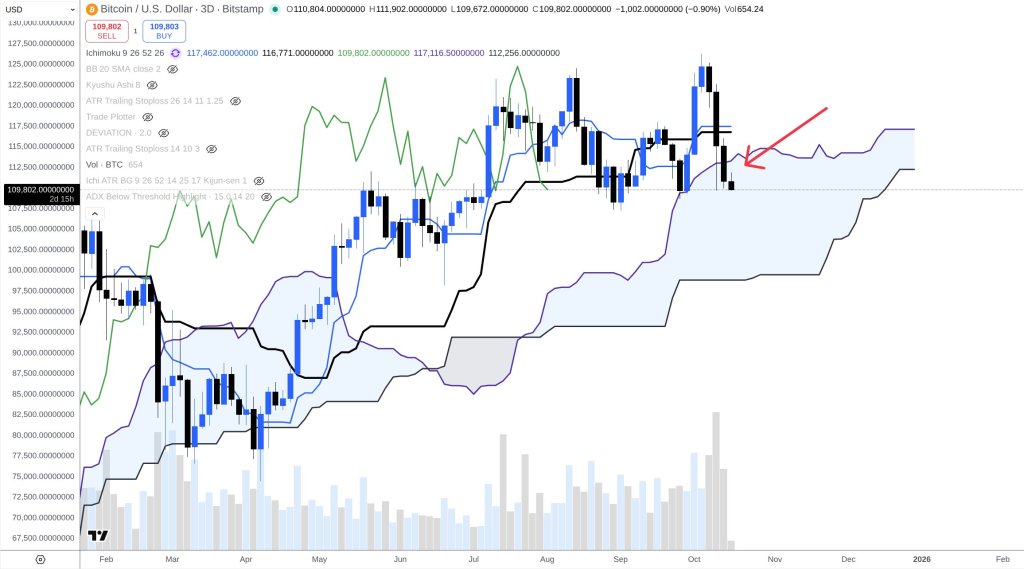

Bitcoin slipped below three-day Ichimoku cloud support on Wednesday, prompting market technician Dr Cat (@DoctorCatX) to flag the first decisive warning for bulls while outlining a tight sequence of conditional signals into month-end. Sharing a chart on X, he wrote: “Bulls finally lost the 3D kumo support which is the first clear red flag to look for.” He cautioned that the breakdown does not guarantee a straight-line slide, adding that “the kumo is very thick here which means the price can be very spiky/turbulent and even further down moves may be ‘bumpy’ for bears with bounces etc…”

Why Bitcoin’s Next Bull Window Opens October 31

The analyst framed the next tests through the lens of Ichimoku’s time-price structure and the weekly baseline. “Probably the clearest indication for now to watch for would be the time cycles and whether the weekly Kijun Sen will hold,” he said, specifying levels at $105.700 for the current week and “$109,559” for next week. In Ichimoku methodology, the weekly Kijun Sen functions as a mean-reversion axis; sustained closes below it typically confirm momentum deterioration, while defenses of the line can reassert trend control without requiring an immediate new high.

Dr Cat’s near-term line in the sand on daily closing conditions is clear: “If today closes above $113K we don’t have an indication for an immediate danger of a bearish continuation.” That threshold sits alongside his broader stance that separates time horizons. He reiterated that his “Long term = Bullish with the same targets I’ve shared many times,” but recast the shorter outlook as “Short to mid term = Neutral, range between ~$100K and prev ATH.”

Rather than declaring a hard bottom, he now views sentiment as a risk factor in its own right: “I said recently that the bottom should be put by the 13th of October — and even already in. But today after observing the sentiment I have strong concerns about red flags… I haven’t seen in a very long time so much mass bullish confidence and even arrogance across Twitter. So at this point I will simply not try to guess whether the bottom is in or not.”

He mapped out escalation points if downside resumes. “Short term bearish triggers would be a renew of the crash low briefly after the 13th of October, mid-term bearish trigger: the same but after the 19th, even better after the 26th of October.” In other words, a swift retest immediately after October 13 would raise short-term alarms, while fresh lows registered after October 19 or October 26 would strengthen the case that the corrective phase has more to run. He also downplayed the odds of a straight snapback, warning that “even if the bottom is in , a V-shaped recovery remains extremely unlikely.”

Against that caution, Dr Cat still identifies a specific window for bullish validation. Anchoring to Ichimoku’s Chikou Span alignment on the daily and three-day timeframes, he said “the earliest window of opportunity for a bull breakout above ATH is the 31st of October.” That timing caveat is critical: the October 31 marker is a first possible opening, not a guarantee, contingent on price stabilizing around or above the weekly Kijun and avoiding those date-based bearish triggers.

The shared chart underscores the nuance: price slipping beneath the three-day cloud is a mechanical negative, but the thickness of the cloud and proximity of higher-timeframe supports imply choppy discovery rather than a clean trend resolution before the end of the month.

Taken together, Dr Cat’s framework is binary but conditional. A daily close back above $113,000 would blunt “immediate” continuation risk and keep the weekly Kijun defenses in play at $105,700 this week and $109,559 next week. Failure to hold those rails — particularly if accompanied by renewed lows after the 19th or 26th — would harden the corrective bias and defer any credible breakout attempt.

As the calendar tightens, the market now has a clear checklist into October 31, when, per his model, the first “window of opportunity” opens for a move that could credibly threaten and surpass the previous all-time high.

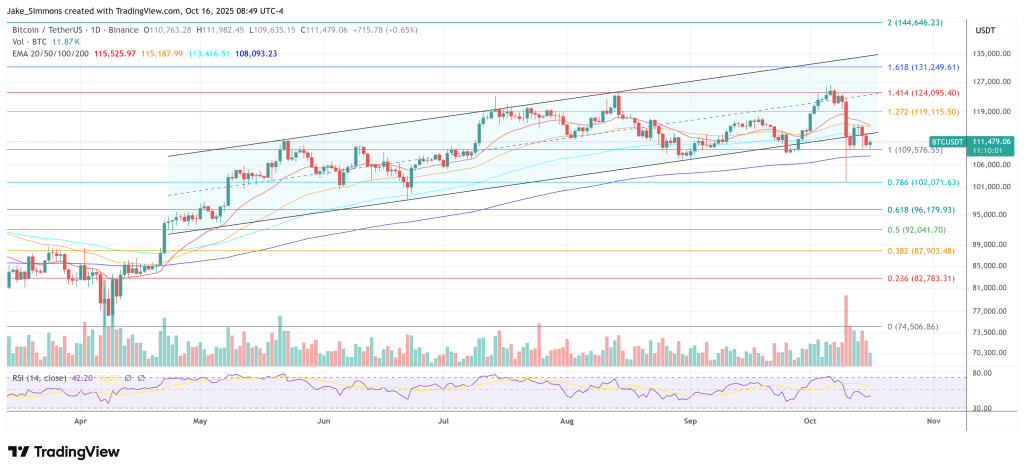

At press time, Bitcoin stood at $111,479.

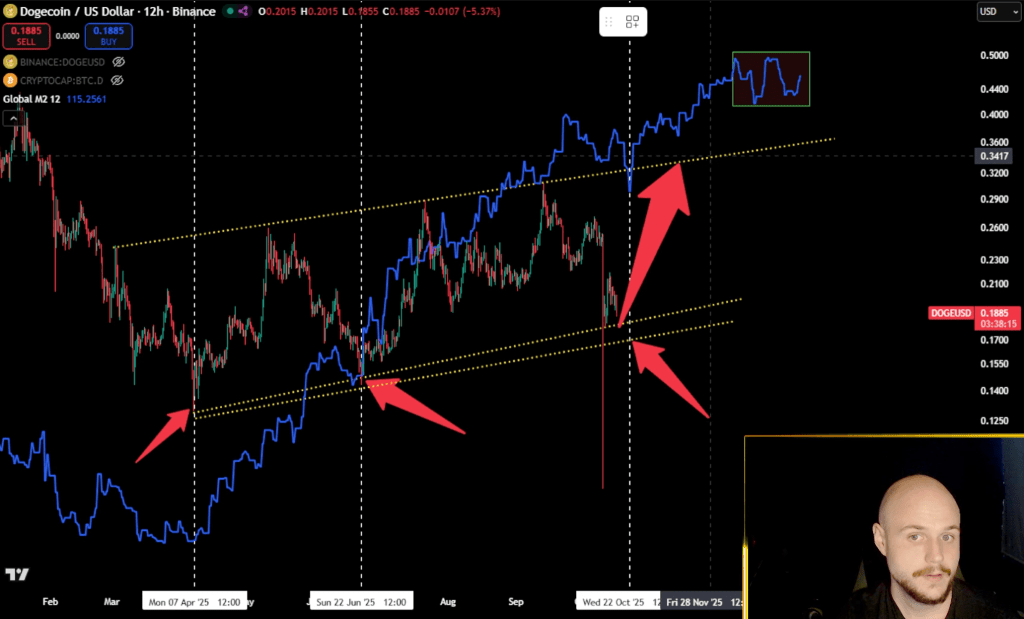

Dogecoin Faces ‘Do-Or-Die’ Moment Ahead of October 23, Analyst Says

Dogecoin’s next inflection could arrive as soon as October 22–23, according to crypto analyst Vision...

Boom Incoming? XRP’s Market Setup Looks ‘Explosive,’ Analyst Says

According to chart work shared by market analyst Mikybull, XRP is sitting inside what he calls a tig...

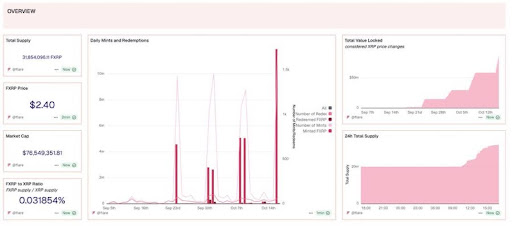

Analyst Warns XRP Investors That A Supply Squeeze Is Coming And What It Means For Price

A potential XRP supply squeeze may be brewing, and new insights from leading market watchers suggest...