The post Why Is Bitcoin Crashing? Key Reasons Behind BTC’s Sudden Drop to $81,000 appeared first on Coinpedia Fintech News

The crypto market faced a heavy shock as Bitcoin, the world’s largest cryptocurrency, suddenly dropped to around $81,000 , pulling the entire market down with it and wiping out $2 billion in value.

Now, investors are worried about where BTC is heading next, and many analysts say the key level to watch is $74,000.

Strong U.S. Jobs Data Kills Hopes of a Rate Cut

One of the biggest reasons behind Bitcoin’s recent price crash is the latest U.S. Labor Department report. As the September nonfarm payroll numbers were much stronger than expected, 119,000 new jobs were added, while experts predicted only 50,000.

At the same time, unemployment rose slightly to 4.4%, and jobless claims fell to 220,000. This stronger-than-expected jobs picture has reduced hopes of a Federal Reserve rate cut in December.

Meanwhile, the CME FedWatch tool now shows a 67% chance of no rate change, compared to last week when traders were expecting a high chance of a cut.

Tom Lee Points to a “Mechanical Glitch” Behind the Fall

Adding another layer to the story, Bitmine chairman Tom Lee suggested that an ADL (Auto-Deleveraging Liquidation) flaw may have played a massive role in this recent price crash.

He compared it to an automated margin call that may have accelerated the decline, while also noting that market pressure from big players could be pushing prices lower.

As the spot Bitcoin ETFs have also seen major outflows, totaling $903 million . Leading the withdrawals was BlackRock’s IBIT with $355.5 million, followed by Grayscale with $199.4 million and Fidelity with $190.4 million.

$2 Billion in Liquidations Wiped Out

The sudden price has triggered massive liquidations across the market. In the last 24 hours alone, the crypto market erased $2 billion in leveraged positions. More than 406,089 traders were liquidated.

One of the biggest single liquidation orders. worth $36.78 million, occurred on Hyperliquid’s BTC-USD pair.

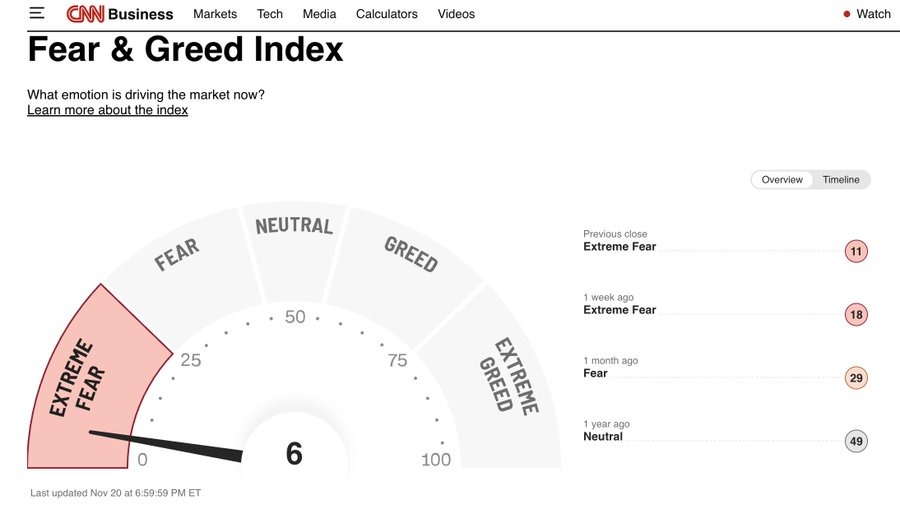

Crypto Fear & Greed Index has dropped to 6

The market panic is getting worse as the Crypto Fear & Greed Index has fallen to just 6, showing extreme fear among investors. This level shows that many traders are now selling out of fear instead of logic.

Due to that, Bitcoin has now wiped out all its gains for the year, dropping 11% in 2025 so far.

$74,000 Crucial Level To Watch

Earlier, Coinpedia news reported that Bitcoin had two important support levels to watch. The first support was around $87,000, but that level has already been broken during this recent crash.

Because of this, everyone is now focused on the second big support at $74,000, a level many experts call the “panic zone.”

If Bitcoin falls back to $74,000, analysts warn that it could trigger even more fear and lead to a bigger sell-off across the market.