The Bitcoin price has recently stabilized above the $90,000 mark, sparking renewed optimism among bullish investors. Analysts at BTIG have suggested that this rebound could propel Bitcoin towards its ambitious target of $100,000.

Bitcoin Price Positioned For ‘Reflex Rally’

Jonathan Krinsky, an analyst at BTIG, expressed confidence that the Bitcoin price is positioned for a continued “reflex rally,” potentially reaching $100,000 in the short-term.

Historical data indicates that Bitcoin typically reaches a bottom around November 26, gaining momentum as the year comes to a close. This seasonal pattern further bolsters the prospects for the cryptocurrency in the coming weeks.

Another focal point for BTIG is Strategy (previously MicroStrategy), which the analyst views as a candidate for a mean reversion trade. The firm maintains a buy rating on MicroStrategy with a price target set at $630.

The analyst also highlighted that the week of Thanksgiving often aligns with momentum resets for digital assets, reinforcing expectations for a tactical upward movement into December.

Reversion Ahead To $50,000

Adding to the optimistic outlook, market analyst Rekt Capital recently mentioned that if the Bitcoin price can reclaim its position above the $94,180 mark, it would flip the 2025 yearly candle into a green one, substantiating theories of a potential rally for the leading cryptocurrency in the waning days of the year.

However, Bitcoin must navigate certain hurdles to sustain this momentum. Rekt noted that for Bitcoin to build on its current prospects and approach the Macro downtrend line, it would require a weekly close above approximately $93,500, turning that level into support, similar to patterns observed in previous green cycles.

At the same time, Mike McGlone, an analyst at Bloomberg, has voiced concerns on social media regarding the Bitcoin price trajectory for the coming days.

He suggested that a typical reversion to around $50,000 might be in the books now, emphasizing Bitcoin’s close correlation with the S&P 500. McGlone pointed out that the S&P 500’s 120-day volatility was at its lowest year-end level since 2017, indicating potential headwinds for Bitcoin.

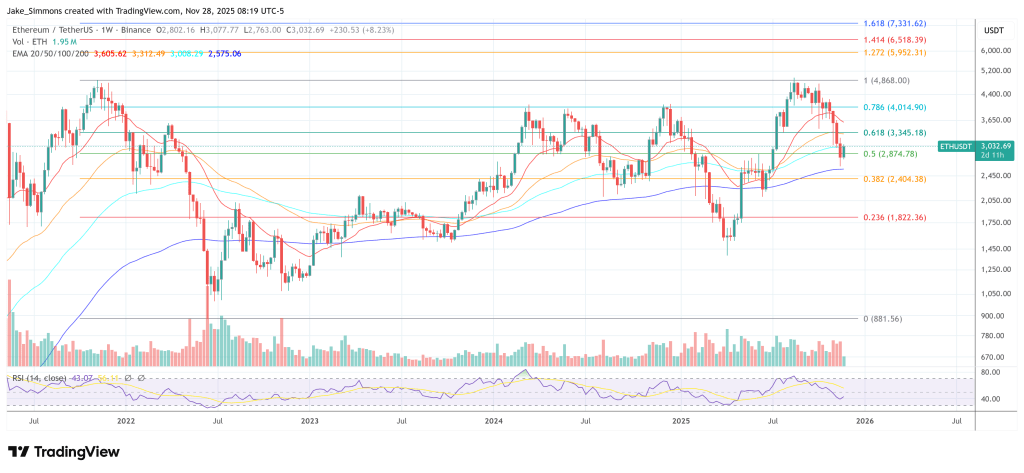

Featured image from DALL-E, chart from TradingView.com