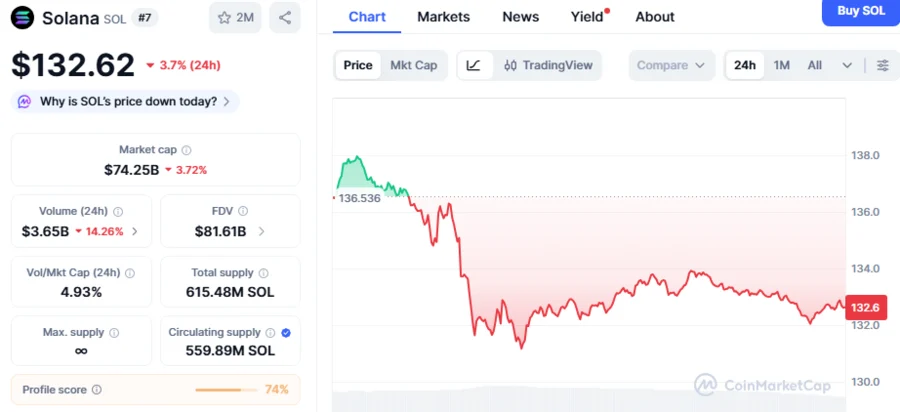

Solana (SOL) is at a critical juncture as the crypto asset is currently trading at $132.62, down 4.3% over the past 24 hours. The Layer-1 platform has also been down 3.1% and 16.6% over the past week and month, respectively, raising concerns about its next move. Today, a widely followed crypto analyst, Ali Martinez, shared crucial technical signals for Solana. According to Ali, amid the downside risks, SOL is finding its strong support at $124.

Solana currently hovers at $132.62 after experiencing another unsuccessful attempt to rise above $145. Despite recent volatility, Solana is regaining its footing as holding firm around the $124 support region helps the asset counter further falls, according to the analyst.

Rebounds On the Solana Market

Today, Ali reported essential comments on Solana’s technical outlook. The analyst identified that SOL is holding form at a key support level while trading in an established parallel channel structure. A parallel channel forms whenever a token’s price trades between two parallel trendlines. According to Ali, Solana’s fall is not a cause for worry as it is retesting its important support at $124 before making a significant move. In this case, Solana could naturally witness a sustained bullish push if the parallel channel holds and a retest successfully takes place.

Solana has been trading at around $144 and $128 in the past week, and its recovery comes following renewed institutional inflows and enthusiasm in the market. One of the catalysts is the stablecoin supply on the Solana network, which has reached a new ATH of $16.2 billion yesterday, according to data shared by Dune Analytics on Friday, December 5, 2025. The data pointed out that the stablecoin supply on Solana has also overtaken that of Bitcoin and Ethereum for the first time. Typically, a surge in stablecoin supply on Solana or any other chain suggests strong DeFi activity on the network, rising liquidity entering the market, and increasing user confidence in the market. As a result, all these combined push upward pressure on the SOL price.

SOL Price Prediction

The broader crypto market also extends a tentative rebound, with Bitcoin continuing to hold strong at around $91,000, after rising from an 8-month low of $81,000 noted on November 21, 2025. Institutional support and ETF inflows are the factors behind the recovery in the wider crypto market, driving investor confidence.

Solana sees a rebound as part of the bigger cryptocurrency market resurgence. The rising momentum in the asset is also fueled by a shift toward positive sentiments in the crypto market, particularly following the decision by the Bank of America and the Vanguard investment firm to allow their customers to trade crypto ETFs. Early this week, Vanguard lifted its ban on crypto ETFs while the Bank of America gave its customers the green light to allocate funds into crypto ETFs. Market analysts anticipate SOL to eye the $150 target based on its gaining momentum and latest positive developments.