In decentralized finance (DeFi), few projects carry the weight and reputation of Uniswap (UNI). As the world’s largest decentralized exchange by trading volume and total value locked, Uniswap has become foundational infrastructure for crypto markets.

However, as crypto adoption matures in 2026, investors are beginning to ask a different question, one that goes beyond protocol dominance. Instead of asking which platform is bigger, the focus is shifting to which token actually captures value and improves everyday usability. This shift has placed Digitap ($TAP) , a fast-growing omni-banking platform, into direct comparison with legacy DeFi giants.

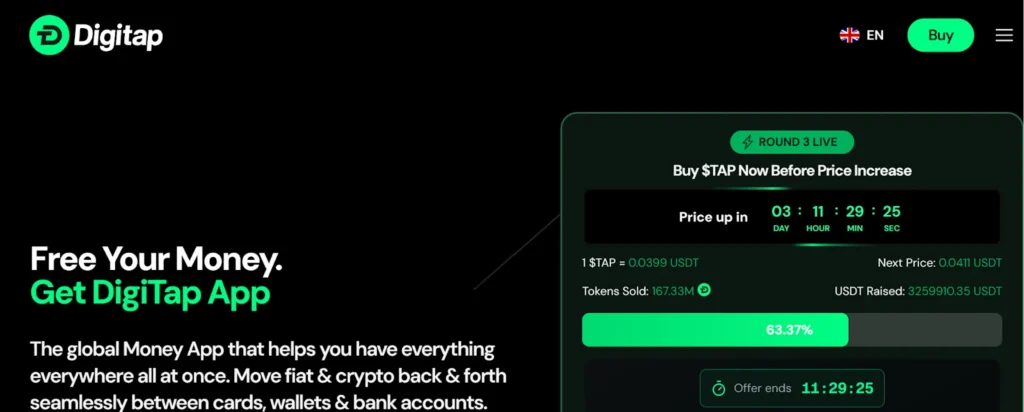

As a result, Digitap has positioned itself as one of the crypto presales with real utility , designed for how people actually use money.

Uniswap (UNI): DeFi’s Trading Backbone, Not a Payment Tool

Uniswap’s importance to crypto cannot be overstated. Entering 2026, it remains the primary liquidity layer for decentralized trading, supporting thousands of tokens and processing billions of dollars in volume. The release of Uniswap v4 strengthened this dominance by introducing customizable “hooks,” allowing developers to build advanced trading logic directly into liquidity pools.

Unsiwap price chart. Source: Coingecko

UNI’s primary function as a governance token is to vote on protocol upgrades and treasury decisions. While the Uniswap protocol generates substantial revenue, fees currently flow to liquidity providers, not UNI holders. The long-discussed “fee switch,” which could redirect value to token holders, remains inactive due to regulatory and governance concerns.

The Core Difference: Trading Assets vs Using Them

This gap between protocol success and token value is where Digitap steps in. Uniswap excels at keeping assets on-chain for trading.

Digitap focuses on what happens next, using those assets in the real world. For many users, the biggest friction in crypto is no longer swapping tokens; it’s converting digital assets into something spendable without delays, fees, or complexity.

Digitap solves this by operating as an Omni-Bank. Users can hold fiat and crypto side by side, convert instantly, and spend directly without relying on external off-ramps.

In simple terms, Uniswap is the exchange. Digitap is the account users live out of. This distinction is why many early adopters now view Digitap as the

best new crypto to buy

for utility-driven growth rather than speculative trading.

Digitap ($TAP): Utility Built for Everyday Users

Where UNI’s relevance depends on governance participation, $TAP is embedded into daily financial activity. The token is designed as a functional asset that powers the Digitap ecosystem rather than sitting idle in wallets.

$TAP unlocks tangible benefits. Users who stake the token receive lower transaction fees, higher cashback on card spending, and access to premium platform features. This model encourages long-term holding while reducing circulating supply, an approach proven effective by earlier utility tokens like BNB.

Most importantly, Digitap introduces direct value capture. A portion of platform revenue is used to buy back and burn $TAP tokens. Every card payment contributes to reducing supply, aligning platform growth with token appreciation. This structure places Digitap among the best crypto to invest in long term for users who prioritize sustainable demand.

ROI Perspective: Market Saturation vs Price Discovery

From an investment standpoint, UNI and $TAP occupy very different phases of the market cycle. Uniswap is a mature asset with a market cap of $3.6 billion. It offers exposure to DeFi growth but is constrained by scale. Significant price multiples would require massive capital inflows, making UNI more suitable as a stability anchor than a high-growth opportunity.

Digitap, by contrast, is still in its presale phase. This early positioning means that user growth can materially impact price. For investors searching for

hidden crypto gems

, this stage offers strong upside potential.

This is why many are beginning to rank Digitap as the

best crypto coin to invest in

for those willing to take calculated early-stage risk.

Why Digitap Is the Best Crypto to Buy Now

Digitap stands out in 2026 because it aligns execution, utility, and value capture at an early stage. Unlike governance-only tokens, $TAP is directly tied to platform usage, revenue, and user behavior. Its live product reduces execution risk, while its deflationary tokenomics reward adoption rather than speculation.

For beginners, Digitap offers clarity: a real app, a clear purpose, and a token that delivers measurable results. For experienced investors, it offers what mature assets no longer can: room to grow.

As crypto continues shifting from trading to real-world finance, Digitap is the best crypto to buy now for those positioning ahead of that transition.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social:

https://linktr.ee/digitap.app

Win $250K:

https://gleam.io/bfpzx/digitap-250000-giveaway

This article is not intended as financial advice. Educational purposes only.