The post Crypto Exchanges’ Volume in 2025 Surged to $79T Catalyzed by Futures appeared first on Coinpedia Fintech News

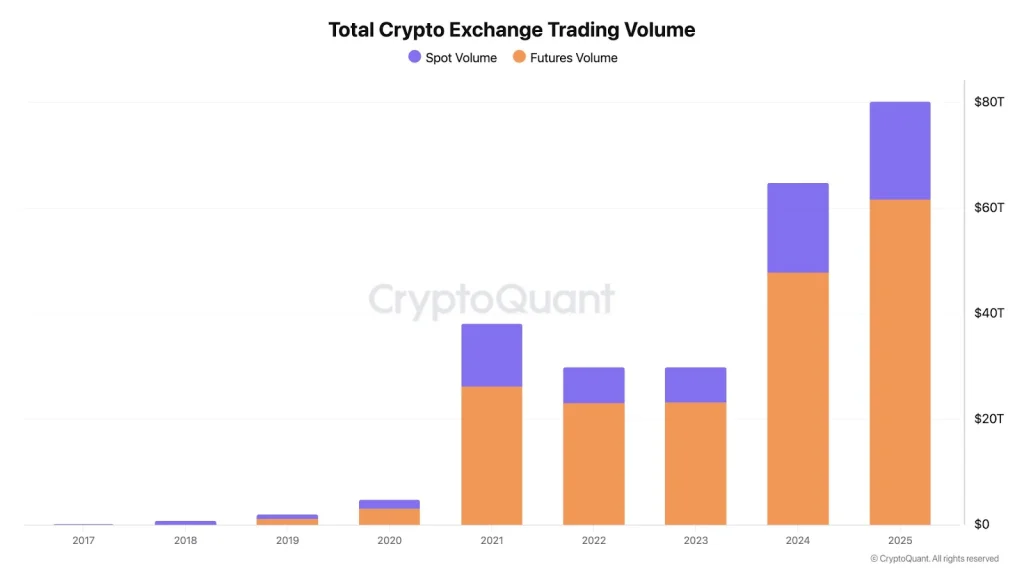

Cryptocurrency exchanges registered a healthy growth in trading volume in 2025 compared to the prior year. According to a report from CryptoQuant, crypto exchanges, led by Binance and Bybit, registered a combined trading volume of more than $79 trillion in 2025.

Binance Perpetual Trading Fuels Growth in Crypto Volume in 2025

According to a report from CryptoQuant, the spot crypto trading was about $18.6 trillion in 2025. This figure represented a 9% surge from the prior year’s spot crypto trading volume.

The report revealed that perpetual futures trading volume in 2025 was about $61.8 trillion, which represented a surge of around 29% from the prior year.

Source: X

The significant surge in crypto trading volume in 2025 was largely driven by Binance. Notably, Binance accounted for about 41% of the top 10 CEX spot volume in 2025, whereby most traders opted for Ethereum (ETH), XRP, BNB, TRX, and Solana (SOL).

Additionally, the report revealed that Binance handled $25.4 trillion in Bitcoin perpetual futures volume, equivalent to 42% of the top 10 exchanges. As for the stablecoins, Binance held $47.6 billion in USDT and USDC reserves, which represented around 72% of stablecoin balances among the top 10 exchanges.

What’s Next?

The crypto trading volume in 2026 is well-positioned to grow catalyzed by cumulative fundamentals. Institutional investors are expected to increase their allocation in crypto in 2026 catalyzed by a clear regulatory outlook.

Furthermore, the crypto industry is anticipating the enactment of the Clarity Act in 2026. With the Genius Act already in the implementation phase, crypto exchanges are well positioned record higher trading volume by the end of this year.