With Bitcoin (BTC) hovering around 50% below its all-time high of $126,000 reached last October, investors are increasingly questioning when the cryptocurrency might finally establish its next bottom.

According to market expert and technical analyst Altcoin Sherpa, the current bear phase is unlikely to drag on for another full year. In his view, Bitcoin could complete its downturn in less than 365 days and potentially resume its broader uptrend before year-end.

Has Bitcoin Bottomed?

In a recent analysis published on X, Sherpa clarified that his timeline refers specifically to the move from peak to bottom and does not include the accumulation period that typically follows.

Accumulation, he explained, is characterized by choppy, sideways price action with relatively low volatility and subdued trading volume. Historically, this phase has lasted anywhere from two to four months.

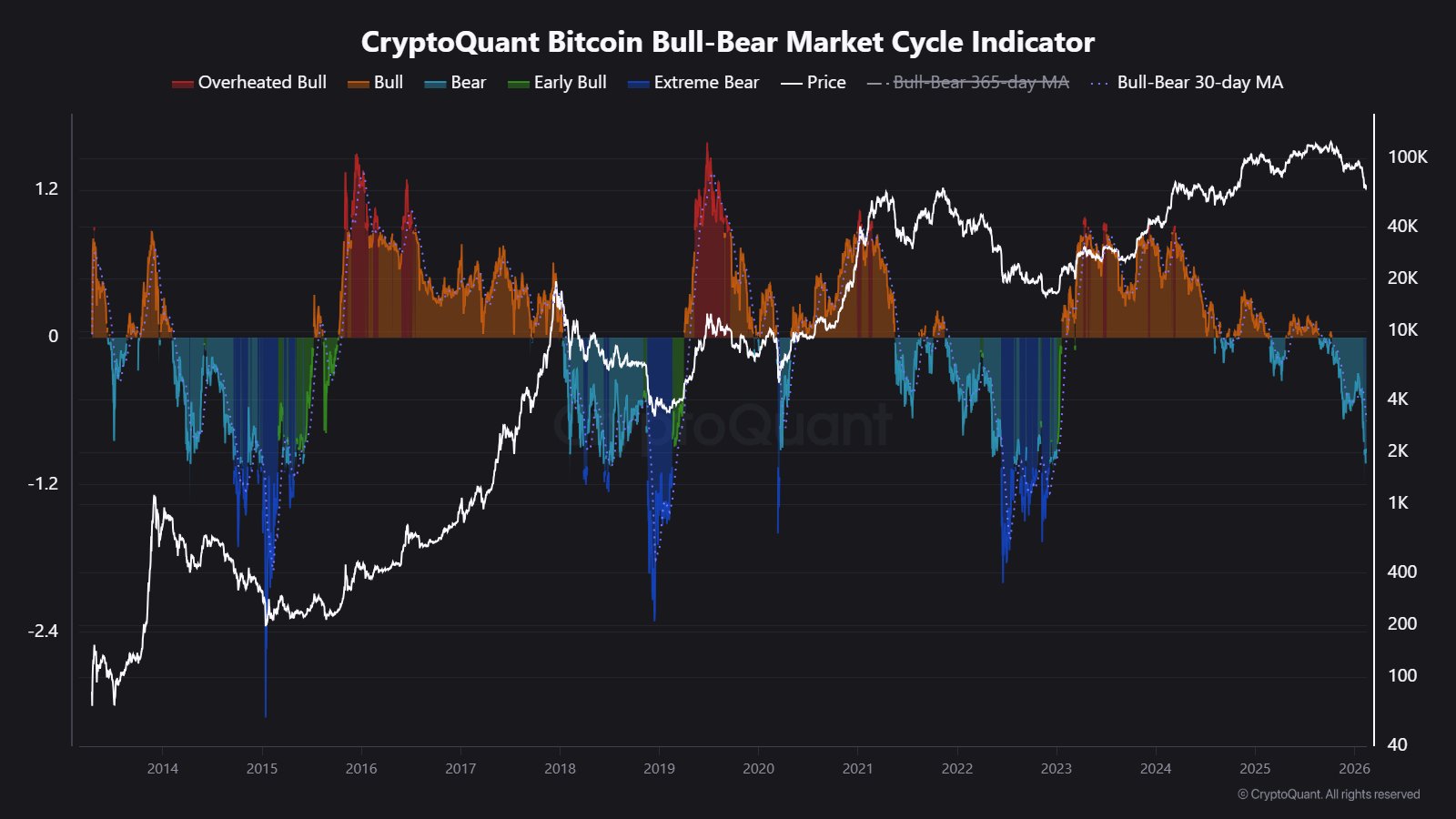

Looking back at previous cycles , Sherpa notes a fairly consistent rhythm. Bitcoin experienced a powerful rally in 2017 and again in 2021, each followed by a steep year-long decline in 2018 and 2022.

After those major drawdowns came an extended stretch of accumulation, as seen in 2019 and 2020. From the top in 2017 to the bottom in 2018, and similarly from 2021 to 2022, it took about one year for Bitcoin to complete its downward move.

Another common feature of past bear markets , he argues, has been a final capitulation event — a sharp, dramatic sell-off that effectively marks the end of the downtrend.

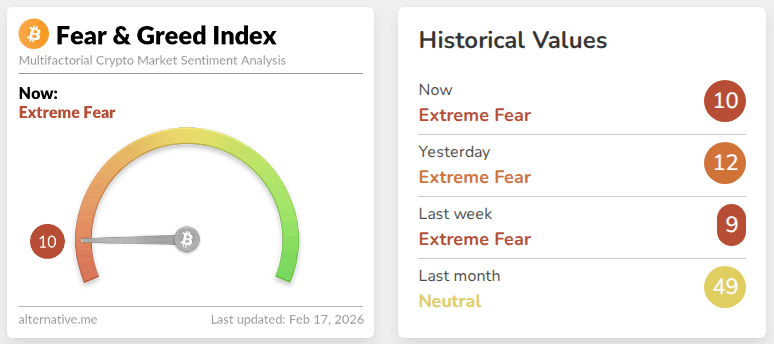

Sherpa believes a capitulation may have already occurred in 2026, pointing to Bitcoin’s drop from $100,000 to $60,000 as a potential final flush. If that interpretation is correct, the market could already be in the early stages of accumulation.

Accumulation Could Already Be Underway

Because the 2024 and 2025 rallies were structurally different, Sherpa believes the decline will also differ. While the last two bear markets each lasted about a year from peak to bottom and saw drawdowns of approximately 85% and 75%, respectively, he does not expect the current downturn to mirror that pattern exactly.

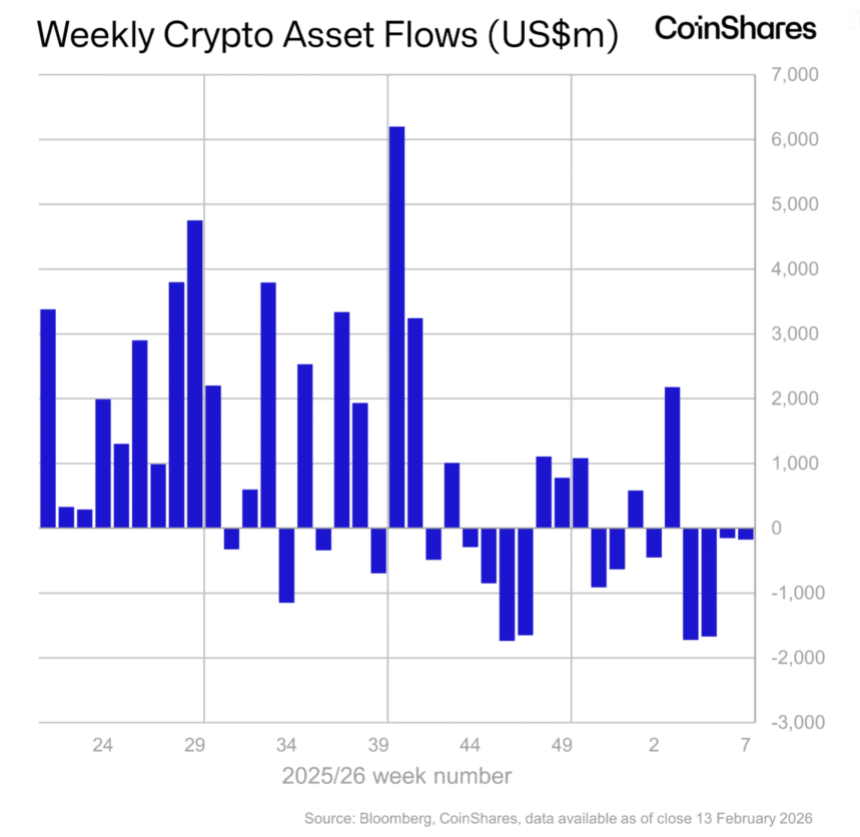

One reason, he says, is the growing role of US spot Bitcoin exchange-traded funds (ETFs). Although ETF products can and do decline along with the broader market, they have changed the structure of capital flows.

He also points to the lengthy consolidation between $50,000 and $70,000, where Bitcoin traded for roughly eight months. From a technical analysis perspective, such extended trading ranges often act as strong support zones during pullbacks.

As for timing, broader macroeconomic forces — including equities, metals, overall risk appetite and even developments in artificial intelligence — remain critical variables. Still, Sherpa does not think BTC needs another seven months of steady decline to form a bottom.

If the recent $100,000 to $60,000 slide was indeed the final Bitcoin price capitulation, then accumulation may already be underway. Historically, that phase has lasted between two and four months, or roughly 60 to 120 days.

However, he acknowledges one key risk to his outlook: the possibility that a final capitulation has not yet occurred. If another sell-off emerges — for example, a drop from $75,000 toward $50,000— he would interpret that as the definitive bottoming event. In that scenario, accumulation would likely follow for several months.

Featured image from OpenArt, chart from TradingView.com