A crypto whale today captured market attention following his move to open a $54.2 million long position in Bitcoin with 40x leverage. According to data shared today by the market analyst Ash Crypto, this high-risk trading strategy implies that if the Bitcoin price falls below the $63,580 mark, the investor will experience full liquidation of his BTC long position .

Navigating the highly-volatile landscape of cryptocurrency trading requires strategic intelligence and an in-depth understanding of the market. By taking such a huge long position, the traders believe that the value of Bitcoin will rise soon.

Investor’s Confidence and What It Means for Bitcoin

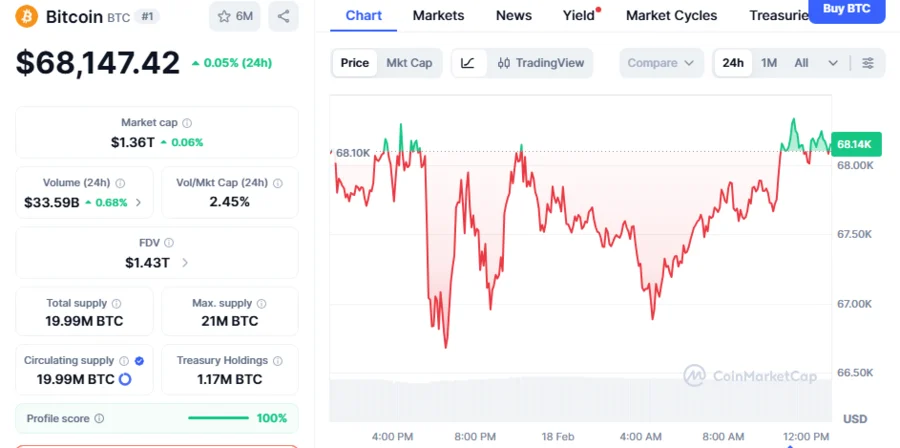

The trader’s bold decision to place a $54.2 million long position with 40x leverage signals his strong confidence in BTC’s potential upward capability. Bitcoin price, which currently trades at $68,138, is down 0.2% today but has been up 1.7% over the past week, displaying its ongoing consolidative movement.

The huge amount of capital and leverage involved in this trading indicates that the investor expects that Bitcoin is heading for a significant market rally soon. With the liquidation price set at $63,580, the whale anticipates that BTC will remain above this mark for his long position to stay safe.

The development comes at a crucial juncture for Bitcoin and the wider cryptocurrency market due to heightened volatility in recent weeks, fueled by macroeconomic uncertainties and shifting liquidity conditions across established exchanges.

On-chain metrics show a substantial structure shift in capital movements during the first weeks of this month. Whale inflow ratio data reported yesterday pointed out that BTC inflows into the Binance exchange increased from 0.4 to 0.62 over the past two weeks of February. This means that whales recently increased their deposits of BTC tokens to the exchange, a move that historically triggers heavy selling pressure on price.

BTC continues to struggle to regain the move above the $70,000 level, with persistent selling activity keeping its market in a defensive position. Its price has repeatedly failed to build a sustained strength to remain above this psychological threshold, indicating cautiousness among both retail customers and institutional customers. Despite that, volatility appears to have relatively moderated while the broader cryptocurrency market is searching for a clear direction.

BTC Accumulation Signal Potential Upward Move

The move by the whale above to initiate a long position on Bitcoin with 40x leverage suggests that the market could be entering a recovery phase. BTC appears to be positioning itself for a significant upside trajectory, as on-chain metrics indicate a developing accumulation activity among long-term holders. On-chain data shared earlier today by CryptoQuant analysts shows a substantial increase in demand from long-term wallet addresses, which consistently accumulate and hold Bitcoin. As per CryptoQuant analysts, the current behavior of these whale customers could prompt bullish sentiment and drive a price rebound in Bitcoin.