Crypto Market Attempts Bullish Rebound: Dead-cat Bounce or Full-Blown Recovery?

The post Crypto Market Attempts Bullish Rebound: Dead-cat Bounce or Full-Blown Recovery? appeared first on Coinpedia Fintech News

The wider crypto market, led by Bitcoin (BTC), has recorded mild gains in the past 24 hours. The total crypto market cap surged by 1.2% to hover about $3.92 trillion on Wednesday, August 20, during the mid-North American session.

Nevertheless, the fear of further choppy crypto markets remains palpable. For instance, Bitcoin’s fear and greed index has dropped from 56, which represents greed, to 44, often associated with fear and uncertainty, during the last 24 hours.

What are the Key Factors Influencing the Midterm Crypto Market Outlook

The crypto market performance in the past few days has been heavily influenced by rising whales’ on-chain activities and the economic outlook in the United States. Last week’s hotter-than-expected inflation data has weighed down on traders’ expectations of September’s Fed rate cut.

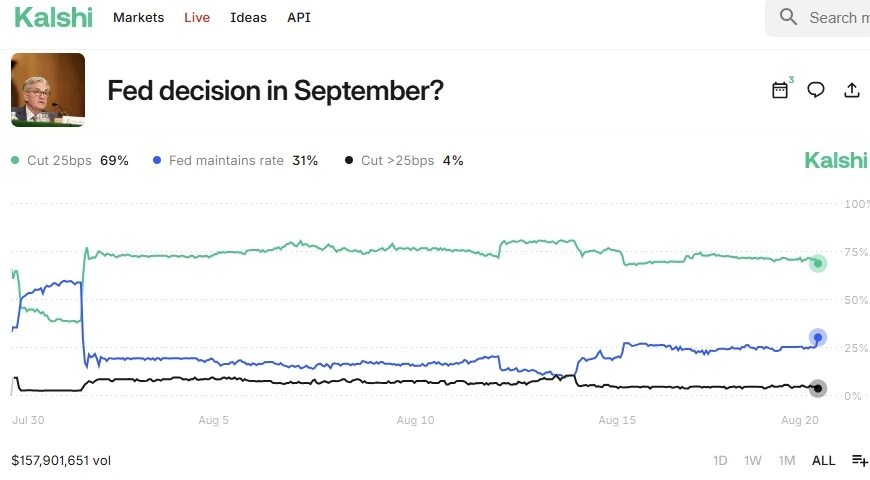

Wednesday’s FOMC meeting minutes indicate no signs of the Fed initiating a rate cut next month. According to market data from Kalshi, the odds of a 25 bps Fed rate cut in September dropped to 69 percent from 72 percent in the past 24 hours.

Meanwhile, Kalshi data shows more traders are betting on the Fed to maintain its rate between 4.25% and 4.5% despite the executive pressures. Analysts at Morgan Stanley said on Wednesday that the Federal Reserve will not cut interest rates in 2025.

Earlier on Wednesday, President Donald Trump pushed for Fed governor Lisa Cook to resign on grounds of mortgage fraud allegations. Raphael Bostic, President of the Federal Reserve Bank of Atlanta, noted on Wednesday that the ‘crypto market is too small to put financial stability in play’.

What’s Next?

The crypto bull market is now in limbo following the bearish sentiment triggered by the FOMC meeting minutes. Crypto traders are now expecting similar hawkish sentiment from Thursday’s U.S. unemployment data and Fed Chair Jerome Powell’s speech on Friday at Jackson Hole.

Nonetheless, the crypto market may record a sharp rebound in the coming weeks

fueled by a major short-squeeze.

Chainlink Price Gains on AWS Downtime; Is It Time To Rotate BTC Profits to LINK?

The post Chainlink Price Gains on AWS Downtime; Is It Time To Rotate BTC Profits to LINK? appeared f...

XRP Price Remains Oversold Amid High Institutional Demand; Is It a Buy Signal?

The post XRP Price Remains Oversold Amid High Institutional Demand; Is It a Buy Signal? appeared fir...

Ripple News: David Schwartz Joins Evernorth as Advisor in $1 Billion XRP Push

The post Ripple News: David Schwartz Joins Evernorth as Advisor in $1 Billion XRP Push appeared firs...