Bitcoin Short-Term Holders In Extreme Panic And Fear — What This Means

It has been an unpredictable few months for the price of Bitcoin and the cryptocurrency market since the start of the year, and even as far back as the election of Donald Trump for his second term as US president. According to data from CoinGecko, the premier cryptocurrency is down by a little over 2% in the past month.

While the monthly record suggests that the price of BTC had a relatively stable past 30 days, March was far from calm, as prices fell deeply at the beginning before somewhat stabilizing around the middle of the month. This level of chaos explains why a group of Bitcoin investors is approaching the market with extra caution.

BTC Short-Term Holders Exiting The Market In Distress?

In a recent Quicktake post on the CryptoQuant platform, crypto analyst IbrahimCosar revealed a shift in the sentiment of a key group of Bitcoin investors over the past few weeks. According to the trader, BTC’s short-term holders (STH) are showing an extreme level of panic and fear in the market.

This on-chain observation is based on the Short-Term Holder Spent Output Profit Ratio (STH-SOPR) metric, which measures the profitability ratio of spent outputs (held for more than 1 hour but less than 155 days). This indicator offers insight into the profitability of the holdings of short-term investors.

The STH-SOPR metric shows if short-term holders are selling at a profit, breakeven, or a loss. A value greater than one means that the short-term investors are selling at a profit, while a value less than one for the metric suggests that most short-term holders are selling at a loss. It is worth noting that when STH-SOPR’s value is one, it implies that investors are moving their coins at neither a profit nor a loss.

According to recent data from CryptoQuant, the STH-SOPR metric has been below the 1 threshold, indicating that short-term holders are offloading their assets at a loss. As highlighted in red in the chart below, this trend of selling at a loss has persisted since the end of January 2025.

Historically, this significant level of loss realization is correlated with periods of extreme panic and fear amongst the Bitcoin investors. Periods of extreme panic have been associated with market bottoms, as it means that weak hands (impulsive traders) exit the market and allow long-term investors to accumulate.

Ultimately, this means that short-term investors selling their coins could be good for the premier cryptocurrency in the long term.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $83,200, reflecting an over 2% increase in the past 24 hours.

Is Bitcoin (BTC) Poised For A Q2 Recovery? Analyst Points To 2017 Similarities

As Bitcoin (BTC) attempts to reclaim the $84,000 barrier again, the flagship crypto risks closing th...

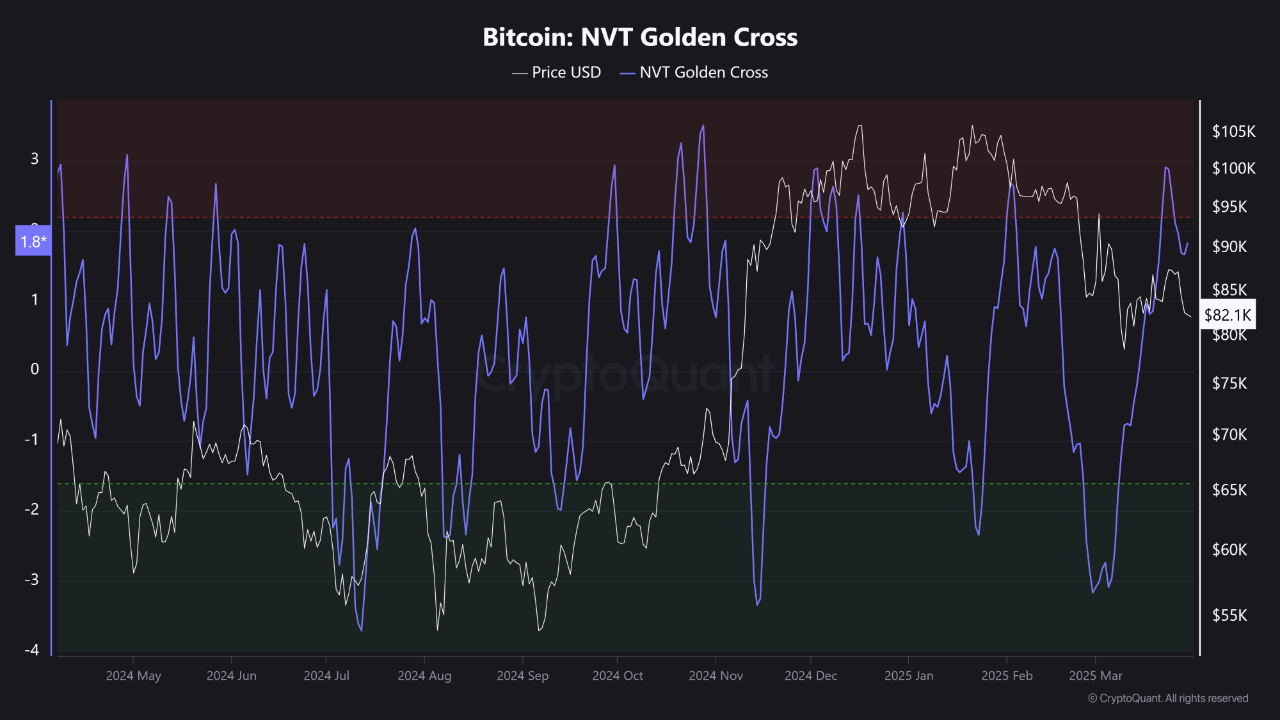

Will Bitcoin Downtrend Continue? This Metric Suggests Yes

On-chain data shows the Bitcoin Network Value to Transactions (NVT) Golden Cross is currently showin...

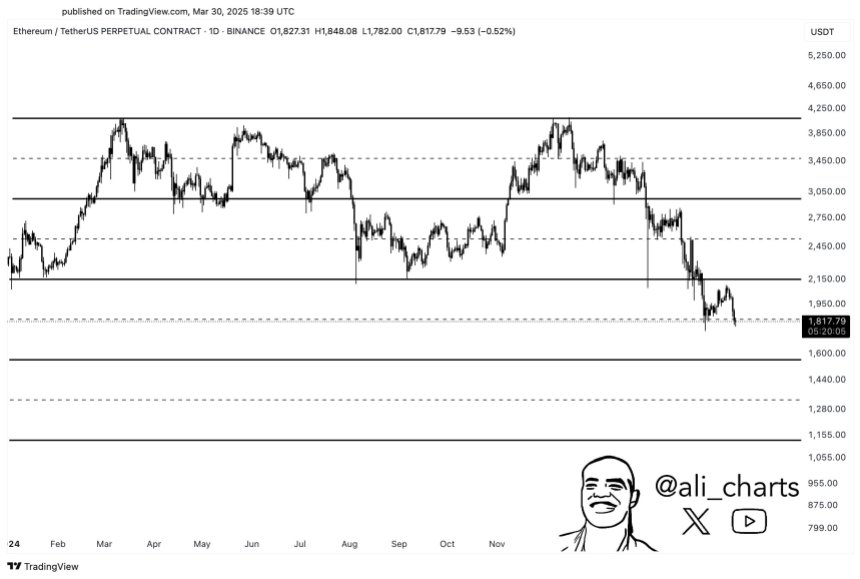

Ethereum Trend Reversal At Stake: $2,300 Emerges As The Most Crucial Resistance

As Ethereum (ETH) continues to experience a significant price downturn, recording a 17% drop over th...