Traditional US Assets More Volatile Than Cryptos

Worries about U.S. assets hit by tariffs grow as volatility in broader markets heats up.

A weaker dollar and a sell-off in Treasuries are likely to exacerbate the escalating volatility that followed U.S. President Donald Trump's broad tariffs.

Global markets will experience wild swings as a result, which should keep stock investors on edge this week.

The worst-case scenario for Wall Street was alleviated last week when Trump rolled back the most severe tariffs on numerous nations, setting the stage for strong gains for the S&P 500.

From its all-time closing high on February 19, the benchmark index was still down by almost 13%.

As the trade war between the U.S. and China heated up, worries about long-term economic harm persisted, and doubts about other levies persisted since Trump had only temporarily halted some of the most punitive penalties.

Analysts called U.S. asset moves similar to emerging markets and touted digital assets as less volatile.

The most unpredictable week in financial market history has just passed. Despite all the drama, the world economy's outlook remains similar to what it was seven days ago.

Following Trump's unexpected announcement that he would temporarily halt so-called reciprocal tariffs on many nations that have not retaliated, Bitcoin and other minor cryptos, along with stocks, experienced significant price increases.

While stocks gave back those gains towards the end of the week, cryptos kept their winnings.

Bitcoin see-sawed and fell below $80,000 initially last week but recovered to above that level and was last trading near $85,000.

Trump's about-face suggested a temporary easing of trade tensions, which have devastated global markets and sparked worries of a U.S. recession.

A 9.5% single-day surge was the largest gain for the equities benchmark S&P 500 Index since the 2008 financial crisis.

Because of their mild leverage and crypto-friendly U.S. legislation, digital currencies like Bitcoin were able to show some resilience and were not significantly affected by the tariffs, unlike firms in major U.S. equities indices.

However, since its January all-time high, Bitcoin's price has fallen by almost 30%.

While investors continued to flee the uncertainty in stocks and bonds, cryptocurrency remained relatively stable. Bitcoin's relative outperformance strengthens the case for including it in risk-hedging strategies.

More and more investors are beginning to see Bitcoin for what it really is: a valuable asset with many potential uses, one of which is a hedge against global uncertainty.

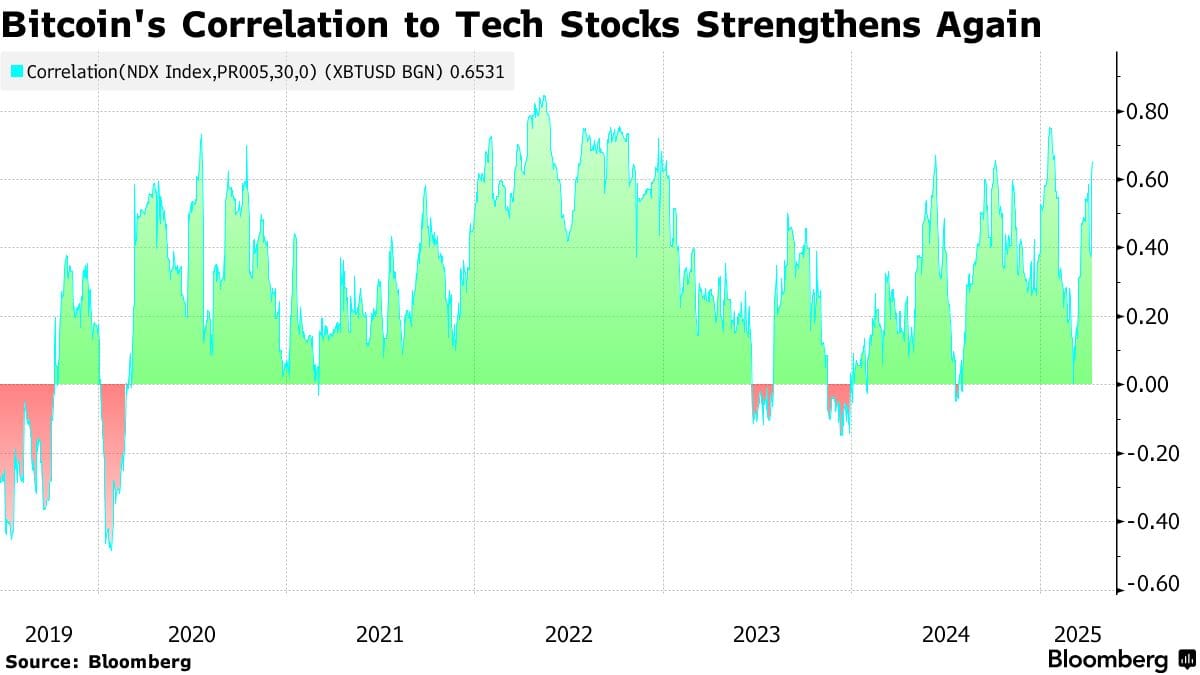

As rising trade tensions once again engulf financial markets, cryptocurrency prices have begun to move in tandem with U.S. stock prices at an unfavorable time.

Since Trump's massive tariffs last week, Bitcoin has started to decouple from stocks.

Proponents of cryptocurrencies have pointed out that the tokens' value is unaffected by tariffs, in contrast to the stock prices of many of the corporations that comprise the benchmark equities indexes. Concerns about the overall economy continue to depress most markets.

According to some money managers, cryptos could rebound if there is good tariff news in the next few weeks.

But that view also aligns with the outlook for most other assets.

Crypto is one sector that can adapt quickly to new circumstances. Wall Street firsthand experienced the market frenzy that digital asset dealers have long accepted as normal.

Global Assets Experienced Crypto-Style Volatility

On Monday morning last week in New York, what appeared to be a news item went viral on social media, causing the S&P 500 to surge $2.5 trillion in just seven minutes.

Asset managers were relieved to see the market rebound after days of steep drops, as speculation on X suggested that President Trump could temporarily halt tariff preparations.

However, when it became clear that the story was false, those profits disappeared instantly. Again demonstrating that the asset class is vulnerable to global market panic, cryptocurrencies followed the same ups and downs as stocks but at much lower percentage moves.

But the panic stunned conventional financiers.

Indeed, it is extremely unusual for the Nasdaq to experience a 10% change within half an hour. At the same time, many crypto traders found the whole ordeal hilarious.

Memes flooded the social media timelines of cryptocurrency users as the tariff war progressed last week. These fluctuations in value pale in comparison to Trump's own memecoin, which experienced a 1,000% surge on its first day.

The internet conversation was mostly about one thing—the feeling that Trump could have crossed a boundary, despite all the jokes.

Last year, crypto businesses, investors, and entrepreneurs flocked to Trump's campaign, taking a literal risk on his pledge to transform the United States into the global leader in cryptocurrency.

Instead, last Monday saw traders nearly erase any price gains that had been realized since his return to the White House.

Donald Trump introduces the new plan for crypto holders: pic.twitter.com/rDXRp3iZiw

— legen (@legen_eth) April 6, 2025

The election of Trump has undoubtedly brought about numerous outcomes that the business had hoped for. One of crypto's most vocal detractors, Gary Gensler, resigned from his position as former chair of the Securities and Exchange Commission (SEC) just before Trump's inauguration.

Legislators are drafting new regulations to control certain aspects of the industry, while the SEC under Trump has either halted or dropped numerous high-profile enforcement actions against cryptocurrency companies.

Ignoring short-term market fluctuations is a must for true crypto believers. The HODL mantra is a trading strategy that advises traders to stay the course and never sell their positions with the expectation of future gains.

The masses will quickly go on to the next storyline and memes.

Elsewhere

Blockcast

Inside the Crypto & AI-Powered Adult Playground with Oh's Nic Young

Ever wondered what happens when AI, crypto, and the adult entertainment industry collide?

This week, Blockcast delves into the developing space of digital interaction with Nic Young, CEO of Oh , a platform at the forefront of integrating artificial intelligence and cryptocurrency within the adult entertainment industry. Nic unpacks how Oh is building AI-powered digital companions, including realistic twins of creators, offering a personalized and uncensored experience underpinned by crypto transactions: "We felt that it was the perfect incubator... an industry that really needs crypto."

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found on Podpage , with guests like Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our most recent shows.

Debt Crisis? All Because of the U.S.

Rising US debt interest, Fed decisions, and trade war fears are shifting investor interest towards B...

Why We're Reducing Exposure in the Short-Term

Your daily access to the backroom....

Strategy Deepens Bitcoin Dominance With Another $285 Million Acquisition

With its latest acquisition, Strategy reinforces its dominance as the largest corporate holder of Bi...