Inside Hyperliquid's Technical Architecture

DeFi promised to democratize finance, but traditional blockchain architecture forced a painful choice: fast and centralized, or slow and decentralized. Users had to pick between Coinbase's speed or Uniswap's transparency.

Hyperliquid breaks this false trade-off with computer science innovations that solve fundamental distributed systems problems. The result: centralized exchange performance with full decentralization.

What you'll discover:

- How unified state eliminates cross-chain delays that plague DeFi

- Why HyperBFT consensus delivers 600x faster finality than Bitcoin

- How dual-block architecture serves both traders and developers optimally

- Why this represents the future of financial infrastructure

Performance Comparison: Hyperliquid vs. Traditional Blockchains

| Metric | Bitcoin | Ethereum | Hyperliquid |

|---|---|---|---|

| Finality | 60 minutes | 13 minutes | 0.1 seconds |

| Transactions/Second | 7 | 15 | 200,000+ |

| Bridge Risk | N/A | High | None |

| Cross-Layer Latency | N/A | 2-15 minutes | Instant |

1. The Unified State Architecture Challenge

In distributed systems, keeping data consistent across multiple computers represents one of computer science's hardest problems. When blockchain layers work together, they face this same challenge with devastating consequences for users.

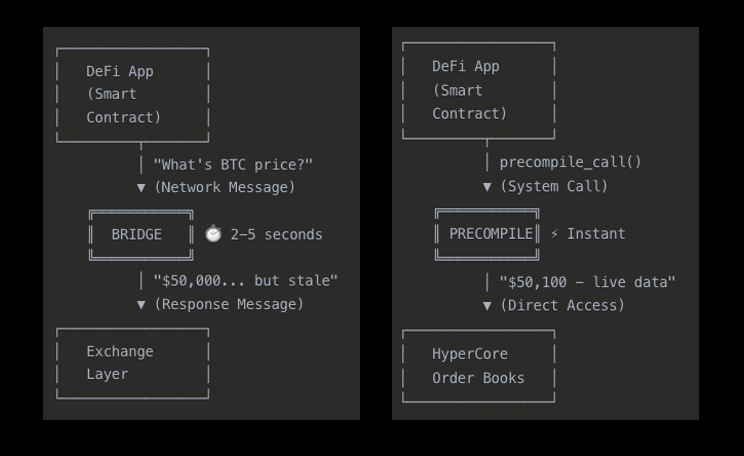

In the traditional blockchain approach, HyperCore (trading layer) might report that Bitcoin's price is $50,000, while HyperEVM (application layer) queries for Bitcoin's current price. However, this creates a significant problem: by the time the message travels between layers, the price might have already changed to $50,100. As a result, applications end up making critical decisions based on stale or incorrect data.

Hyperliquid's solution addresses this fundamental issue through synchronized data sharing. When HyperCore updates Bitcoin's price to $50,100, HyperEVM instantly sees the new $50,100 price without needing to send a query. This ensures that both layers always maintain the exact same data at the exact same time, eliminating the lag-induced discrepancies that plague traditional blockchain architectures.

This works because the HyperEVM is not a separate chain, but rather, secured by the same HyperBFT consensus as HyperCore. This lets the HyperEVM interact directly with parts of HyperCore, such as spot and perp order books.

Instead of two separate systems trying to stay synchronized, Hyperliquid created one unified system with shared state. Traditional blockchains are like separate office buildings connected by slow messenger service. Hyperliquid is one building where trading happens on the ground floor and apps operate on the second floor. When prices change downstairs, apps upstairs see it through the same windows instantly.

Consider a lending protocol that needs Bitcoin's current price to check liquidation thresholds. Instead of calling another building and waiting for an answer, it looks directly at the trading floor in real-time. The protocol can instantly verify if a borrower's collateral has dropped below safe levels and execute liquidations immediately, all based on live market data.

This architecture eliminates bridge risk that has cost DeFi users billions in hacks, enables real-time financial applications previously impossible in decentralized systems, and reduces operational complexity by removing cross-chain infrastructure requirements.

2. The Consensus Speed Problem

When thousands of computers need to agree on something, you encounter the "Byzantine Generals Problem." Traditional solutions are slow because every computer waits for every other computer to respond before moving forward.

In traditional blockchain consensus, Computer 1 announces "I approve transaction A" and waits for everyone to respond. Computer 2 does the same. After 10-60 seconds of waiting, Transaction A finally gets confirmed, and only then can they start on Transaction B. This sequential processing creates the speed bottlenecks that make traditional DeFi feel sluggish.

Hyperliquid's HyperBFT takes a different approach. Computer 1 announces "I approve transaction A and I'm ready for transaction B." Computer 2 makes the same dual announcement. The result is that transactions can continue to be sequenced without having to wait for the hash of the current block, unlike in Tendermint and Ethereum.

The Hyperliquid L1 will be transitioning to HyperBFT, a custom consensus algorithm written from the ground up. The implementation is in final stages of testing on testnet. The mainnet migration is expected to happen in the coming weeks.

— jeff.hl (@chameleon_jeff) May 5, 2024

The Hyperliquid L1 is one of a few chains…

Source: https://x.com/chameleon_jeff/status/1787140092735185365

HyperBFT processes transactions like an assembly line instead of a single-file queue. Built on the HotStuff protocol with pipeline processing, multiple transactions get processed simultaneously instead of one-by-one. This architectural change delivers median latency of 0.1 seconds, while 99th percentile latency stays under 0.5 seconds. Meanwhile, HyperCore supports up to 200,000 orders per second, with consensus designed to scale beyond 1 million orders per second.

Even though Hyperliquid is 600 times faster than Bitcoin, it's still just as secure. The system can handle up to one-third of its validators being bad actors or hackers without breaking. This is the same security level as other major blockchains.

3. The Block Size vs. Speed Trade-off

Computer systems face a fundamental trade-off: process things quickly or handle large, complex tasks, but traditionally not both simultaneously. It's like highway design. You can either build fast lanes for cars or wide lanes for trucks, but mixing them typically slows everyone down.

Traditional blockchains face this dilemma constantly. Should blocks be fast (2 seconds) or big (30MB)? You must pick one. Fast blocks or big blocks. The result is that either users wait longer for confirmations, or developers can't deploy complex applications due to size constraints.

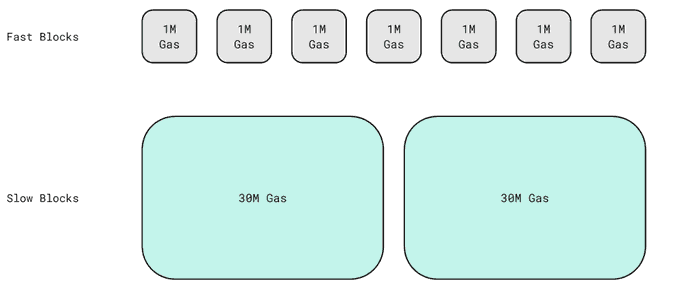

Hyperliquid's dual-block architecture splits the difference intelligently. Fast blocks handle regular transactions every 2 seconds, while slow blocks process complex deployments every minute. The total HyperEVM throughput is split between small blocks produced at a fast rate and large blocks produced at a slower rate.

The primary motivation behind this dual-block architecture is to decouple block speed and block size when allocating throughput improvements. Users want faster blocks for lower time to confirmation. Builders want larger blocks to include larger transactions such as more complex contract deployments. Instead of one lane that's either fast or wide, Hyperliquid built two parallel highways - an express lane for cars and a freight lane for trucks. Both operate at optimal speed without interference.

Fast blocks process with 2 seconds timing and a 2M gas limit, perfect for regular trades. Slow blocks take 1 minute but offer a 30M gas limit for complex smart contract deployments. Developers can choose which lane their transactions use through smart routing systems.

When you're trading, your transaction uses the fast lane with 2-second blocks. When a developer deploys a new DeFi protocol, it uses the slow lane with 1-minute blocks without slowing down your trade. This eliminates performance trade-offs in blockchain design, optimizes user experience for different business needs, and enables true multi-tenancy where various applications get optimal performance.

4. The Cross-System Communication Problem

In computer operating systems, when an application needs data from the core system, it makes a "system call." The challenge is making this communication fast and secure, especially when dealing with financial data that changes rapidly.

Traditional blockchain applications face a communication nightmare. A DeFi app asks "What's the current BTC price on the exchange?" The exchange sends a message across the network responding "It was $50,000... 2 seconds ago." By the time the app receives this answer, the data might already be outdated. Applications end up making financial decisions based on stale information, leading to failed trades, incorrect liquidations, and user losses.

Hyperliquid's solution uses read precompiles that work like built-in system functions. When a DeFi app asks "What's the current BTC price?" HyperCore instantly returns the live price from the order book. The values are guaranteed to match the latest HyperCore state at the time the EVM block is constructed.

Instead of sending messages between separate systems, Hyperliquid gives smart contracts direct "system call" access to trading data. Traditional blockchains require calling a librarian in another building to ask about a book. Hyperliquid's precompiles provide direct access to the card catalog. You can instantly look up what you need.

This enables sophisticated financial applications that were previously impossible. A lending protocol can instantly check if Bitcoin's price dropped below a liquidation threshold, then immediately execute the liquidation. This occurs all in the same transaction. No delays, no stale data, no failed operations due to price movements.

This approach eliminates communication delays between blockchain layers, provides guaranteed data freshness for financial applications, and enables real-time trading strategies impossible with traditional cross-chain messaging.

5. The Liquidity Provision Problem

Financial markets need constant buyers and sellers for smooth trading. Traditional exchanges use professional market makers, specialized firms that always offer to buy or sell. The challenge in DeFi is creating an automated system that makes intelligent decisions across thousands of trades without human intervention.

Traditional DeFi approaches this problem like so: a liquidity pool announces "I'll hold 50% TokenA and 50% TokenB."

When a trader says "I want to buy TokenA," the pool mechanically adjusts ratios based on a predetermined formula.

But this creates a significant problem. The pool has no intelligent decision-making capability. As such, this may lead to poor prices for traders and predictable losses for liquidity providers.

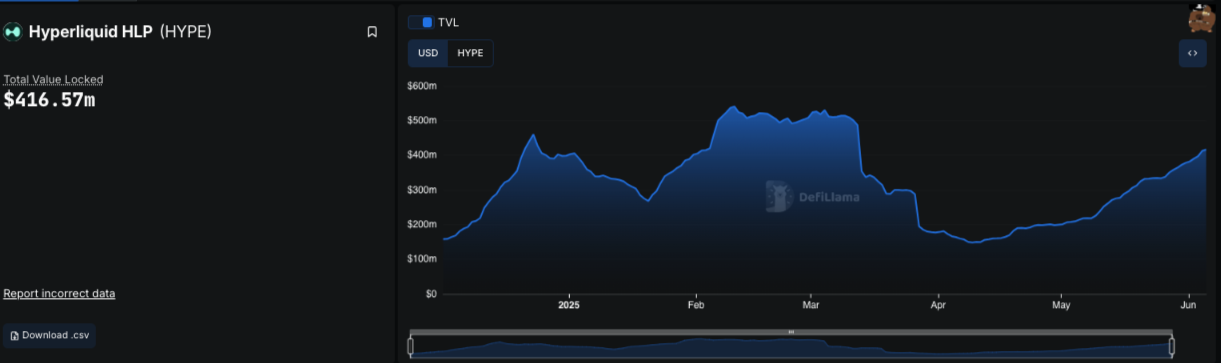

Hyperliquid's HLP (Hyperliquidity Provider) represents a fundamentally different approach. The HLP algorithm analyzes market conditions in real-time. When a trader wants to buy BTC futures, HLP intelligently decides whether to take the opposite side of the trade based on current market conditions, volatility, and risk parameters. When a trader opens a position, the vault can take the opposite side of the trade, ensuring enough liquidity.

HLP runs an active market-making strategy, adjusting it dynamically based on market conditions. It's not just a passive pool, but an intelligent trading algorithm. Traditional liquidity pools are like vending machines. They dispense what you want at preset prices. HLP is like having a skilled chef who adjusts the menu and prices based on customer demand, ingredient costs, and kitchen capacity.

The system accumulates the platform's fees, including revenue from trading, funding, and liquidations, and distributes them back to users. HLP's strategy uses tick data from Hyperliquid and centralized exchanges to determine fair prices. It executes orders through market-making and taking strategies to provide continuous liquidity. While the strategy operates off-chain, all vault positions, open orders, trade history, deposits, and withdrawals are visible onchain for transparency.

In practice, when Bitcoin becomes volatile, HLP adjusts its approach to manage risk exposure. When markets are calm, it provides liquidity to capture trading fees. The exact trading mechanisms behind the strategy are not openly shared, which is standard practice for market-making operations to prevent gaming.

This approach democratizes market-making strategies that were previously available only to institutional participants, creates revenue models based on actual trading activity rather than token inflation, and demonstrates that dynamic liquidity provision can outperform simple automated market maker formulas.

6. The Token Transfer Problem

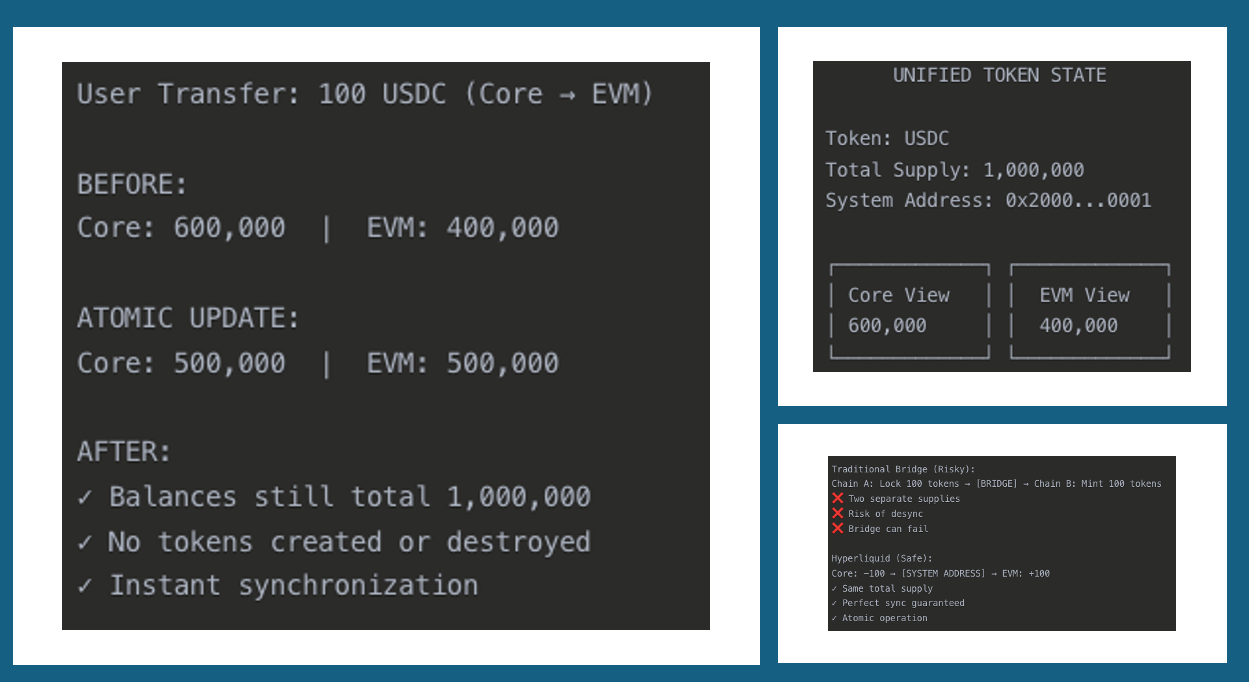

When the same asset exists in two different environments, keeping them synchronized is complex. Traditional systems don't update everywhere at once. When you change something, it slowly spreads to other parts of the system. Until it's done spreading, different parts might show different information.

Traditional blockchain bridges create significant problems. When users want to move tokens between different blockchains - like from Ethereum to Solana, or from Layer 1 to Layer 2 networks like Arbitrum - bridges typically lock tokens on the source chain and mint equivalent tokens on the destination chain. This creates two different token contracts representing the same underlying asset across separate blockchains, leading to bridge vulnerabilities, transaction delays, and scenarios where tokens might get stuck in transit or the accounting between chains could become mismatched.

Hyperliquid's unified token management works differently. When users request "Move my tokens between layers," the system updates the same underlying record that both layers read from. Every token has a system address on the Core, which is the address with first byte 0x20 and the remaining bytes all zeros, except for the token index encoded in big-endian format.

Instead of separate token contracts on each blockchain, Hyperliquid uses one master record. Both HyperCore and HyperEVM read from different "views" of the same data. Traditional bridges are like having your money represented by different currencies in different countries. You need to exchange dollars for euros when traveling, with exchange risks and fees. Hyperliquid is like one bank account that you can access through both online banking and mobile app, same money, different interfaces.

The technical implementation works like this: the system keeps a master balance sheet that both layers can read and update. When tokens move between layers, the system automatically adjusts the numbers on both sides to keep everything balanced.

When you move 100 USDC from HyperCore to HyperEVM, the system doesn't "send" tokens anywhere. It updates the master balance sheet so HyperCore shows 100 less and HyperEVM shows 100 more, while the system automatically keeps everything balanced. It's like moving money between checking and savings at the same bank. The transfer is atomic: it either completes or fails, with no possibility of tokens getting lost in transit.

This architecture aims to eliminate bridge risks that have plagued cross-chain transfers. Bridge hacks have cost users nearly a billion dollars in major incidents alone.

In February 2022, the Wormhole exploit saw hackers steal roughly $320 million by exploiting smart contract vulnerabilities. Two months later, attackers compromised validator private keys in the Ronin Network bridge hack , stealing roughly $625 million.

These attacks demonstrate the vulnerabilities in traditional bridge designs. Hyperliquid's unified architecture could avoid these risks entirely.

Current Limitations & Trade-offs

No system is perfect, and Hyperliquid's innovations come with important considerations that potential users and developers should understand.

The validator decentralization currently involves approximately 16 validators compared to Ethereum's thousands. This represents a trade-off between higher performance and a smaller validator set. Though the trajectory points toward expanding the validator network over time as the system matures.

Ecosystem maturity presents another consideration. As a newer platform, Hyperliquid has fewer battle-tested applications compared to established blockchains like Ethereum. This creates a trade-off between cutting-edge technology and a less proven track record. Though it also presents early adopter advantages for developers willing to build on emerging infrastructure.

System complexity represents the final major consideration. Hyperliquid's architecture is more sophisticated than simpler blockchain designs, creating a trade-off between advanced capabilities and a steeper learning curve for developers. However, this complexity enables future-proof design as DeFi continues to mature and demand more sophisticated infrastructure.

Potential Industry Impact

For financial institutions, Hyperliquid's architecture offers a potential path toward enterprise-level performance with blockchain transparency. While still early, the platform's speed improvements could make real-time risk management more feasible at scale. Trading algorithms may perform better on this infrastructure, though institutional adoption will likely require extensive testing and clearer regulatory frameworks.

DeFi protocols have new possibilities to explore, though widespread adoption remains uncertain. High-frequency trading strategies show promise on faster infrastructure. Real-time liquidation systems could become more reliable. However, these applications are still experimental and face the usual challenges of security audits, user adoption, and market volatility.

End users may experience improvements in trading speed and convenience. Early reports suggest faster transaction times and reduced delays compared to traditional DeFi platforms. Bridge risks appear minimized through unified architecture, though the platform's long-term security record is still developing as it's relatively new.

For competitors, Hyperliquid demonstrates that the performance-decentralization trade-off may not be as fixed as previously thought. Other platforms will likely pursue similar architectural improvements. Whether unified state becomes standard or remains a niche approach depends on broader market adoption and technological development over the coming years.

Bottom Line for Decision Makers

Hyperliquid shows a potential breakthrough in blockchain architecture. It suggests you might achieve centralized exchange speed without giving up decentralization. The technical innovations are promising but still need broader testing.

The platform combines several improvements.

Unified state eliminates cross-chain sync problems. HyperBFT consensus delivers much faster finality than Bitcoin. Dual-block architecture handles both speed and capacity needs. Real-time communication between layers becomes possible. Liquidity systems operate more intelligently. Bridge risks appear reduced through unified token management.

For enterprises considering blockchain infrastructure, these innovations address real problems that have limited institutional DeFi adoption. However, enterprise adoption typically requires extensive testing and proven track records over time.

The technology offers a useful case study for CTOs exploring next-generation financial systems. The old performance-decentralization trade-off may be less fixed than previously thought.

Early results suggest modern infrastructure could deliver both speed and transparency. This could represent a meaningful shift in what's possible with decentralized technology, though broader adoption will determine long-term impact.

Companies should consider evaluating these architectural patterns for their own systems. Pilot programs could test high-performance DeFi applications. The future direction appears to favor fast, transparent, and decentralized finance.

While market adoption will ultimately determine which approaches succeed, the early results are encouraging. For builders and enterprises willing to experiment, Hyperliquid's innovations offer a compelling foundation to explore what's now possible in decentralized finance.

Elsehere

Singapore & the Future of Crypto (11 June)

Join us for a compelling fireside chat on 11 June with Jeremy Tan , entrepreneur and independent GE2025 candidate, as he sits down with Saad Ahmed, Head of APAC at Gemini, to explore what Bitcoin really is, why it matters, and how it could help shape the future of Singapore — and its people.

Whether you're new to Bitcoin, curious about crypto, or eager to understand where the future of money is headed, this is your chance to gain clear, honest insights. No jargon. No hype. Just practical knowledge for everyday Singaporeans.

The event is free to attend, though seats are limited and subject to confirmation. If not approved, you’ll still receive a livestream link to attend online. Apply early to secure your spot!

Blockcast

Fideum's Anastasija Plotnikova on Building Regulated Crypto Infrastructure

In this episode, your host Takatoshi Shibayama sits down with Anastasia Plotnikova , CEO of Fideum , a regulated digital asset infrastructure company operating across Lithuania and Canada. They dive into what it's like to build in Europe under the new MiCA regulation, the practical challenges of regulation, and the global dichotomy between CeFi and DeFi. Anastasia shares her journey from law enforcement to crypto, and how growing up in the post-Soviet era shaped her deep appreciation for decentralized finance.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets .

Corporate Cash Exodus Continues as Metaplanet Targets Massive Bitcoin Holdings

Japanese firm's $5.3B plan to hold 1% of all Bitcoin highlights accelerating shift from traditional ...

Binance Compliance Chief Tigran Gambaryan Exits Exchange After Nigeria Detention

Former IRS agent leaves crypto exchange following eight-month imprisonment and health complications....

Musk vs. Trump Sparks Liquidations – Why We Believe the Correction Will Extend

Your daily access to the backroom....