Corporate Cash Exodus Continues as Metaplanet Targets Massive Bitcoin Holdings

The corporate exodus from traditional cash holdings is accelerating as companies increasingly turn to Bitcoin as a treasury asset, with Tokyo-listed Metaplanet becoming the latest firm to make a massive bet on cryptocurrency's long-term value proposition.

*Metaplanet Announces Accelerated 2025-2027 Bitcoin Plan*

— Metaplanet Inc. (@Metaplanet_JP) June 6, 2025

*Targeting 210,000 $BTC by 2027* pic.twitter.com/xJKu3J8Apb

Metaplanet has unveiled an ambitious $5.3 billion fundraising plan to accumulate over 210,000 Bitcoin by 2027 , or roughly 1% of the total Bitcoin supply, through what it calls the largest warrant issuance in Japanese capital market history. The move represents a dramatic escalation in the corporate Bitcoin adoption trend that has gained momentum as traditional cash management strategies fail to preserve value in an era of monetary expansion and currency volatility.

Why Companies Are Abandoning Cash

The shift away from traditional cash treasuries reflects fundamental changes in the global financial landscape. Corporate treasurers increasingly view holding large cash positions as a liability rather than a conservative strategy, as inflation erodes purchasing power while central bank policies keep interest rates below inflation rates in many jurisdictions.

Bitcoin's fixed supply of 21 million tokens offers an alternative that companies view as digital gold for corporate balance sheets. The cryptocurrency has emerged as a hedge against currency debasement and monetary expansion, particularly appealing for firms operating in economies with negative interest rates or weakening currencies.

The movement was pioneered by MicroStrategy (now Strategy), which under CEO Michael Saylor has accumulated over 580,000 BTC worth more than $61 billion. What began as an unconventional corporate finance strategy has increasingly attracted followers as institutional acceptance grows and Bitcoin's long-term value proposition becomes more widely recognized.

For Japanese firms like Metaplanet, this strategy offers particular appeal given Japan's prolonged negative interest rate environment and the yen's historical weakness against major currencies. The corporate playbook typically involves using various funding mechanisms, such as equity raises, convertible bonds, and warrant issuances, to systematically convert cash into Bitcoin while maintaining operational liquidity.

Metaplanet's Aggressive Execution

The Japanese investment firm will issue 555 million stock acquisition rights through its "555 Million Plan," following the successful completion of its earlier "21 Million Plan" that raised $600 million and helped accumulate nearly 9,000 Bitcoin. The latest plan represents a dramatic acceleration from the company's previous pace.

メタプラネット、2025〜2027年のビットコイン戦略を加速へ:2027年までに21万BTCの保有を目指すと発表。 https://t.co/6Mxw871otL pic.twitter.com/iWEPjVjq6l

— Metaplanet Inc. (@Metaplanet_JP) June 6, 2025

Nearly 96% of the raised capital will go directly to Bitcoin purchases, with smaller amounts allocated to bond redemptions and income-generating strategies like selling put options. This laser focus on Bitcoin accumulation mirrors Strategy's approach while adapting to Japanese market conditions.

The company has structured the issuance using moving strike warrants—where exercise prices adjust with market conditions—marking a first for the Japanese market at current price levels. EVO FUND, a Cayman-based investor that has backed Metaplanet's previous financing deals, will purchase the warrants.

To minimize shareholder dilution, the issuance includes minimum exercise prices and gives the company rights to temporarily suspend conversions. This careful structuring reflects lessons learned from other corporate Bitcoin adopters about managing shareholder concerns while pursuing aggressive accumulation strategies.

Market Response and Growing Momentum

Metaplanet's shares have surged more than 275% this year as investors embrace the Bitcoin strategy, though they closed down 1.6% Friday following the announcement. The stock's performance reflects the inherent volatility of Bitcoin-focused corporate strategies, where share prices become highly correlated with cryptocurrency market movements.

However, early adopters of corporate Bitcoin strategies have generally been rewarded as cryptocurrency appreciation has driven substantial returns. Strategy's stock has far outperformed traditional indices, validating the approach for investors willing to accept increased volatility in exchange for potential upside.

The trend shows no signs of slowing as more companies recognize that traditional cash management strategies may no longer serve shareholder interests in an environment of persistent inflation and monetary expansion. Metaplanet's ambitious 210,000 Bitcoin target would establish it among the world's largest corporate cryptocurrency holders.

As corporate treasuries continue their exodus from cash, Bitcoin adoption represents a fundamental shift in how companies think about preserving and growing shareholder value. What once seemed like a radical financial experiment is increasingly becoming a mainstream corporate strategy, with Metaplanet's massive accumulation plan serving as the latest proof point in Bitcoin's evolution from speculative asset to institutional treasury standard.

Elsewhere

Singapore & the Future of Crypto (11 June)

Join us for a compelling fireside chat on 11 June with Jeremy Tan , entrepreneur and independent GE2025 candidate, as he sits down with Saad Ahmed, Head of APAC at Gemini, to explore what Bitcoin really is, why it matters, and how it could help shape the future of Singapore — and its people.

Whether you're new to Bitcoin, curious about crypto, or eager to understand where the future of money is headed, this is your chance to gain clear, honest insights. No jargon. No hype. Just practical knowledge for everyday Singaporeans.

The event is free to attend, though seats are limited and subject to confirmation. If not approved, you’ll still receive a livestream link to attend online. Apply early to secure your spot!

Blockcast

Fideum's Anastasija Plotnikova on Building Regulated Crypto Infrastructure

In this episode, your host Takatoshi Shibayama sits down with Anastasia Plotnikova , CEO of Fideum , a regulated digital asset infrastructure company operating across Lithuania and Canada. They dive into what it's like to build in Europe under the new MiCA regulation, the practical challenges of regulation, and the global dichotomy between CeFi and DeFi. Anastasia shares her journey from law enforcement to crypto, and how growing up in the post-Soviet era shaped her deep appreciation for decentralized finance.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets .

Binance Compliance Chief Tigran Gambaryan Exits Exchange After Nigeria Detention

Former IRS agent leaves crypto exchange following eight-month imprisonment and health complications....

Musk vs. Trump Sparks Liquidations – Why We Believe the Correction Will Extend

Your daily access to the backroom....

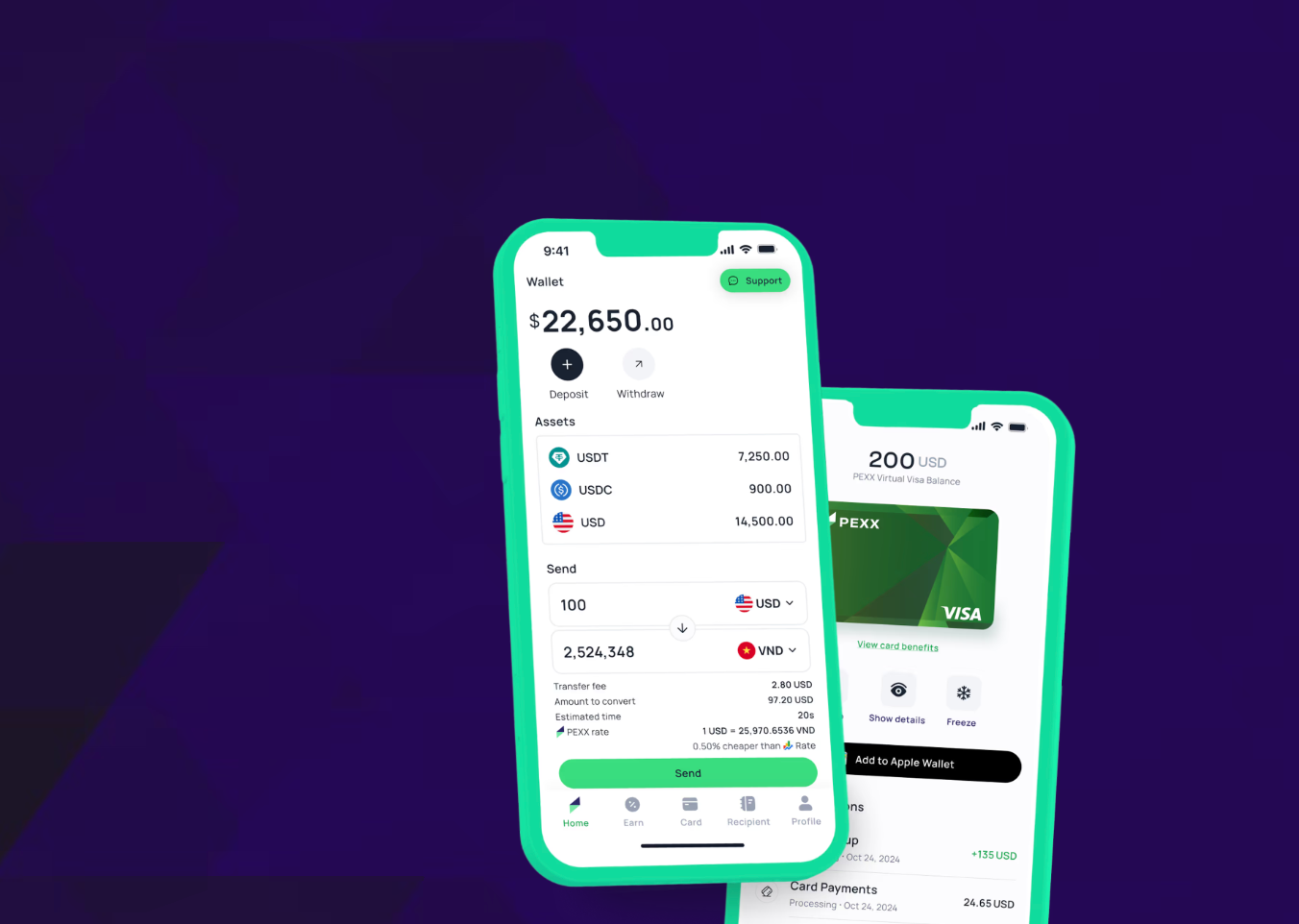

PEXX Launches Neobank, Bridging USD, Crypto for Global Users

Singapore-based fintech opens full banking suite across 50+ countries with stablecoin integration...