PEXX Launches Neobank, Bridging USD, Crypto for Global Users

PEXX, a cross-border USD banking platform, has launched its full neo-banking suite across more than 50 countries, targeting the growing population of remote workers, freelancers, and digital nomads who need seamless access to US dollar banking services.

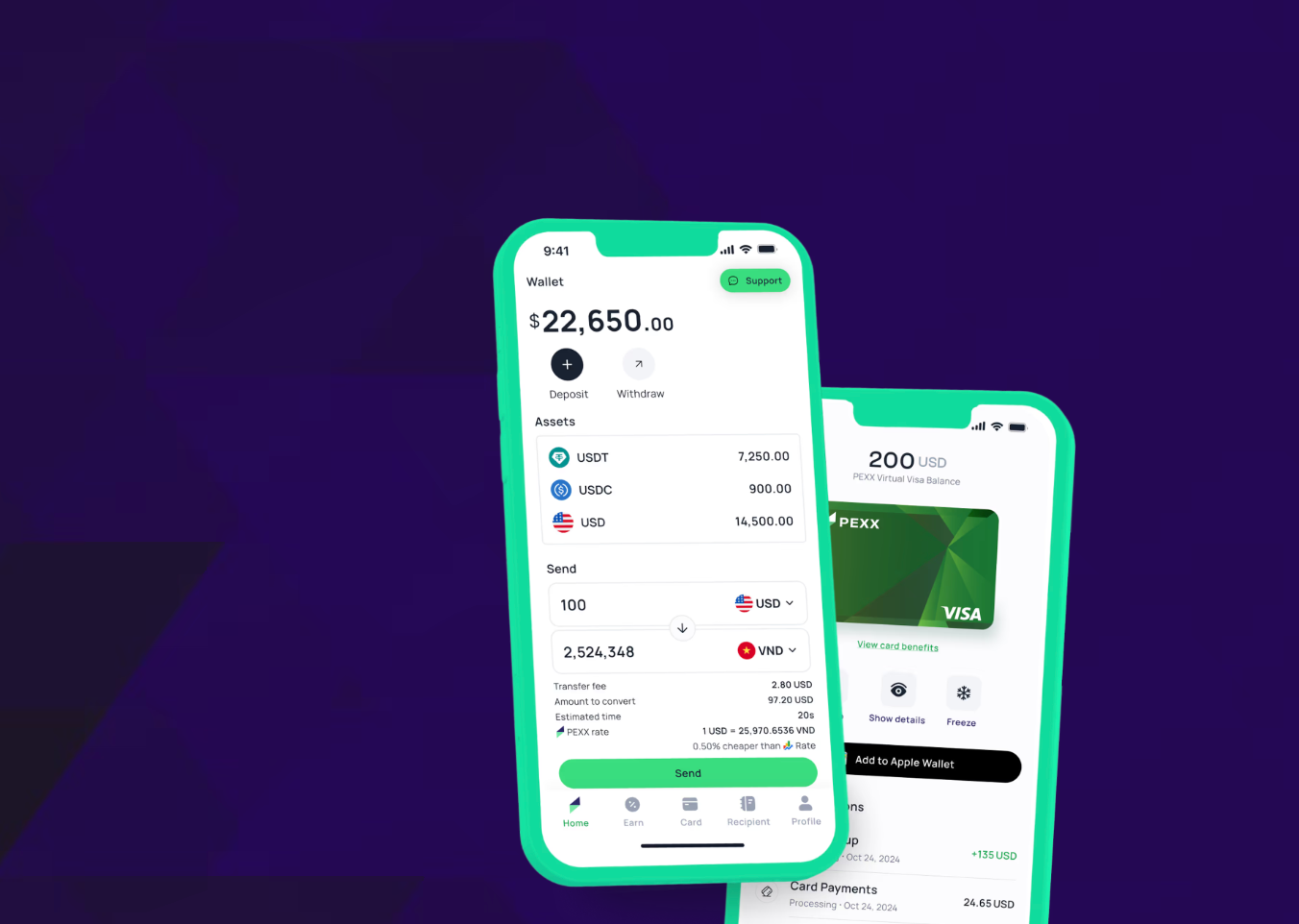

The Singapore-based fintech allows users to open USD accounts without US residency requirements, using only a passport and phone for instant onboarding. The platform integrates traditional banking with cryptocurrency capabilities, enabling deposits in USDT and USDC stablecoins alongside standard USD transfers via SWIFT and ACH.

Key features include a global Visa debit card that works with both USD and stablecoins, earning up to 3.5% APY on idle balances through tokenized US Treasury Bills, and rapid cross-border transfers that typically clear within minutes. The company claims its stablecoin payment infrastructure delivers superior exchange rates compared to traditional fintech competitors, with users keeping 1-2% more on international transfers.

"PEXX gives you everything you expect from a USD bank—except the borders, high fees and friction," said Marcus Lim, CEO and founder. "Our mission is simple: if you've got a passport and a phone, you should have full access to USD, just like anyone else."

The platform launch follows PEXX's $4 million seed funding round led by TNB Aura, with participation from Antler and LongHash Ventures. The company operates as an AUSTRAC-registered Digital Currency Exchange in Australia and a Money Service Business in the US, while partnering with Fireblocks for asset custody and Ripple for blockchain payments.

PEXX said it plans to use the funding for global licensing and expansion across Asia, Latin America, and the Middle East as it targets freelancers, expats, startups, and other globally mobile professionals seeking alternatives to traditional banking constraints.

Corporate Cash Exodus Continues as Metaplanet Targets Massive Bitcoin Holdings

Japanese firm's $5.3B plan to hold 1% of all Bitcoin highlights accelerating shift from traditional ...

Binance Compliance Chief Tigran Gambaryan Exits Exchange After Nigeria Detention

Former IRS agent leaves crypto exchange following eight-month imprisonment and health complications....

Musk vs. Trump Sparks Liquidations – Why We Believe the Correction Will Extend

Your daily access to the backroom....