Crypto pundit Kyle Chassé has pointed to the rising global liquidity to prove that Bitcoin is currently undervalued . His comments come as fiat currencies like the Dollar and Yen continue to weaken amid concerns about governments’ fiscal policies.

Global Liquidity Points To A Bitcoin Target Of $270,000

In an X post , Kyle Chassé shared an accompanying chart highlighting a Bitcoin target of $270,000 based on rising global liquidity. The pundit stated that the herd says that $90,000 BTC is expensive, but that the fiat ledger has reminded everyone why the digital ledger exists. This came as he revealed that the global M2 money supply has hit a record $98 trillion, driven by aggressive expansion from the U.S., the Eurozone, China, and Japan.

Chassé further noted that year-to-date (YTD) global liquidity growth is now 6.2%, the fastest pace since the 2020 pandemic response. The pundit warned that in a system where the fiat denominator is permanently diluted, fixed-supply assets are not going up in price, but that cash is “loudly becoming worthless.” As such, he believes that BTC is a good hedge against currency debasement and potentially inflation.

The pundit’s comments notably come amid a decline in the dollar, with the DXY down since the start of the year. The yen is also down YTD, as these fiat declines are coming amid a push by the governments to increase spending. Increased government spending is considered bullish for Bitcoin, given its fixed supply compared to fiat currencies, which governments continue to print. BitMEX co-founder Arthur Hayes had also recently predicted that a rise in dollar liquidity would spark higher BTC prices.

However, that is yet to be the case as Bitcoin continues to trade like a risk asset and has erased its year-to-date (YTD) gains amid political tensions in the U.S. A U.S. government shutdown is also looking more likely by January 31, sparking a BTC drop below $87,000 yesterday.

BTC Will Rise Once Liquidity Returns

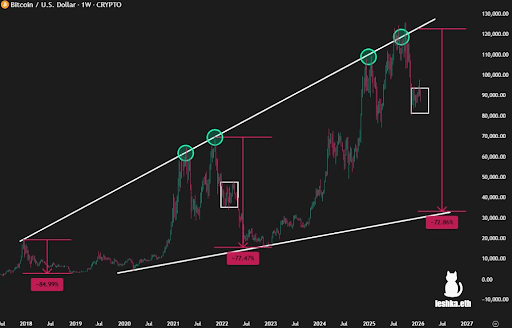

Crypto pundit Merlijn assured that Bitcoin will rise once liquidity comes back. In an X post , he urged market participants to zoom out and that the BTC pattern would become obvious. The pundit revealed that the flagship crypto has already recorded waves 1, 2, and 3 with lower highs , which signal trend fatigue.

Now, Bitcoin is looking to form waves 4 and 5, which would signal a reset, absorption, and base building. Merlijn suggested that the bottom may not yet be in, but that once that happens, BTC could rally to as high as $124,000, bringing it close to its current all-time high (ATH) of $126,000.

At the time of writing, the Bitcoin price is trading at around $87,700, down in the last 24 hours, according to data from CoinMarketCap.