Improving Community Distribution

来源:zeeprime.capital

作者:Cam

With yet another big airdrop and the associated fanfare, I am once again asking you to rethink the distribution methodology for your protocol .

We think airdrops are stupid and furthermore, aside from the 5 minutes of hype, they are overall negative for most protocols. It is no surprise that phrases like “it’s time to responsibly dump my responsibility” are a thing. Freebies just don’t work. If the goal is that the asset should become valuable overtime a free airdrop for a past action is just digging a hole of devaluation that would have to be filled with financial capital.

Community Distribution in crypto is really about customer acquisition. Lest the crypto fam forget that most of the jobs at Web 2 tech companies are sales. Our current models of “sales” in Web 3 are lazy.

A basic model for evaluating web 2 hypergrowth tech businesses is looking at Customer Acquisition Cost (CAC) versus the Lifetime Value (CLV). Everytime you give away tokens can be likened to web 2 marketing spend (CAC), while CLV is the total of economic rewards (such as protocol earnings) that a user brings by using the platform. Hyper growth tech company XYZ is happy to be burning the capital as long as they see an attractive CLV/CAC. If they don’t see this long-term value they change their approach, why don’t you? Simply put you want CLV>CAC otherwise you are losing money. The payback (breakeven in CAC) also matters, as you want to recoup your investment in 12-24 months, rather than 5-7 years.

While part of this critique is unwarranted, part of it ain’t untrue.

If your token is really your tool for acquiring these users in Web 3 (who are in the room right now with us?), being loose with it is terrible for a business who is hardly making any money to begin with (CLVs are low). Generally speaking the goal for you as the protocol owner should be to get your tokens into the hands of the right people (who will use your application and have a high CLV) – those that truly believe in your protocol. If they are not in the hands of users who truly believe in your team or product, they will probably claim and dump them (i.e. finding product market fit is harder if you gave it all away early/ to the wrong people).

Tokens are pseudo-equity-like instruments. If you are launching a valueless governance token with no real tangible benefits (relying on memetic quality or hopium) to hold it, non-zealots will inevitably dump the token while the value is > 0.

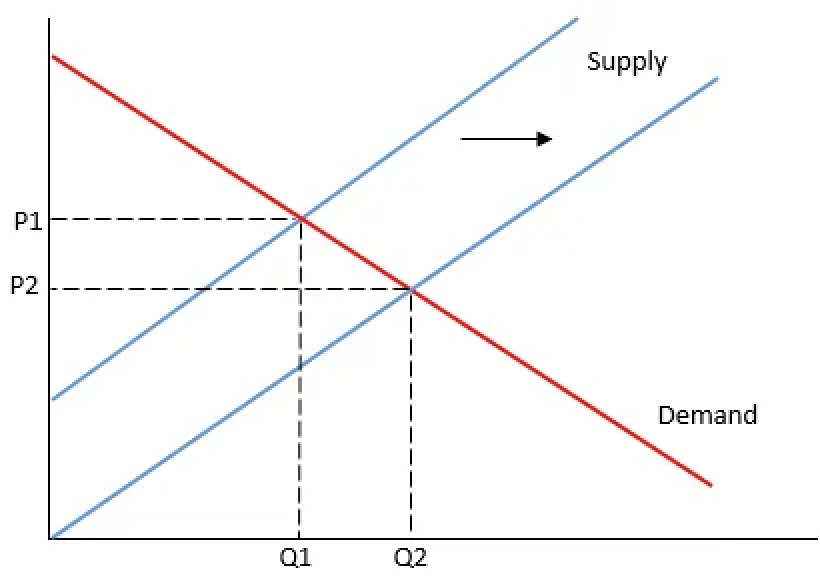

People hold (buy) traditional equity in companies because it is attractive to do so. The entitlement to future cash flows has observable value. Otherwise all your valueless governance token is doing is creating a liquidity event for investors and the team (maybe you and the team want this?). A given goods price is dictated by the supply and demand. Those who took microeconomics know this chart all too well:

If you are unable to create demand for your token (in this case make it desirable to hold), while continuously increasing supply, you know what is bound to happen. While price is not everything, as we’ve seen with so many protocol’s narratives before, it definitely plays an important role.

How do we improve distribution then?

Airdrops

First and foremost a freebie should, at this point, be a nonstarter. Time and again, we see poor results across almost every front. Cpt N3mo from hashed even went through this quantitatively here and showed some poor price performance on median across different time horizons. With median performance 100 days post airdrop of -36% it’s hard to say airdrops are in the hands of the right people. While I appreciate the desire to bootstrap the community and award early participants, we should think of such things more as warrants to exercise at a given strike.

Forcing participants to spend to exercise an option can also do a remarkable thing to psychology (think the endowment effect). While vesting periods can push decision making (such as selling) over longer time horizons such as years.

By offering such mechanisms you can achieve a number of interesting benefits. While the discount to spot is attractive from an arbitrage perspective, you can also shift your “airdrop event” from a discrete process to a continuous one.

One of the most underrated negative aspects of one and done airdrops is that new users can feel like they “missed” an ecosystem. This can actually hurt adoption – “oh the airdrop happened already no point in digging into that ecosystem”. Yes you can add a curve etc. to better reward your earliest supporters, but the fundamental shift is from airdrop to warrant and discrete process to continuous. Optimism’s multi stage event is at least a step in the right direction on this front, however its duration should be much longer.

A continuous process allows new participants becoming important parts of the ecosystem (participating in new products, governance, etc.) to also be able to capture the similar benefits as legacy users. Lets not punish those later than us on a binary scale, especially if they are coming late and adding more value. You want users who bring the most value, not exclusively the earliest users.

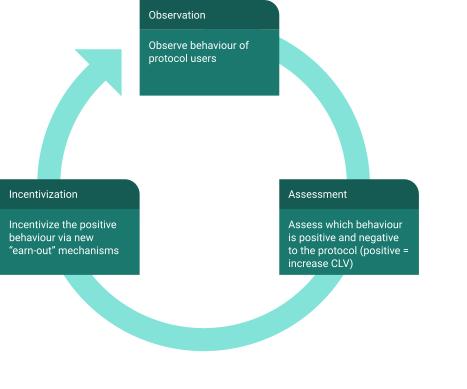

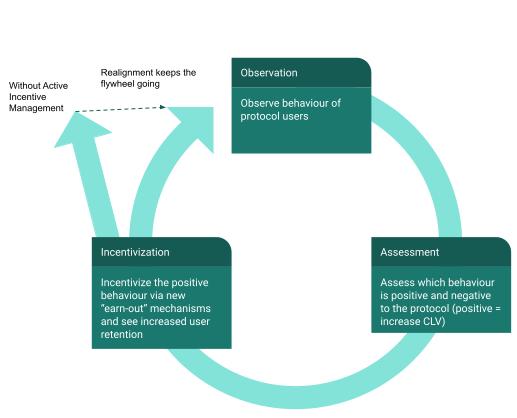

This is also an attractive option as it increases your ability to be dynamic and reflexive to the ecosystem. Criteria can move in response to and from positive and negative behaviour. You as the protocol owner exert greater influence in shaping the behaviour you feel most optimal for your ecosystem.

Generalized Community Distribution

An interesting potential approach to community distribution should be a gamified KPI that adjusts the emission rate. The fundamental activity we are getting at is aligning the desires of the protocol to the rewards for the community, however this is a potentially novel way to do so.

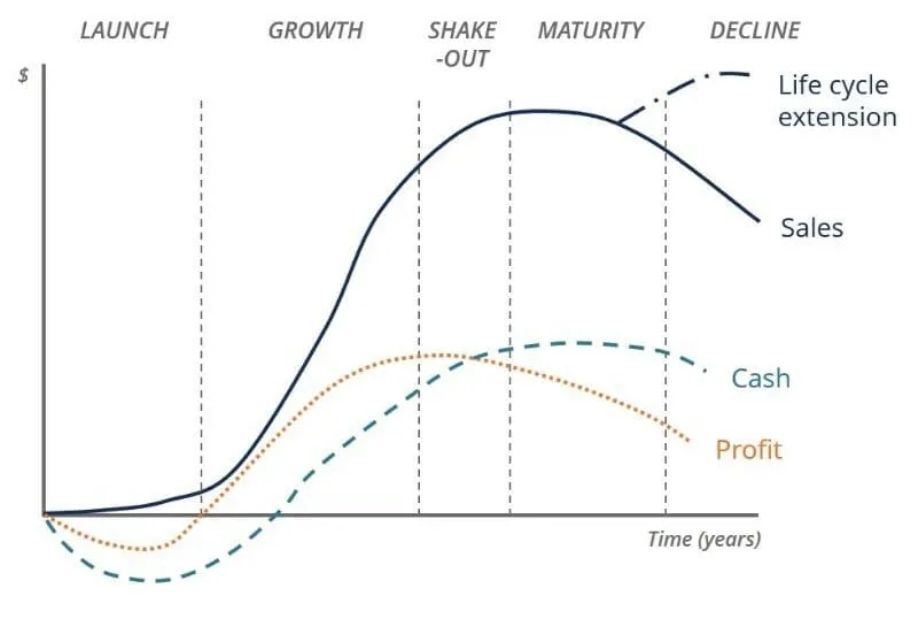

As an example, you could target revenue metrics and have the emission rate adjusting such that profit is a constant function during the adoption phase. In this alignment of incentives you can have a much longer cycle of success, via lifecycle extensions. You can think of the chart of a typical corporate lifecycle, and the associated profitability.

Instead, we are able to effectively map an additional line onto the graph that tracks profit and use that as an emission rate. We are, in a sense, pushing that value back out to users instead of locking into the corporation’s (protocol’s) treasury. This in theory can act as a virtuous cycle and create life cycle extension.

The reflexive cycle

It also goes without saying that this comes with risks. A known qualifying criteria is open to sybil attacks. Despite this, best practices have continued to advance on the criteria front such that we can reduce such costs to an acceptable level of slippage versus the tangible benefits of a traditional airdrop. There is a ton of tinkering you can do with the context of such a distribution method such as increasing discounts for the longer the time you wait to exercise/vest. The most important aspect here is creativity.

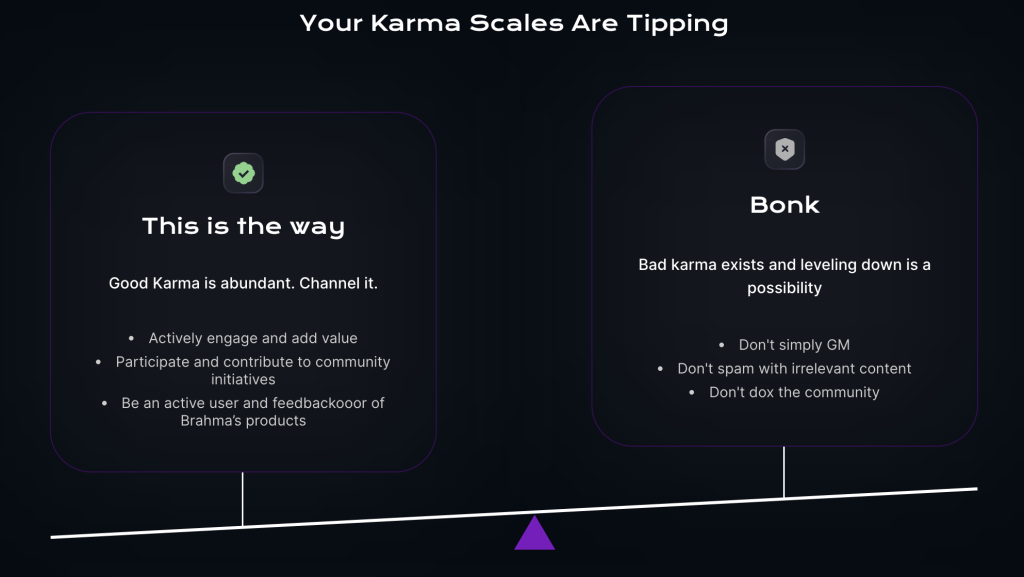

A practical example you can see in the wild is Brahma Finance’s KARMA system. KARMA is a (soulbound) point system that rewards users for efforts within the community. Their system rewards activity and your points can decay for inactivity. Higher KARMA can be used to access special vaults on their protocol, and other tangential benefits like merch and event access. KARMA v2 is also launching soon which will enable usage of the system by other protocols.

This is a continuous rewards system for power users that lowers the CAC significantly compared to direct equity subsidization. In the future they could easily add options for discounted tokens or even free tokens to claim, etc. based on KARMA type scores. Management of the system also allows for better control of your actual emissions – e.g do levels need to be adjusted to balance out the value extraction/creation we are seeing?

As the social tapestry of Web 3 becomes more colorful; with proliferation of decentralized private attestations providers like Sismo (think soulbounds etc.) and various playful metrics like e.g. Degenscore, builders will be able to better target their desired audience.

Summary

In summary better distribution models should look like the following:

-

Warrants for purchase at a discount not airdrops

-

Continuous processes allowing you reward users along a greater timeframe

-

Dynamic criteria to better manage behaviour for reflexive cycles

-

Be creative and experiment

We view these as guiding principles for better alignment of outcomes. In his blog, Fred Ehrsam described such pursuits of incentive alignment as the highest leverage activity protocol’s can pursue:

“So, perhaps the highest leverage thing protocol designers can do is think about how to engineer the evolutionary characteristics of their blockchains — specifically, the economic incentives for anyone to come along and improve them.”

We believe this to be true. In reflexive systems the highest goal should be alignment. This is what a flywheel is. Decentralized token systems facilitate this, but careful thought, consideration, and active management is needed to maintain alignment.

Simply leveraging such decentralized/token systems does not guarantee this. We know this to be true because 99% of the charts in crypto look like this:

Is this your favourite token ?

As a result, we should be pushing the boundaries to create higher leverage (alignment) for the protocols we steward.

==

Helios Blockchain Partners ZNS Connect to Launch Web3 Naming on Testnet

Helios intends to provide decentralized naming services via its Helios Testnet, improving user ident...

SHIB & PEPE or BONK & PENGU: Where Are The 50x-100x Gains Going To Be Made In 2025?

SHIB, PEPE, BONK, and PENGU show meme strength, but Remittix (RTX) leads with real PayFi utility, st...

Dogecoin Rally On Thin Ice: Analyst Predicts Sudden Shakeout

Dogecoin begins the new trading week in an unusually precarious spot on its higher‑time‑frame chart:...