SignalPlus波动率专栏(20230720):大宗交易继续逢低押注看涨期权

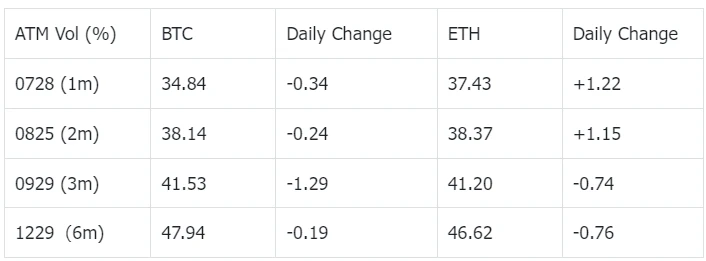

美国 SEC 将于本周启动 Bitcoin 现货 ETF 审核,这对整个加密货币行业和投资者来说意义非凡,BTC 徘徊在 30000 美元关口待变,ETH 保持弱势联动,尾盘均出现上扬趋势。BTC 隐含波动率在今日持续下跌,但包含了 Fed 不确定性的前端 IV(28 ju l 2 3/4 aug 23)在结算后出现小幅反弹,与此同时,ETH 的中前端 IV 在经历昨天的大跌以后也于今日收复部分失地,远端的波动率由于新的看涨策略放缓而略有回落。

Source: Deribit (截至 16: 00 UTC+ 8)

Source: SignalPlus

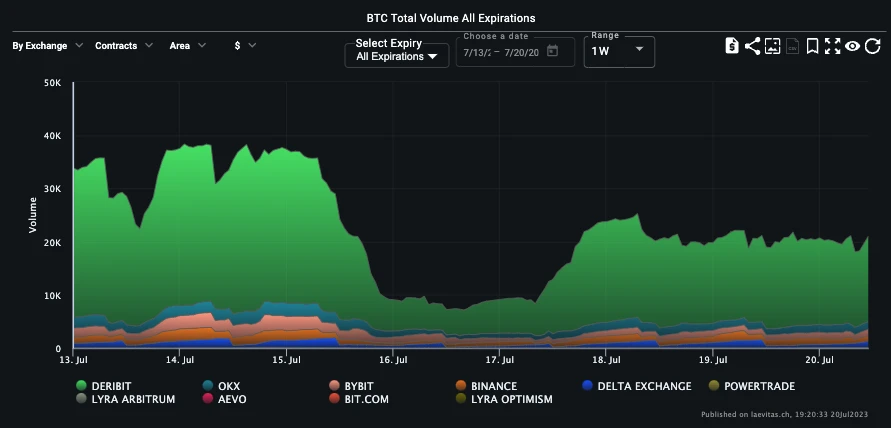

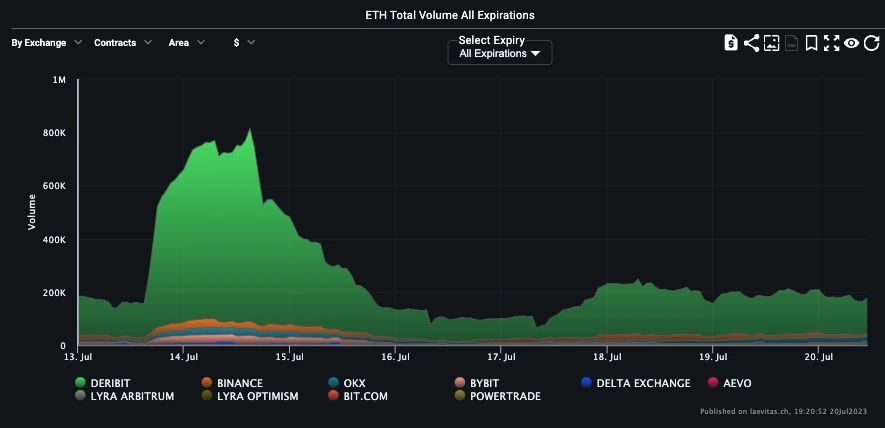

Source: Laevitas ,期权市场整体的交易量没有明显变化

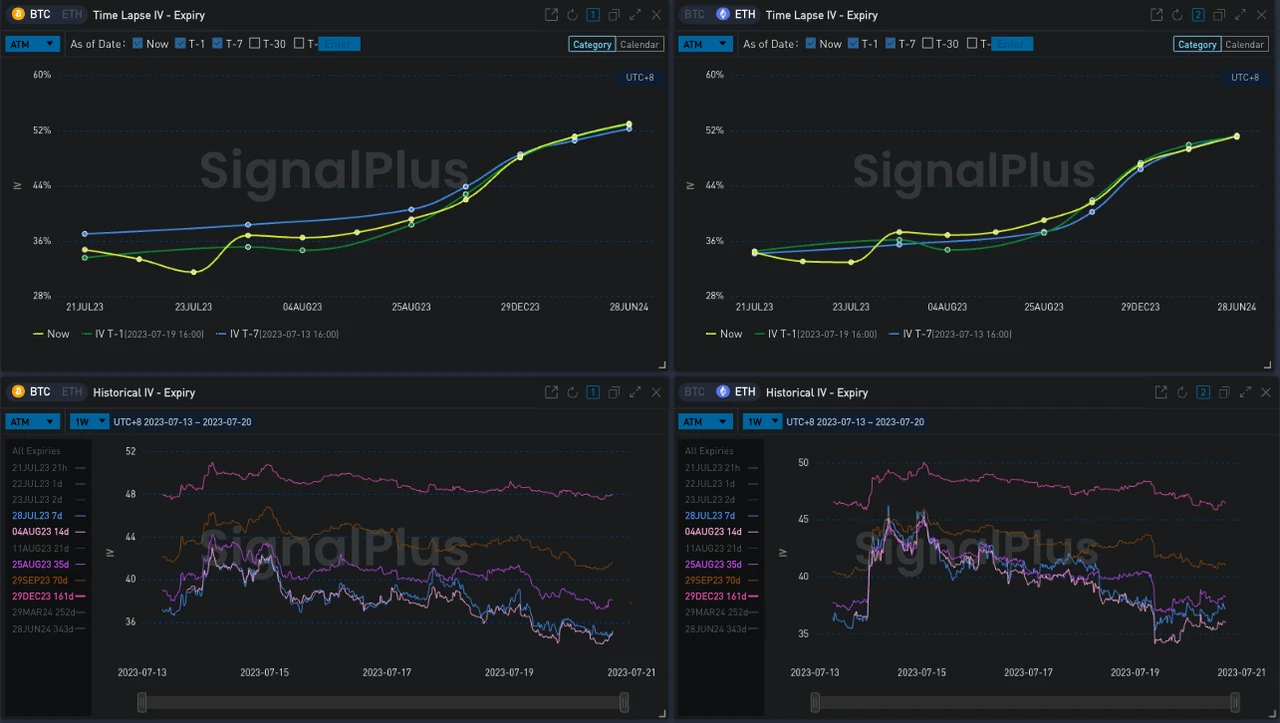

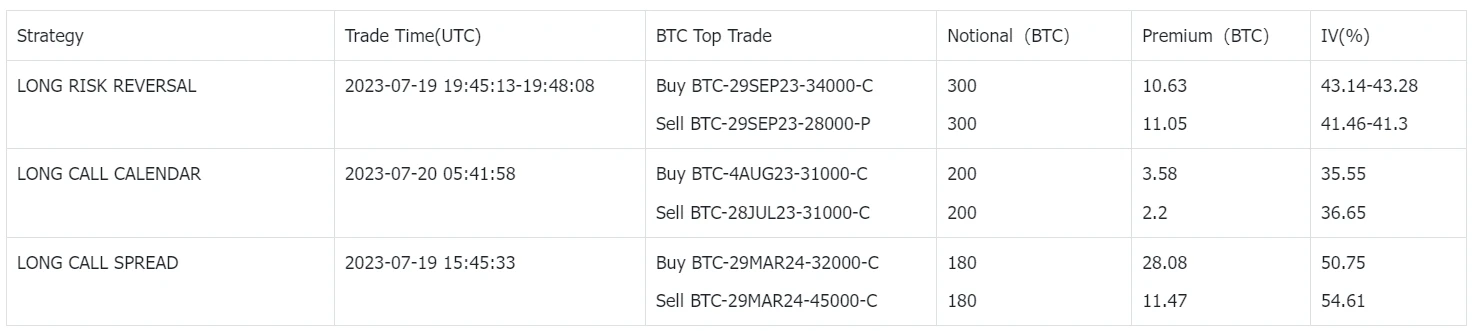

BTC 大宗交易方面,交易员仍未停止在远期上逢低买 Vol 的趋势,在 29 SEP 23 买入 34000/28000 , 37000/25000 Risky,次年三月底 Long 32000/45000 Call Spread 。

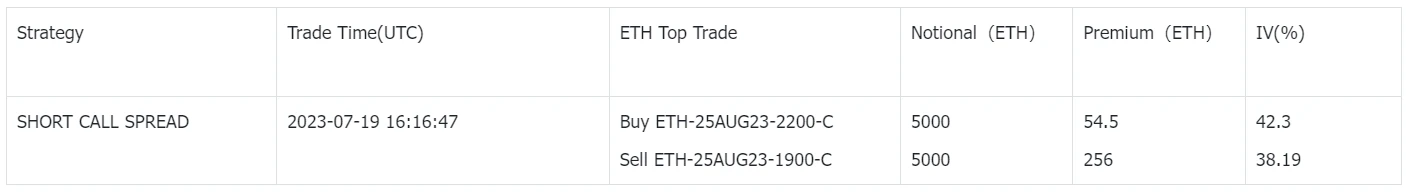

ETH 上大宗较少,这时一笔中期 10000 ETH notional 的看跌 Call Spread (25 AUG 23-1900-2200-CS)就显得格外引人注目。事实上,Deribit 散户在短期限上的成交也体现了强烈的卖压,七月底 2100-C 净卖出约 5900 张, 4 AUG 23 的主要成交也集中在 Short 2000-C, 2050-C。

Source: Deribit Block Trade

Source: Deribit Block Trade

Titan Network Joins Forces with Filecoin to Advance Decentralized Computing Efficiency

Based on this alliance, the two companies utilize the strengths of their networks to develop a distr...

Ripple (XRP) and Solana (SOL) Are Too Big to Explode 2,000%, But This High-Potential Token Could Lead the Next Bull Run

XRP and SOL are too large for 20x gains, but Little Pepe’s $0.0014 presale price, Layer 2 tech, and ...

Dogecoin (DOGE) Breaks Out, Can It Go Parabolic Again or Has the Spotlight Shifted This Cycle?

Dogecoin breaks out above $0.25, but Remittix (RTX) steals focus with real PayFi utility, staking re...