Nasdaq Files For Grayscale's Hedera ETF, HBAR Pumps

Nasdaq has filed a 19b-4 form with the Securities and Exchange Commission ( SEC ) to list and trade Grayscale’s spot Hedera ( HBAR ) ETF.

The move follows Canary HBAR's ETF filing, marking the second ETF-related milestone for Hedera within a week.

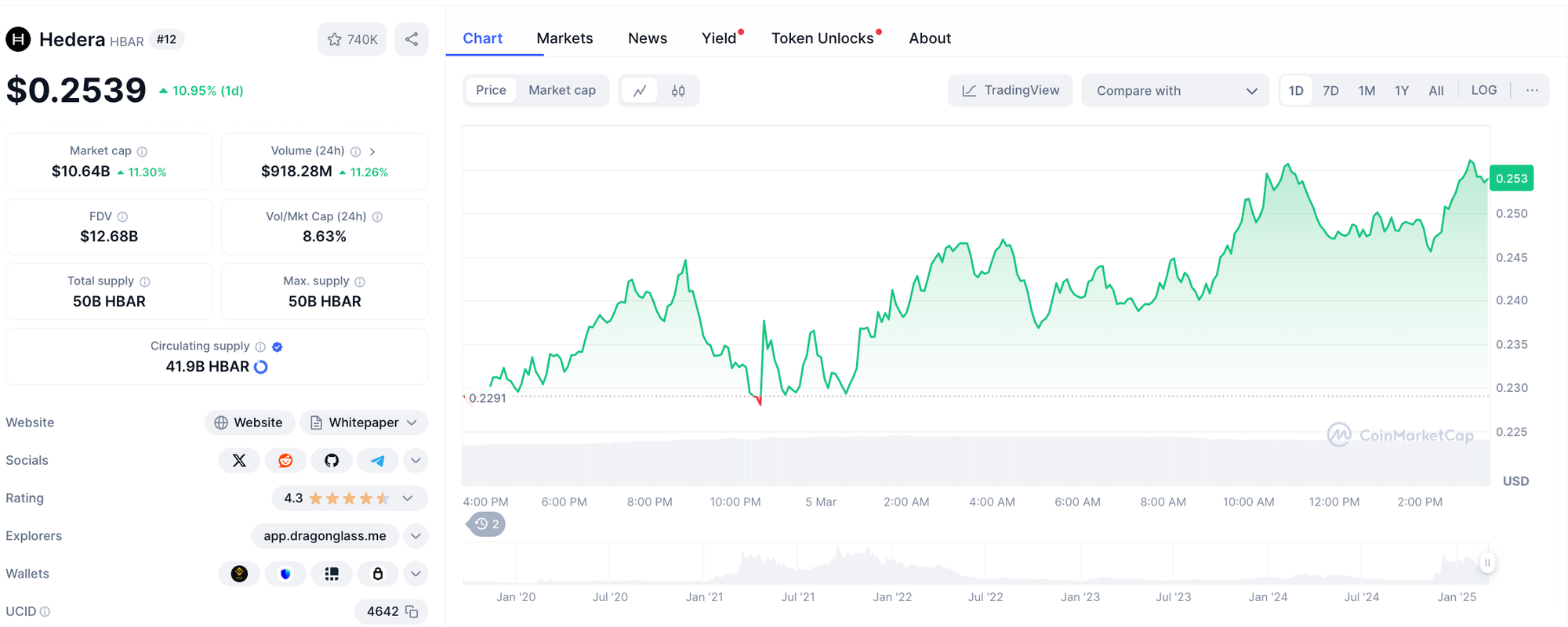

Since ETF speculation took off on February 25, HBAR has surged by 28%, reflecting increased investor confidence and growing interest in the token. HBAR experienced an 11% surge in a single day following the Grayscale filing.

Grayscale, which has the third-largest Bitcoin ETF by market cap, recently added a Polkadot ETF to the list of its ever-growing crypto ETF filings, including XRP , Solana , Cardano , and Dogecoin .

The SEC has already begun reviewing applications for XRP, Dogecoin, and Solana, while Polkadot and Cardano await evaluation.

If the Grayscale Hedera ETF gains approval, it would enable investors to track HBAR’s price movements without directly holding the token. Thelisting could further boost Hedera’s visibility and liquidity in traditional financial markets.

The SEC now has 45 days to approve, reject, or extend its review of the Grayscale Hedera ETF. If extended, it could take up to 240 days before a final verdict is reached.

Being an American crypto project, Hedera could fall under US President Donald Trump's crypto tax exemption for US firms. If implemented the tax policy would "put non-American crypto at a -37% tax disadvantage" according to WEF member Shayan Salehi.

Senator Says Bitcoin Reserve To Come From States First

Senator Lummis' Bitcoin reserve bill faces delays, as states hesitate on crypto reserves. Trump back...

Cardano Founder Charles Hoskinson Snubbed From White House Summit Despite ADA Crypto Reserve Inclusion

Cardano’s Charles Hoskinson was excluded from the White House Crypto Summit, despite ADA’s inclusion...

Matrixport Subsidiary Fly Wing Secures Key Singapore License

The license positions Fly Wing, and Matrixport as a whole, as a leading player in the regulated digi...