Ripple Files "Ripple Custody" Trademark, Signalling at Crypto Custody Shift

Ripple Labs has made a trademark filing for "Ripple Custody," suggesting the firm intends to offer digital asset storage solutions for both individual and institutional clients.

This move signals a strategic expansion beyond Ripple’s traditional focus on cross-border payments, aiming to capture a share of the rapidly growing crypto custody market.

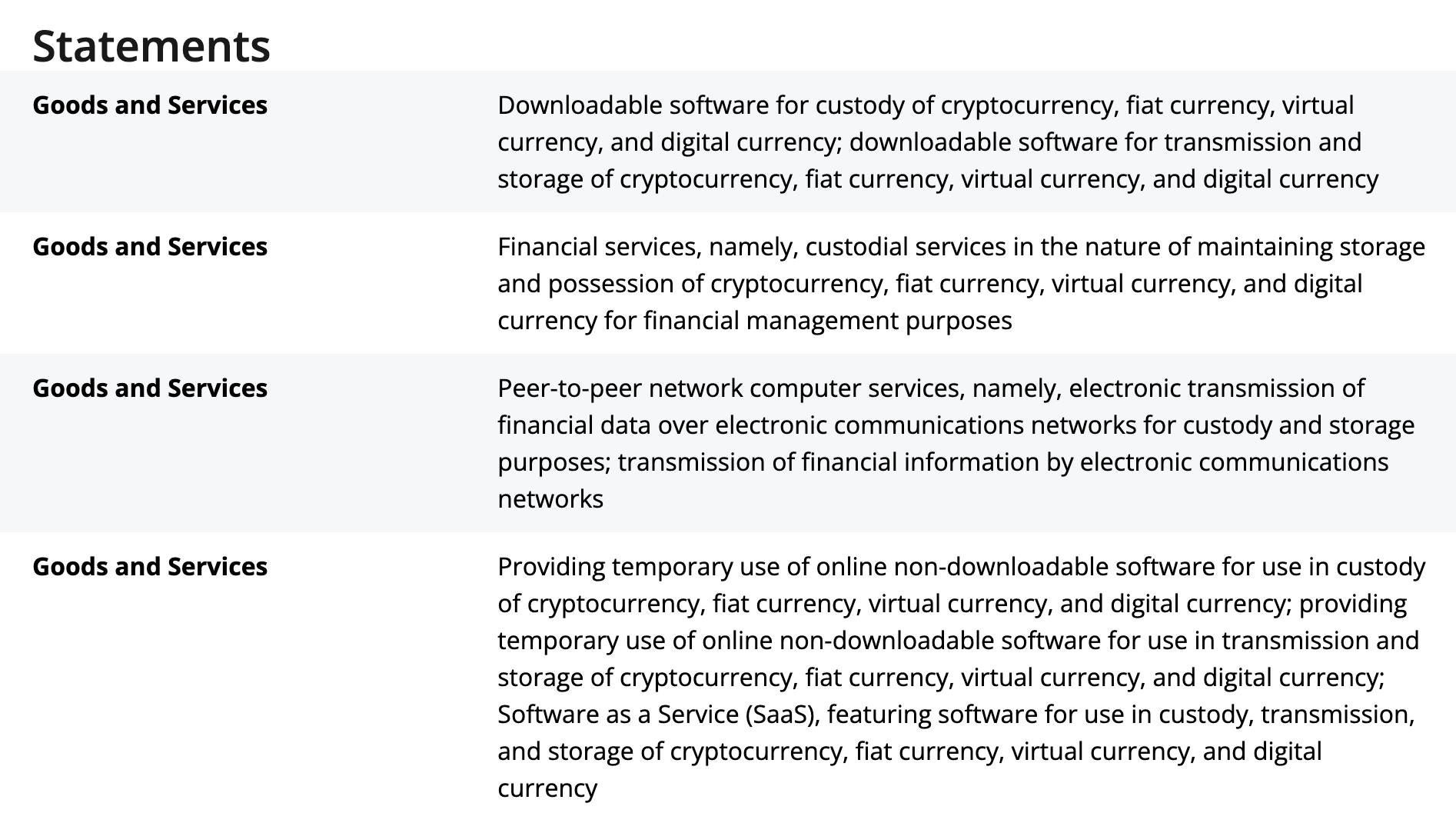

The trademark application, submitted to the United States Patent and Trademark Office (USPTO), outlines cases for the new brand including downloadable software for crypto custody.

A Ripple-branded wallet could serve both retail and institutional users, offering a secure and streamlined platform for managing XRP and other cryptocurrencies, pitching themselves in competition with the likes of Ledger.

According to the filing, the trademark applies to “financial services, namely, custodial services in the nature of maintaining storage and possession of cryptocurrency […] for financial management purposes.”

Crypto custody services play a critical role for institutions in safeguarding digital assets, protecting them from cyber threats, key mismanagement, and unauthorized access. Major players in the space include Coinbase, Citi, and BNY Mellon.

In October 2024, Ripple introduced a new service that helps banks and fintech firms store digital assets on behalf of clients.

Aaron Slettehaugh, Ripple’s SVP of product explained, “Ripple’s custody technology offers a single platform for safeguarding and managing digital assets, designed with the security and compliance standards that top global banks and financial institutions have come to rely on.”

These new updates to Ripple Custody include new transaction screening services, additional hardware security module (HSM) options, integration with XRP Ledger (XRPL) for tokenizing Real World Assets (RWA), pre-configured policy frameworks, and improved usability.

Last week, Ripple secured approval from the Dubai Financial Services Authority (DFSA) to offer regulated crypto payments and services within the Dubai International Finance Centre (DIFC).

This approval makes Ripple the first blockchain-enabled payments provider to be licensed by the DFSA and marks Ripple’s first regulatory license in the Middle East.

S&P 500 Enters Correction as Most Crypto Stocks Get Battered

US stocks including RIOT, MARA, and COIN continue to decline with only MSTR staying in the green thi...

BRN Discusses Where Bitcoin is Headed on MoneyFM 89.3

BRN analyst Valentin Fournier speaks to Money FM 89.3 host Hongbin Jeong about Bitcoin's recent pri...

Coinbase Launches Verified Pools in Singapore, US for On-Chain Liquidity Transparency

Coinbase launches Verified Pools to enhance onchain security via KYC verification, reducing risks...