Terraform Labs Opens Portal for Investors to File Loss Claims in Bankruptcy Proceedings

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Terraform Labs, the embattled company behind the collapsed TerraUSD (UST) stablecoin and LUNA token, is set to open its claims portal for creditors.

The

portal

will be available starting March 31 as part of the company’s Chapter 11 bankruptcy filing last year. For context, this move comes after

the collapse of its $40 billion ecosystem

in 2022. The development left many investors and creditors facing significant financial losses.

Registering Claims as Portal Opens

Terraform Labs has announced that eligible creditors must register their claims through the "Crypto Loss Claims Portal" on April 30 at the latest for their claims to be considered. Notably, the firm will not entertain any claims after the deadline.

The portal is part of Terraform’s bankruptcy reorganization efforts and provides a formal process for creditors to seek compensation for their losses. The company is expecting a significant number of claims as it works to manage its massive financial fallout.

Required Documentation for Claims Submission

To file a claim, creditors must provide evidence of their crypto holdings, including wallet addresses for assets held natively and read-only API keys for assets stored on centralized exchanges.

For those unable to provide these standard forms of proof, Terraform Labs will also accept account statements and transaction logs as “manual evidence.” However, claims supported by manual evidence may face longer review periods, as these will be subject to a more detailed, individualized review process.

Terraform has advised all claimants that manual evidence claims will not receive an expedited determination. Notably, the company has stressed the importance of providing accurate and complete documentation to avoid delays.

Reorganization Plan and Creditors’ Repayments

As part of its reorganization plan, Terraform Labs intends to repay creditors up to $442 million. U.S. Bankruptcy Judge Brendan Shannon approved this plan in a previous ruling.

Notably, Terraform’s proposed repayment plan comes after the company’s historic $4.47 billion settlement with the U.S. SEC, which

accused

the firm of defrauding users and creditors.

However, the regular investor may not receive any portion of the settlement funds. Terraform Labs has agreed to prioritize repayments to creditors over the SEC settlement, ensuring that affected investors are compensated first.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/496907.html

Related Reading

Expert Says Only 1% Will Be Able to Afford XRP Soon: Here’s Why

Edoardo Farina, founder of Alpha Lions Academy, has again shared bold XRP predictions, warning that,...

Samson Mow Defends Strategy’s Bitcoin Purchase Price

Samson Mow, CEO of JAN3, has responded to growing criticism over Strategy’s Bitcoin purchase price....

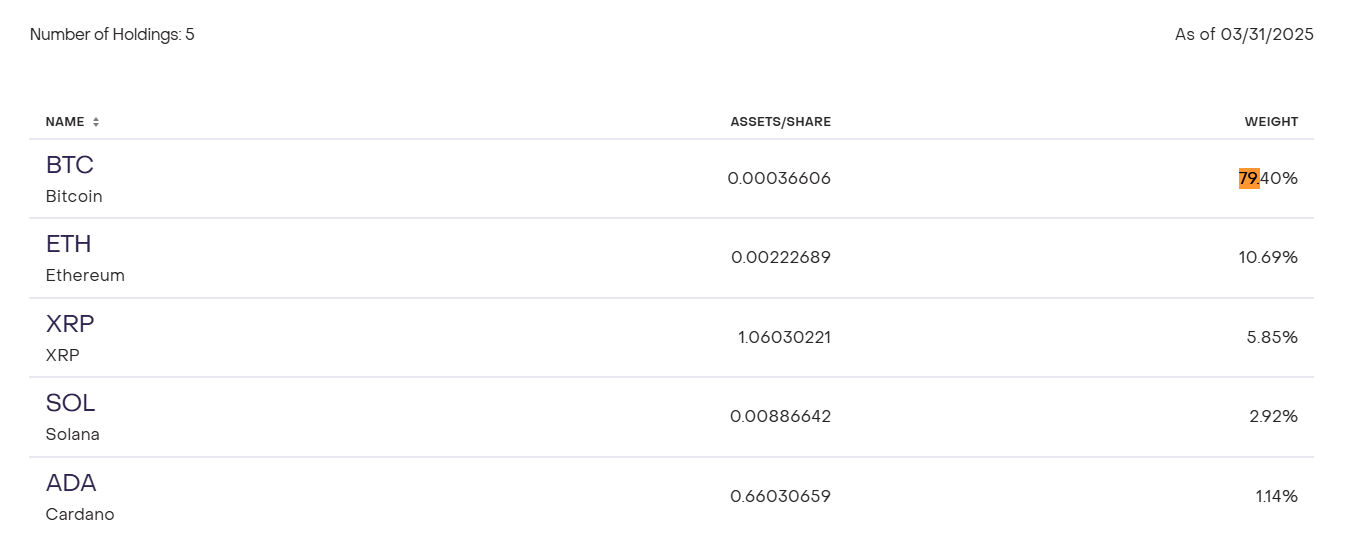

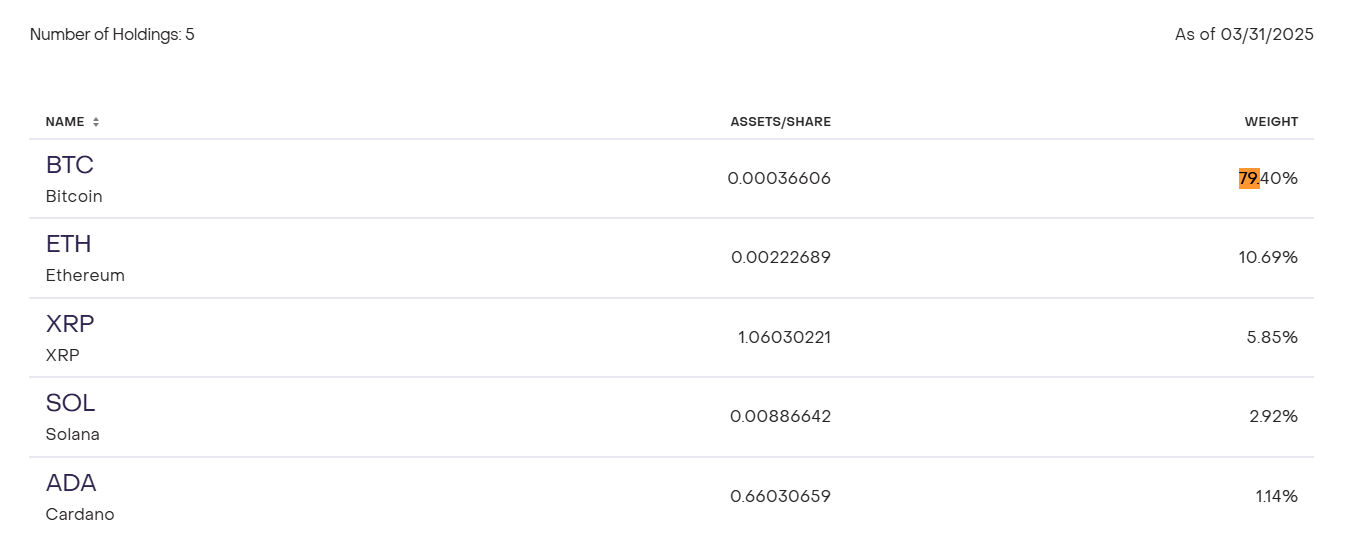

Grayscale Moves to Convert XRP and Bitcoin Large Cap Fund Into Publicly Traded ETF

Multi-billion-dollar asset manager Grayscale has filed with the U.S. SEC to convert its Digital Larg...