Bitcoin Accumulation at its Lowest Pace—Is This a Matter of Concern for the BTC Price Rally?

The post Bitcoin Accumulation at its Lowest Pace—Is This a Matter of Concern for the BTC Price Rally? appeared first on Coinpedia Fintech News

The market sentiments have been varying ever since Bitcoin price volatility seems to have choked up. After the recovery, no specific price movement has been observed, which could have raised concerns among the market participants and also among the bulls. However, the investors remain confident about the BTC price action as the exchange reserves continue to drop extensively. But a drop in whale holdings and the miner accumulation could be a matter of concern.

The whales have been extremely vigilant ever since the Bitcoin price began its journey towards the psychological threshold of $100K. Since then, the accumulation has been on a larger scale, which sent bullish waves across the markets. However, the sluggish behavior of the BTC price rally may have compelled them to not only stop accumulating but also shed some of them.

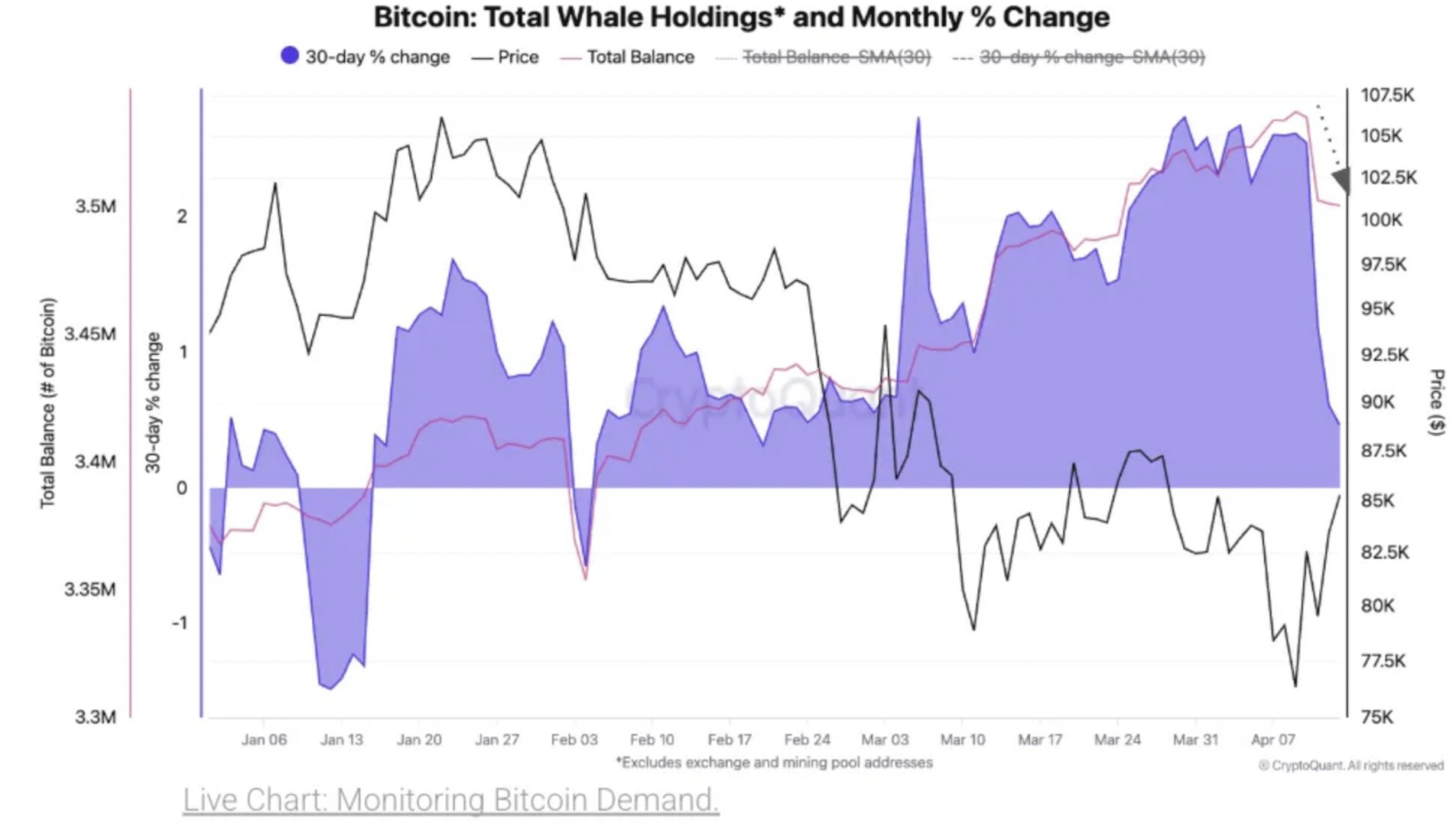

The data from CryptoQuant suggests a major drop in the whale holdings even in times when the price displayed a significant recovery. The total balance held by the whales has dropped by more than 30,000 BTC only in this week. This is one of the largest drops in recent history, which may raise some concerns. On the other hand, the miner’s position has also changed to a large extent. They seem to be bearish on Bitcoin as they have been constantly selling in times when the price declined below $80,000.

Ever since the start of the year, the miners seem to be in disbelief as they have been constantly triggering outflows. In the times when the trend appeared to be changing, they initiated outflows of over 15,000 BTC in the first week of April as soon as the margins sank to 33%, which validates the claim of the accumulation dropping to its lowest pace since February. However, the more FUD, the more the possibility of a larger rebound as the bulls wait for the right time to enter.

Although the whales and the miners have begun to shed their holdings, the market participants remain bullish on Bitcoin. Therefore, the volatility of the token could remain elevated, which could have a larger impact on the upcoming Bitcoin (BTC) price rally.

XRP Price Analysis Today : Golden Cross Points to Potential Breakout

The post XRP Price Analysis Today : Golden Cross Points to Potential Breakout appeared first on Coin...

Will Pi Network & Mantra Restore Investor Confidence? Will PI & OM Prices Recover?

The post Will Pi Network & Mantra Restore Investor Confidence? Will PI & OM Prices Recover? appeared...

Kadena Price Prediction 2025, 2026 – 2030: Will KDA Price 3X This 2025?

The post Kadena Price Prediction 2025, 2026 – 2030: Will KDA Price 3X This 2025? appeared first on C...