Shiba Inu Sees $120 Million Weekly Surge—Whales Tighten Their Grip

New blockchain information shows that large investors remain in control of the Shiba Inu crypto market, potentially creating both stability and risk for smaller traders. The meme coin has experienced regular trading activity throughout while exhibiting zero price actions over recent days.

Major Holders Hodl Most Of SHIB Tokens

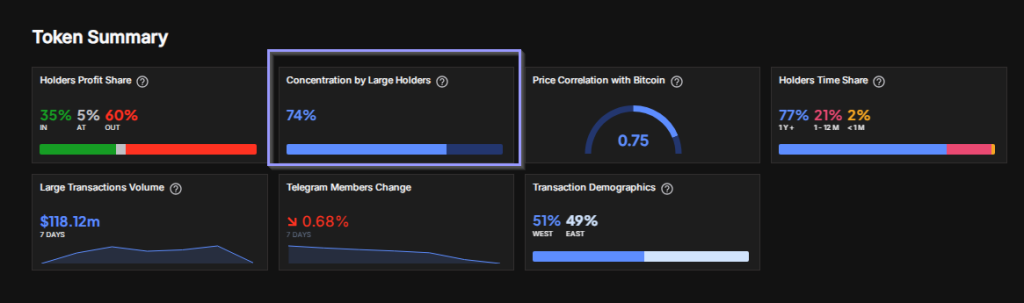

According to blockchain tracking site IntoTheBlock, around 74% of Shiba Inu’s 95 billion circulating tokens are in whale-like large addresses. The concentration is high and puts the token’s ecosystem into the hands of few wealth investors.

Concentration among large holders sends contradictory signals to the market: some analysts interpret it as a confidence vote for SHIB’s future, while others see it as a double-edged sword that creates an unstable environment wherein the big players would set off cataclysmic price fluctuations should they wish to liquidate their assets.

Weekly Transaction Volume Exceeds $120 Million

In the same tracking metrics, there have been large trades covering over $120 million with respect to SHIB within the last week (each trade being above $100,000). This substantial trading volume comes despite minimal price action, with the meme crypto having a current price tag of $0.00001226 and showing less than 1% daily change.

The volume of transactions provides a glimpse into institutional and whale-scale activity on the platform, a market analyst disclosed. The ongoing high-value transactions indicate sustained interest among large investors, despite the price staying flat.

Retail Traders Confronted With Reassurance And Risk

Retail Traders Confronted With Reassurance And Risk

The large holding of SHIB tokens by rich investors is a mixed picture for small investors. On the positive side, the investment from such huge investors could assuage retail investors regarding the token’s stability and long-term worth.

But this configuration also creates substantial risk. Any abrupt change of position by these large holders can bring on rapid and steep price action. Market watchers point out that when the ownership is so concentrated, even normal portfolio rebalancing by a handful of large holders can make a huge market disturbance.

Crypto Market Watches Whale Behavior For Price Signals

Crypto Market Watches Whale Behavior For Price Signals

Since whale activity usually precedes significant market action, it is closely monitored by the crypto community. With over 70% of the SHIB supply in the hands of moneyed investors and $120 million in recent high transactions, many are keeping tabs for reversals in sentiment from such powerful hands.

The current context of SHIB truly depicts a classic case of where a few well-to-do investors can significantly impact price action in cryptocurrency markets. In these circumstances, the very high transaction volumes reflect true interest among institutional investors, while the extreme concentration of holdings must certainly remain a foremost consideration in the assessment of any market dynamics concerning SHIB.

Featured image from Gemini Imagen, chart from TradingView

Bitcoin’s Largest Holders Are Stacking Again — What It Means For The Market

The Bitcoin market has shown high volatility in April, having produced similar levels of gains and l...

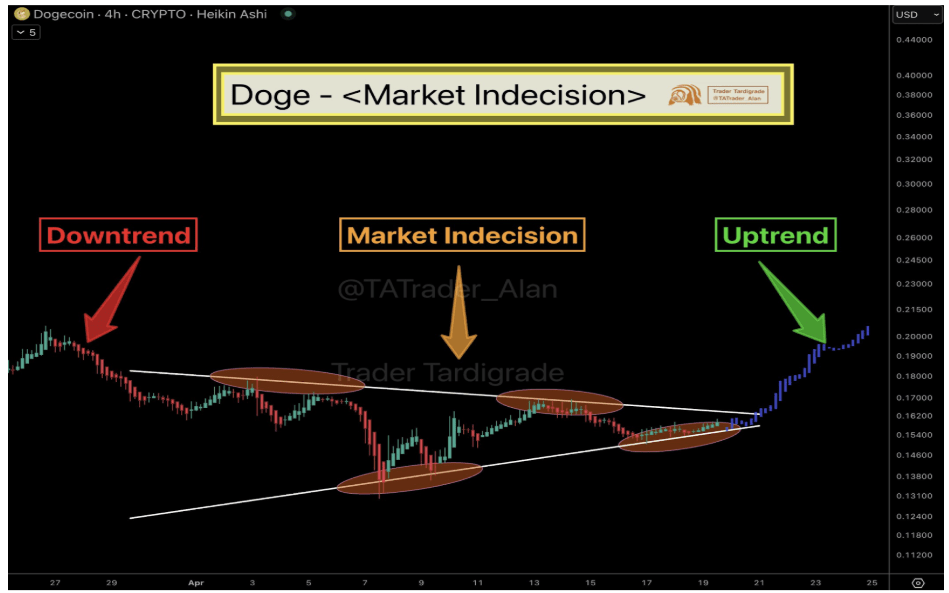

Dogecoin Price Squeezes Into Triangle With Breakout Closing In

Dogecoin has been trading in a tight range lately, with its price movement increasingly narrowing ov...

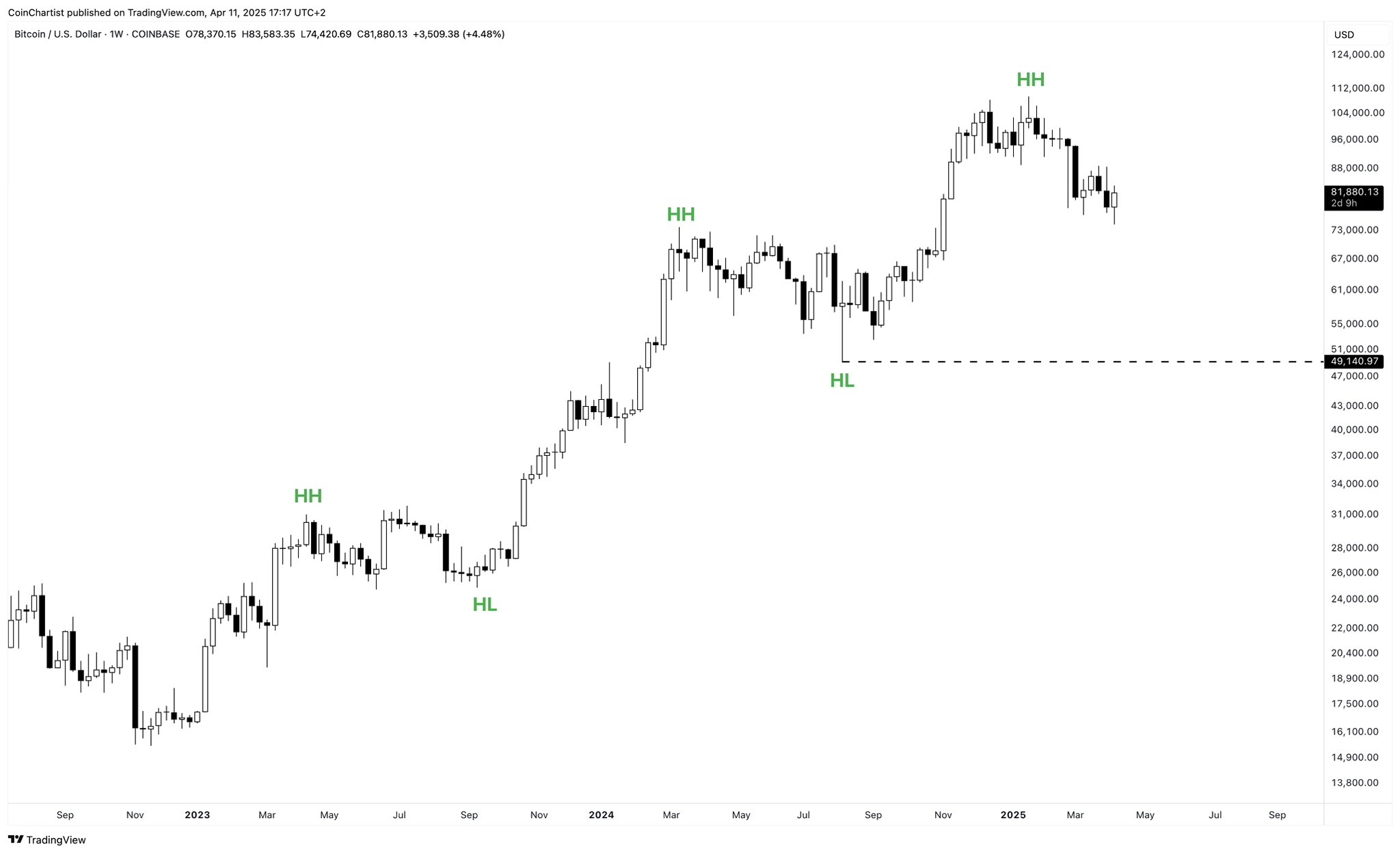

Bitcoin Bull Market Remains Intact Unless This Support Breaks – Analyst

Popular crypto analyst Tony Severino has shared a bold take on the current Bitcoin (BTC) market stru...