Bitcoin Surges Past $91K as BlackRock, Fidelity Fuel Massive ETF Inflows

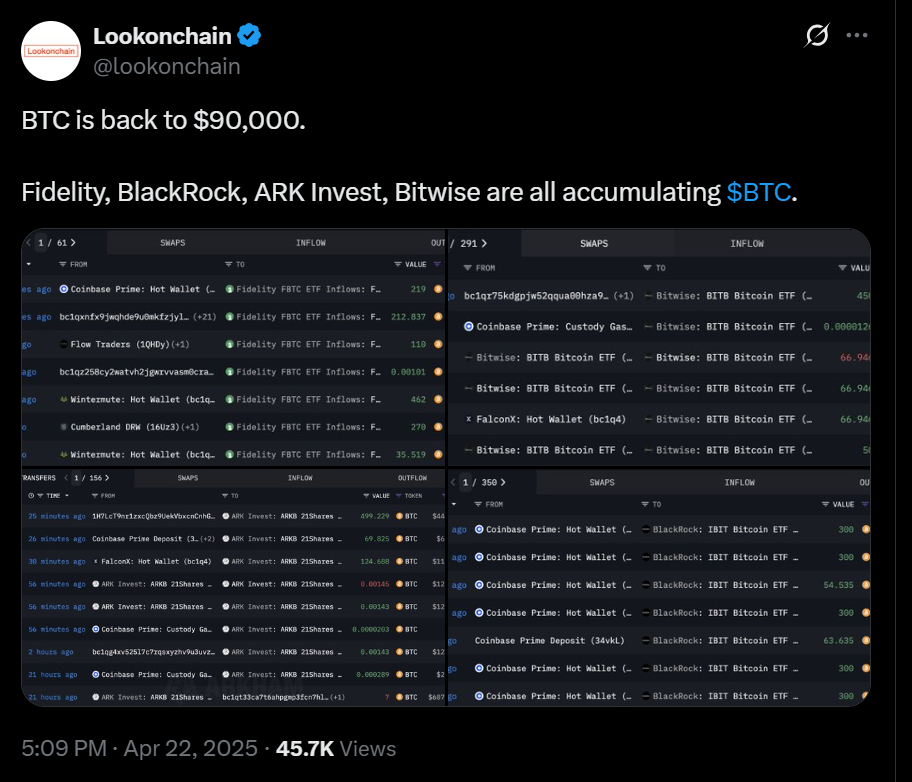

- Fidelity, BlackRock, ARK Invest, and Bitwise, are actively buying Bitcoin to back their ETF offerings.

- On April 21, Bitcoin ETFs witnessed $381 million in net inflows and no outflows from all the twelve funds.

- Ethereum ETFs are still further eroding while specific large players are still slowly stacking ETH from exchanges.

The price of Bitcoin ($BTC) has touched $91,500 for the first time since March 7, driven by the massive accumulation of spot-bitcoin ETFs and renewed institutional interest. According to the blockchain intelligence platform, Lookonchain, Fidelity, BlackRock, ARK Invest, and Bitwise are all significantly increasing their Bitcoin holdings to back their spot ETF offerings.

This synchronized rally occurred while Bitcoin exchange-traded funds (ETFs) saw a net inflow of $381 million on April 21. According to data obtained from SoSoValue, all the twelve U.S. Bitcoin ETFs saw positive or neutral fund inflows, with no known visible outflows, the best single-day performance in this regard since January 30. The increased buying spree is a sign that institutional interest in Bitcoin as an investment asset is back in full swing as these firms continue their purchases for ETFs.

ETF Demand Highlights Institutional Confidence

The sharp increase in the outflows indicates that Bitcoin is gradually becoming a part of most institutional investors’ portfolios. Currently, two of the world’s large traditional asset management firms, BlackRock and Fidelity are in charge of onboard BTC for the retail and institutional interactions through their ETF portfolio.

ARK Invest and Bitwise have also continued to accumulate more Bitcoin, implying long-only strategies due to the expected change in regulation and adoption in the near future. Currently, spot Bitcoin ETFs have become an essential tool for institutional investors. The absence of outflows in all products is an indication that confidence is not only being restored but is increasing.

Bitcoin Hits $91,500 as ETH Lags Behind

While the institutional interest in Bitcoin remains on the rise, Ethereum, on the other hand, witnesses the outflows from the Exchange-traded funds. According to SoSoValue, ETH-based ETFs have experienced negative inflows and outflows on most trading days starting mid-February.

However, a large accumulation of ETH is also visible outside the exchange in large quantities. The wallets 0xd81E and 0x3bd2 have pulled out about $7m in ETH in the last few days, while the former has been keeping more than $100m in ETH since February.

These transactions confirm there are some long-term investments holding Ethereum while institutions continue to dump Bitcoin. As of the time of writing, Bitcoin is valued at $90,777 while Ethereum is at $1,692, indicating a diverging sentiment among the two most traded cryptocurrencies.

Standard Chartered Predicts Bitcoin to Hit $200K by 2025

Geoffrey Kendrick, a Head of Digital Assets Research at Standard Chartered, remains positive on the further BTC appreciation. He foresees the price of Bitcoin to at least double from current levels and reach $200,000 by the year 2025 and up to $500,000 by 2028.

Kendrick attributes this outlook to Bitcoin’s utility as a financial hedge and its decentralized structure. According to him, the use of Bitcoin as a store of value comes into focus during a volatile financial period and

compares it

to gold.

Bitcoin Marches toward $96K Resistance, Eyes $100K

As per Axel Adler Jr., the Bitcoin $BTC is facing key resistance at the $96,000 mark while eyeing $1...

From Interoperability to Tokenization: 6 Best Altcoins to Buy for April 2025 Uncovered

Qubetics leads April 2025's top altcoins with real interoperability, fast-growing presale, and massi...

Bitcoin’s $5.5K Pump Triggers Mass Liquidations: $500M Loss in 24 Hours

An unexpected Bitcoin price increase from $88,000 to over $93,500 recently sparked a rapid string of...