Strategy's Bitcoin Bets Surge Even as Firm Posts Record Loss

Michael Saylor's Strategy's (formerly MicroStrategy, Nasdaq: MSTR) Bitcoin bets are soaring, with the firm set to double its capital-raising goal for Bitcoin to an impressive $84 billion.

This comes after Strategy registered a record loss in the March quarter, attributed to a new accounting regulation mandating the valuation of its substantial Bitcoin holdings at current market prices.

Strategy last week revealed its intention to sell an additional $21 billion in common shares after finalizing a similarly scaled equity initiative approved in October. The planned debt purchase program has been expanded significantly, with $14.6 billion of the $42 billion left, effectively double the initial projection.

Strategy witnessed a large $4.2 billion shortfall in the previous quarter, and strategic assessments and collaboration among corporate buyers of the OG token are recognizing the underlying price volatility that often leads to big changes in earnings.

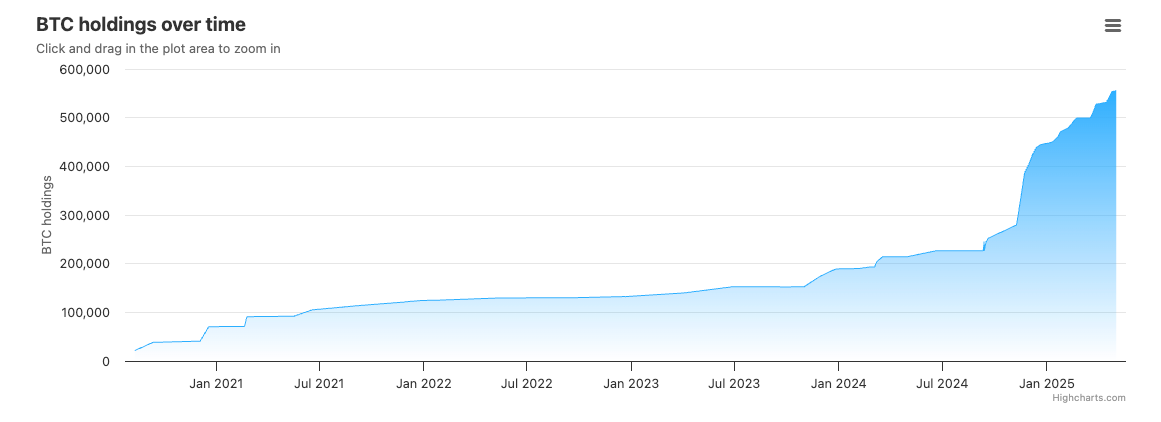

The dot-com software giant, which has since become a leveraged Bitcoin proxy, opted to apply the approved accounting change in the March quarter of 2023. Strategy currently holds 555,450 BTC, or about $53 billion worth of Bitcoin assets, following its most recent purchase announced on Monday.

Prior to the recent change in accounting practices, the firm had previously classified its Bitcoin assets as intangible assets, similar to patents and trademarks. As Bitcoin's price declined, the firm was forced to reduce the value of its holdings. Profits can only be recognized at the point of token sales.

Over the past five years, Saylor has emerged as a significant force on Wall Street and within the cryptocurrency sector. He serves as the co-founder and chairman of Strategy's initiatives.

His notable achievement is transforming his ageing business intelligence software company, Strategy, which was founded in 1989 and went public via an IPO in June 1998, into the largest and inaugural leveraged Bitcoin proxy globally. In the first quarter of 2025, its software segment revenue experienced a decline of 3.6%, reaching $111.1 million, according to its earnings report .

Saylor's dogged lobbying has greatly aided Bitcoin's mainstream market acceptability.

These days, you can find more than ten Bitcoin exchange-traded funds in the United States alone, and there are plenty more imitators — businesses that use their own cash or even borrowed money to buy Bitcoin.

A new world of investing has opened up around this idea, with fund issuers offering products like leveraged convertible bond funds that distribute capital to companies with Bitcoin on their books.

By skilfully courting both risk-taking individual investors and astute hedge funds on the lookout for chances, Saylor has sidestepped the doubts of his Wall Street critics and amassed a sizeable Bitcoin empire.

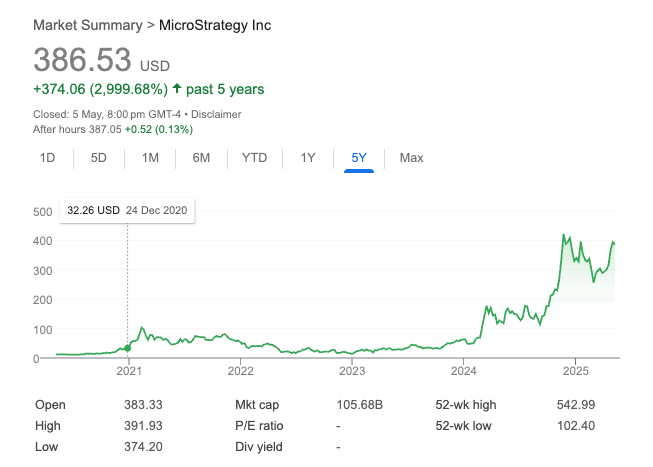

He has been instrumental in developing a cutting-edge crypto-investment complex through this undertaking. Strategy's stock has increased nearly 3,000% since Saylor initiated his Bitcoin purchases in 2020.

While Saylor has leveraged common share and debt offerings to amass Bitcoin, enabling the Strategy to surpass nearly every significant US stock, a pressing concern among many observers remains: how sustainable is this approach in the long run?

So far, the bet is in Saylor's favour.

New players in Strategy's game plan are making things more difficult for investors by posing threats from established players with deep pockets and political clout.

To amass Bitcoin, an affiliate of Cantor Fitzgerald, Tether Holdings – a stablecoin issuer – and SoftBank Group formed Twenty One Capital a couple of weeks ago.

But that has not perturbed Saylor.

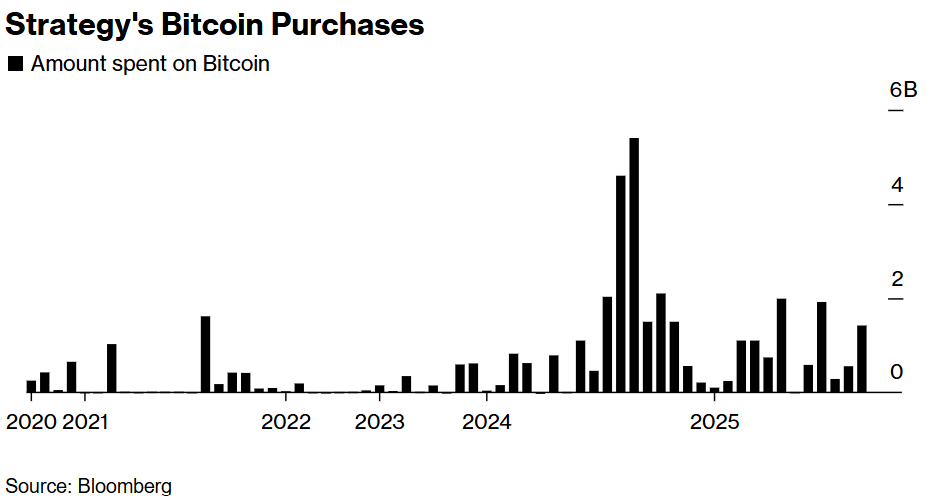

His decision last week to double Bitcoin's capital plan clearly indicated this. Strategy has significantly increased its Bitcoin holdings in the last six months, investing billions of dollars in acquisitions almost every week since late October.

Recently, the company has been funding its acquisition spree through a complex mix of common stock and debt issuances, convertible offerings, and preferred share sales.

Just this week, the company announced the purchase of 1,895 BTC for around $180 million. This follows purchases of 15,355 BTC on 28 April for $1.42 billion, and 6,556 BTC on 21 April for $555.8 million.

$MSTR has acquired 1,895 BTC for ~$180.3 million at ~$95,167 per bitcoin and has achieved BTC Yield of 14.0% YTD 2025. As of 5/4/2025, we hodl 555,450 $BTC acquired for ~$38.08 billion at ~$68,550 per bitcoin. $STRK $STRF https://t.co/rusgfuyCTG

— Michael Saylor (@saylor) May 5, 2025

An increasing number of hedge funds are showing interest in convertible debt as part of their strategy to buy bonds and short-sell shares simultaneously, essentially betting on the underlying stock's swings.

Still, unrealized changes frequently lead to significant fluctuations in earnings or losses, as Strategy encountered last quarter, and other corporate purchasers of Bitcoin are compelled to recognize this reality.

Strategy waited until the first quarter of this year to execute the accounting modification that was approved last year.

According to Bloomberg's calculations, Saylor's recent spending spree contributed to the first quarter loss, which amounted to around $1 billion in paper losses from the $7.79 billion invested in Bitcoin in 2025.

After starting the year with $41.8 billion in Bitcoin, the corporation's token price dropped 12% in the first quarter, resulting in nearly $5 billion in pre-tax "mark-to-market" losses.

Hedge funds are markedly impacting the demand for convertible debt by employing strategies that include acquiring the bonds and concurrently short-selling the shares, thereby betting on the underlying stock's volatility.

The decline in Bitcoin's price, alongside other high-risk assets this year, has decelerated the significant appreciation in the value of Strategy's shares.

Boutique equities research firm Monness, Crespi, Hardt & Co. reduced Strategy's stock last week, giving the company's shares a sell recommendation. The firm cited a saturated market for the assets used to finance Bitcoin purchases.

Still, this is not the first time Saylor has seen bets against him and won't be the last. The Strategy chief seems set in his ways and continues to bet on the OG token.

Elsewhere

Blockcast

Coinbase's Ecosystem Play & Asia's Crypto Landscape

Tune in to hear Coinbase Singapore country director Hassan Ahmed's expert perspective on the trends shaping the industry and Coinbase's pivotal role in this transformation.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Consensus 2025, Toronto

We're a media partner for Consensus 2025, held in Toronto, Canada on 14-16 May. Coinbase, BlackRock, Google & The White House Will Be There – Will You? Use the code BLOCKHEAD20 for 20% off tickets!

Will the Fed Keep the Crypto Rally on Ice?

President Trump wants rates lower — fast. But with inflation still hanging around and a strong jobs ...

How Fading Corporate & Institutional Buying Pressure Could Lead to a Bigger Dip for Digital Assets

Your daily access to the backroom...

Bybit to Offer Stocks, Commodities Alongside Crypto

This move strategically positions Bybit at the intersection of the cryptocurrency and traditional fi...