Brazil’s B3 to Launch Ethereum and Solana Futures, Cuts Bitcoin Contract Size

Favorite

Share

Scan with WeChat

Share with Friends or Moments

The Brazilian Securities and Exchange Commission (CVM) has approved the launch of Ethereum and Solana futures contracts by B3, the country’s main stock exchange.

The products will

launch

on June 16, marking a significant step forward in Brazil's embrace of crypto asset derivatives.

This expansion follows B3's earlier introduction of Bitcoin futures in 2023. Now, investors will have access to a broader range of regulated crypto derivatives through the traditional financial system.

https://twitter.com/thecryptobasic/status/1920831297708064883

Contracts Priced in USD, Tied to Nasdaq Indices

Unlike Bitcoin futures traded in Brazilian reais, the new Ethereum and Solana contracts will be denominated in U.S. dollars. The pricing will be linked to the Nasdaq Ether Reference Price and Nasdaq Solana Reference Price, providing globally recognized benchmarks.

Each Ethereum futures contract will represent 0.25 ETH, while Solana contracts will be sized at 5 SOL. These instruments will settle financially based on price movement, with monthly expirations on the last Friday of each month.

Bitcoin Futures Contract Size Reduced by 90%

Meanwhile, to broaden retail access, the CVM also approved a tenfold reduction in the

Bitcoin futures

contract size. Starting June 16, each contract will represent 0.01 BTC instead of 0.1 BTC. This brings the notional value down to roughly R$5,300, from the previous R$53,000, a 90% reduction.

The goal is to increase market participation and liquidity while reducing the costs of trading large contracts. Regarding accessibility, the change aligns the Bitcoin product more closely with the newly launched Ethereum and Solana futures.

Beyond futures contracts for Bitcoin and Ethereum, B3 is also offering exchange-traded products related to crypto assets. Among the most recent introductions

is the Hashdex spot XRP ETF

.

B3 Positions Itself as a Crypto Derivatives Hub

According to B3's Director of Products, Marcos Skistymas, the move reflects a growing demand from investors for secure, regulated exposure to crypto assets.

He noted that the company is introducing more advanced financial instruments and broadening the choices available for those who want to follow digital asset price movements.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/504924.html

Related Reading

Here Are XRP Price Predictions if Its Market Cap Hits $700B, $1.5T, and $3T

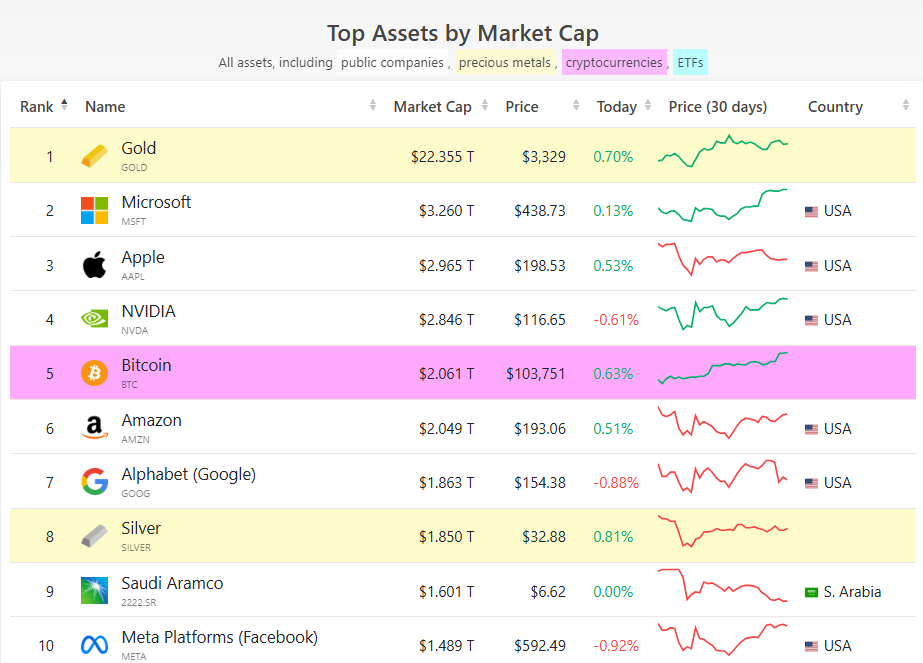

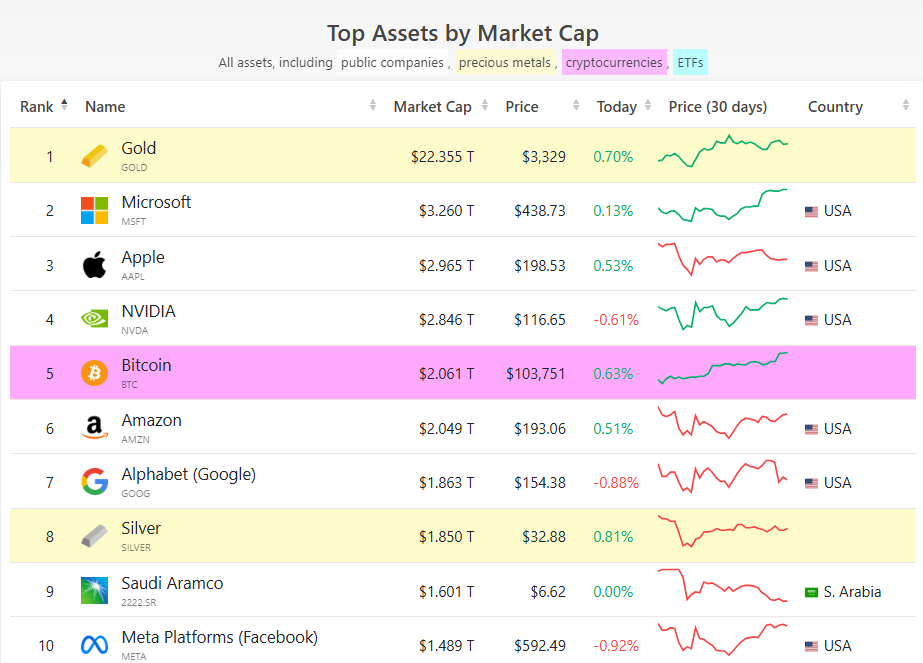

XRP boasts a market cap of around $140 billion, making it the fourth-largest crypto asset, behind on...

Shiba Inu Price Forecast: Here’s What SHIB Could Be Worth If Bitcoin Hits a $200 Trillion Market Cap

Shiba Inu might eliminate two zeros from its price and surpass the $0.001 mark if it closely mirrors...

‘When XRP Hits $2,000, There Will be Signs,’ First Ledger Team Teases

The First Ledger team recently rejuvenated discussions around ambitious XRP price predictions, humor...