Bitcoin Near ATH, But Long-Term Holders Aren’t Selling – More Upside Ahead?

Fresh on-chain data suggests that despite Bitcoin (BTC) trading close to its all-time high (ATH), long-term holders (LTHs) are not offloading their holdings. Instead, these investors are continuing to accumulate the world’s largest cryptocurrency by market capitalization, signaling their confidence in further price gains in the coming weeks.

Long-Term Bitcoin Holders Are Not Selling Yet

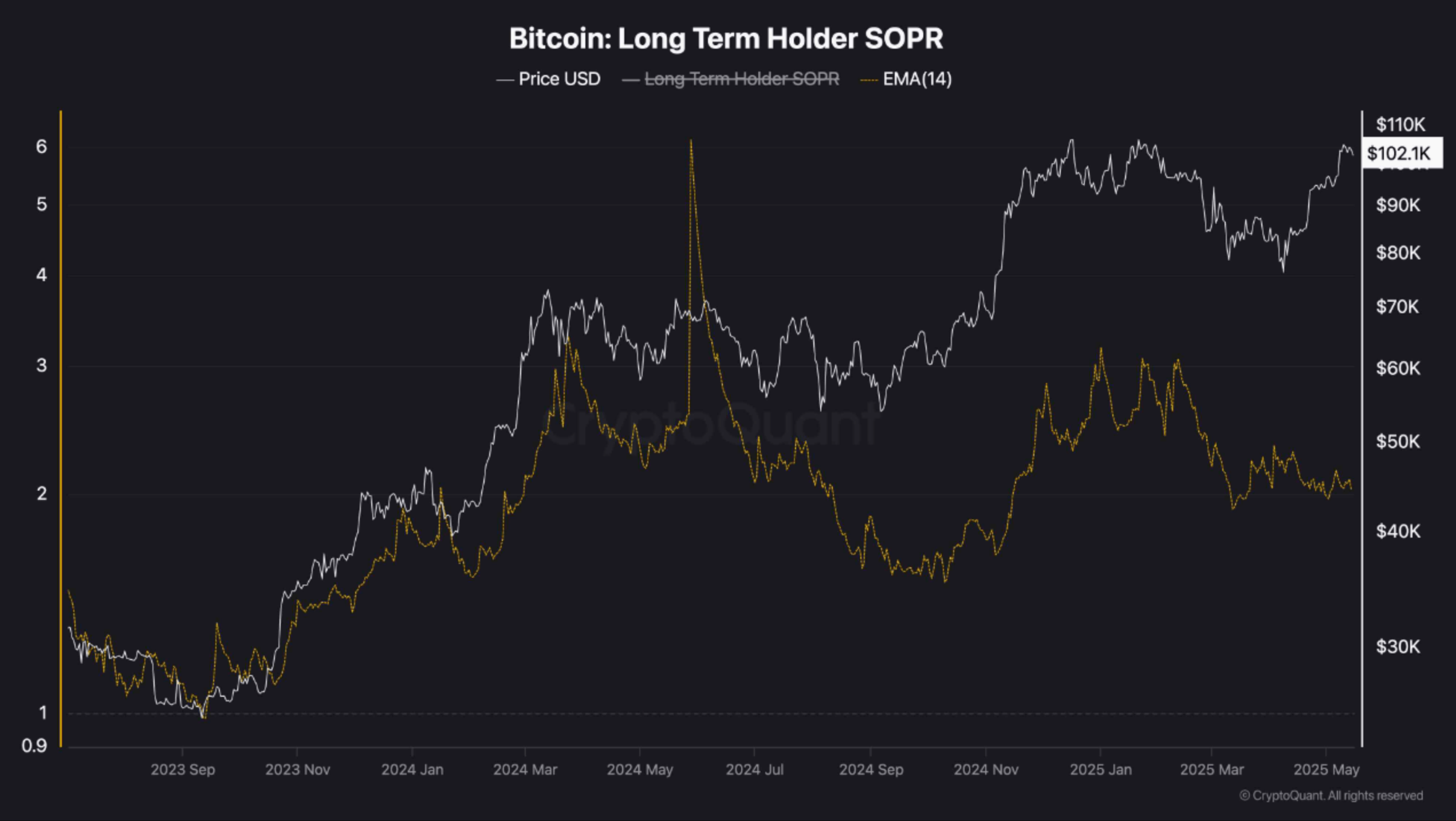

According to a recent CryptoQuant Quicktake post by contributor ShayanMarkets, profit-taking among long-term holders remains relatively low, even as BTC trades near its ATH. Historically, profit-taking activity tends to increase significantly when Bitcoin approaches its previous high, as many investors look to lock in gains. However, that has not been the case in the current market cycle.

The analyst highlighted that Bitcoin consolidating near ATH levels typically results in significant profit realization by market participants. Yet, current data reveals that LTH – those who have held BTC for more than 150 days – have not begun large-scale profit-taking.

Specifically, the LTH Spent Output Profit Ratio (SOPR) metric is heading downwards even when BTC continues to steadily surge toward a new ATH around $109,000. The analyst explains:

This decline suggests that long-term holders have not yet engaged in notable profit-taking. Instead, they appear to be accumulating, signaling confidence in higher price targets and anticipating new all-time highs.

In essence, the ongoing BTC consolidation phase seems to be driven more by short-term holders (STHs) and retail traders. Historically, these investor segments are more reactive to price swings, responding swiftly to both upward and downward movements.

The analyst further stated that Bitcoin is likely to resume its bullish trend following this period of consolidation. If history repeats itself, the next upward movement could propel BTC to new record highs in the mid-term.

Analysis from fellow CryptoQuant contributor BlitzzTrading supports this outlook. BlitzzTrading observed that BTC whales – wallets holding significant Bitcoin holdings – have taken much less profit compared to previous bull runs.

This behavior suggests a long-term investment mindset among whales, aligning them more closely with LTHs than retail traders or short-term speculators. It’s fair to say that BTC whales are typically long-term investors, often holding their positions through market cycles, unlike smaller holders who tend to trade more frequently.

BTC May Follow Gold’s Historic Price Action

Interestingly, comparisons are now being drawn between Bitcoin and gold. Gold has seen impressive gains over the past two years, rising from around $1,800 per ounce in mid-2023 to about $3,200 per ounce today – an increase of nearly 75%.

Crypto analyst Cryptollica recently remarked that BTC is likely to follow gold’s footsteps and experience similar extraordinary gains in 2025. The analyst forecasted that BTC may surge as high as $155,000 this year.

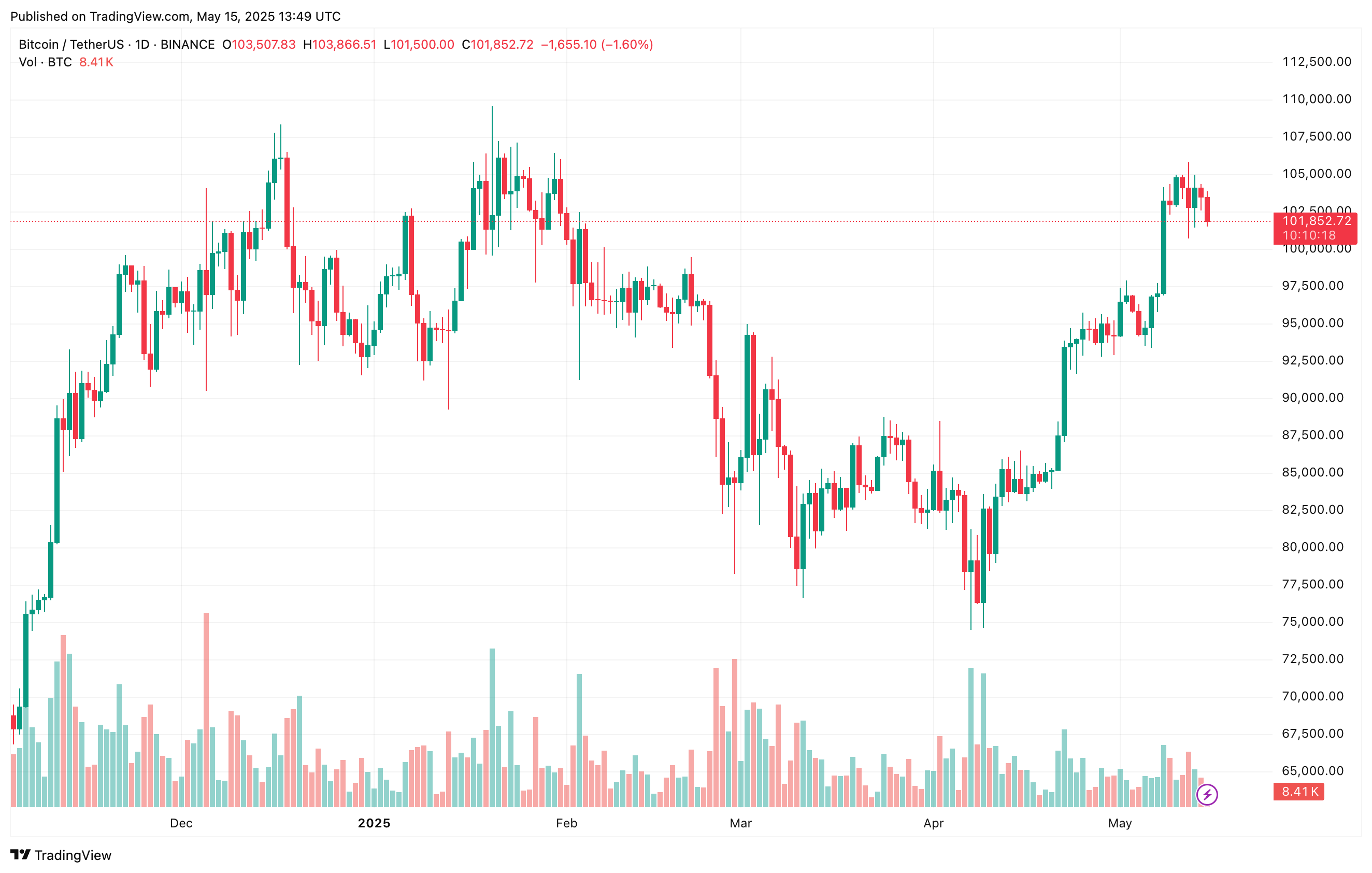

Similarly, the Bitcoin Bull-Bear Market Cycle indicator is pointing toward the continuation of bullish momentum for the apex cryptocurrency. At press time, BTC trades at $101,852, down 1.5% in the past 24 hours.

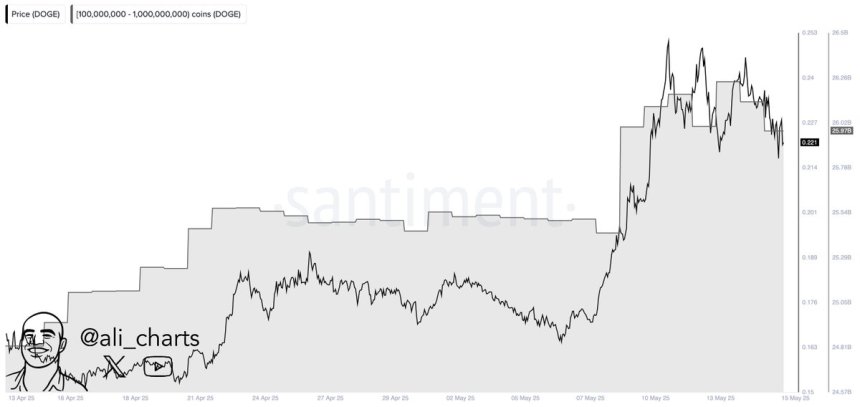

Dogecoin Whales Accumulate 1 Billion DOGE In A Month: Fueling Price Surge Speculation

Dogecoin is back in the spotlight after surging more than 50% in recent weeks, reclaiming bullish mo...

Ethereum Looks Ready To Break Out Of 4-Year Consolidation, Analyst Says Price Will ‘Go Insane’

Ethereum is again looking bullish following its gains of over 17% in the last seven days and the bre...

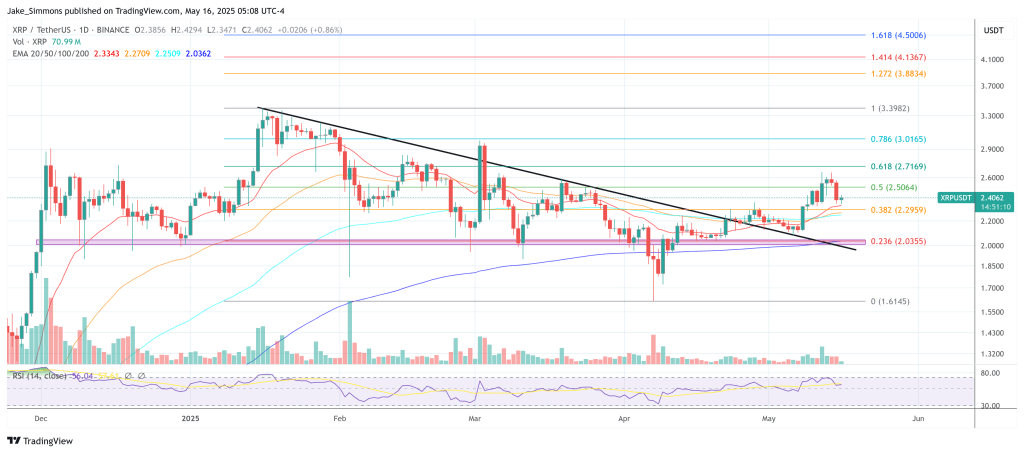

‘What If XRP Is The Next Bitcoin?’ Says Dave Portnoy

Dave Portnoy, the outspoken founder of Barstool Sports, used his debut appearance at CoinDesk’s Cons...