Solana’s Old Hands Are Moving—Is Trouble Brewing?

On-chain data shows the Solana network has just seen a large movement of dormant coins. Here’s what this could mean for the cryptocurrency.

Solana Coin Days Destroyed Has Witnessed A Huge Spike

In a new post on X, the on-chain analytics firm Glassnode has talked about the latest trend in the “ Coin Days Destroyed ” (CDD) indicator for Solana. A ‘coin day’ is a quantity that one token of the asset accumulates after having stayed dormant (that is, not being involved in any transaction activity) for one day.

When a token carrying some number of coin days is moved, its coin days counter resets back to zero, and the coin days that it was carrying are said to be ‘destroyed.’ The CDD measures the total number of coin days being reset in this manner across the network.

When the value of this indicator registers a spike, it means dormant coins are potentially on the move. Generally, this kind of trend is a sign of transaction activity from the long-term holders (LTHs) . The LTHs are resolute entities who tend to hold for long periods, so they naturally hold a large number of coin days. As such, transfers from them usually result in the destruction of a significant number of coin days.

Now, here is the chart for the Solana CDD shared by the analytics firm that shows the trend in its value during the past few months:

As displayed in the above graph, the Solana CDD has observed a large spike recently, suggesting the LTHs have made some transactions. In total, this spike involved the destruction of a massive 3.55 billion coin days. From the chart, it’s visible that the indicator has seen only two spikes of a greater scale in 2025 so far. February 26th recorded a CDD value of 5.53 billion, while March 3rd saw a value of 4.64 billion.

The LTHs usually only break their silence when they want to participate in selling , so movements from them can sometimes spell trouble for the cryptocurrency’s price. Large spikes like these can especially be worth taking note of, as they can point toward a possible shift in holder conviction

. The aforementioned two larger spikes occurred one after the other, with a third, slightly smaller-scale spike following later in March. Therefore, it’s possible that more than a couple of diamond hands lost their belief during that period.

It now remains to be seen whether the latest Solana CDD spike would also be followed up by another, or if this was just a one-off event.

SOL Price

At the time of writing, Solana is trading around $153.9, down more than 10% in the last week.

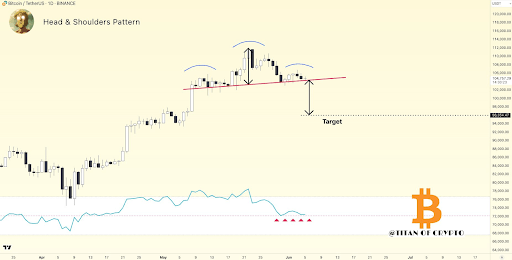

Bitcoin Price Crash Trigger To $96,000: The Head And Shoulders Pattern That’s Forming

After days of fluctuating around the $105,000 range, Bitcoin appears to be succumbing to pressure fr...

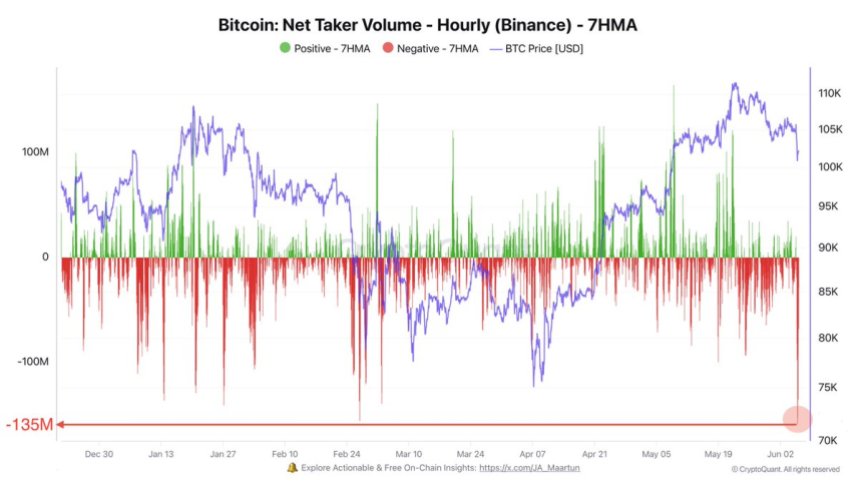

Bitcoin Sees Largest Net Taker Volume Drop Of 2025 – Traders React To Trump-Elon Clash

Bitcoin has continued to show strength amid rising macroeconomic uncertainty, with surging U.S. bond...

Musk Exits DOGE, Clashes With Trump—Dogecoin Gets Caught In The Crossfire

Dogecoin took a hard hit this week as tensions flared between Elon Musk and US President Donald Trum...