Ethereum Breakout Imminent? Broadening Wedge Hints At $4,200 Surge

According to recent technical analysis, Ethereum (ETH) may be gearing up for a major breakout that could propel the cryptocurrency close to the $4,200 mark. Meanwhile, ETH continues to attract growing institutional interest, with Ethereum exchange-traded funds (ETFs) outperforming their Bitcoin (BTC) counterparts.

Ethereum Headed For A Breakout?

In a recent X post, noted crypto analyst Titan of Crypto highlighted that ETH is climbing within a massive weekly broadening wedge structure. The analyst shared the following chart and suggested that ETH could be targeting the $4,200 level – marking the top of the wedge.

For the uninitiated, a broadening wedge is a chart pattern characterized by diverging trendlines, where price makes higher highs and lower lows, forming a megaphone-like shape. It typically indicates increasing market volatility and can signal a potential breakout, with the direction depending on the prevailing trend and breakout confirmation.

Fellow crypto analyst Master of Crypto echoed a similar outlook, stating that ETH is “setting up for a big move,” especially with over $2.2 billion in short positions clustered near the $3,000 level.

If Ethereum breaks above $3,000, it could trigger a short squeeze, potentially accelerating ETH’s rally. At the time of writing, ETH is trading 43.7% below its all-time high (ATH) of $4,878, recorded in November 2021.

Capital flows also indicate rising institutional interest in Ethereum. Crypto market commentator Ted Pillows recently pointed out that spot ETH ETFs attracted $240.3 million in inflows yesterday, compared to $164.6 million for spot BTC ETFs.

The stronger performance of ETH ETFs suggests that capital may be rotating from Bitcoin to Ethereum. It’s worth noting that while BTC is up 54% since June 2024, ETH is still down 24.6% during the same period.

Crypto trader Merlijn the Trader shared the following monthly BTC/ETH chart showing two consecutive red candles, signaling a potential shift in momentum as BTC weakens relative to ETH. The trader noted that a similar capital rotation in 2020 preceded a “monster altseason.”

Things Look Positive For ETH

While altcoins like Solana (SOL), Tron (TRX), and SUI created fresh ATHs in 2024, ETH’s performance did not live up to expectations. As a result, the broader sentiment in the Etheruem ecosystem took a hit .

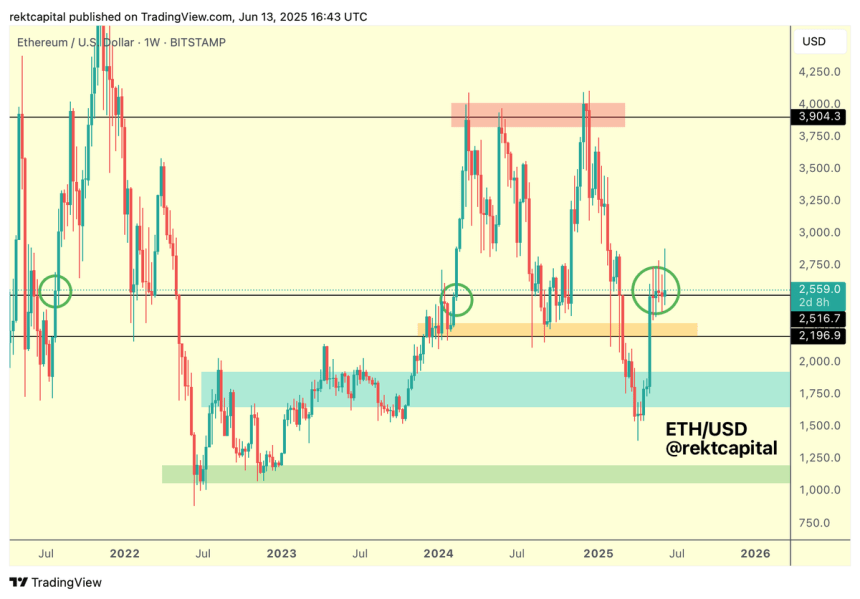

However, 2025 appears to be ushering in a more favorable outlook. On-chain data reveals that ETH faces no major resistance until the $3,417 level.

Additionally, ETH recently flashed a golden cross on the daily chart – a bullish technical signal that could indicate an impending rally. At press time, ETH trades at $2,756, down 1.7% in the past 24 hours.

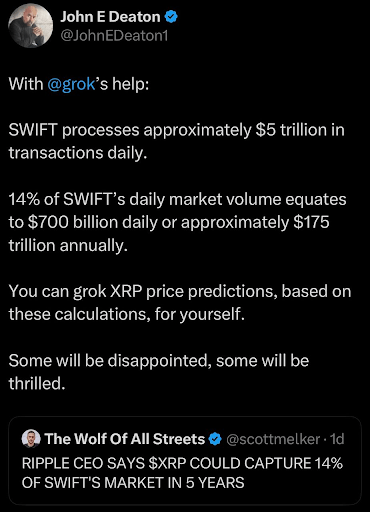

Ripple Plans To Take 14% Of SWIFT Volume, USDC Lands On XRPL – What Does This Mean For XRP Price?

Ripple CEO Brad Garlinghouse predicted that XRP could soon take a chunk of SWIFT’s trading volume. M...

Ethereum Holds $2,500 Support – History Signals $4,000 As Potential Target

Ethereum is trading at a critical level as tensions in the Middle East escalate following fresh conf...

Billionaire Snaps Up $100 Million Of Trump Coin – Details

US President Donald Trump’s media group is making a big splash in crypto finance. A Chicago trading ...