Crypto Fear & Greed Index: Neutral But Nervous?

The post Crypto Fear & Greed Index: Neutral But Nervous? appeared first on Coinpedia Fintech News

The crypto market today is tussling with a wave of uncertainty. With the total market cap falling by 1.83% to $3.28 trillion and trading volumes dropping 7.63% to $123.25 billion, investor confidence appears shaken. The Crypto Fear & Greed Index currently stands at 48, marking a “Neutral” sentiment, suggesting that investors are indecisive and are confused between being cautious and holding confidence.

This shift in sentiments is being shaped by broader macroeconomic and geopolitical triggers. Renewed Trump tariff threats, escalating tension in the Israel-Iran conflict, and fresh debates surrounding the US stablecoin regulation bill have added pressure to an already fragile market. Talking about market share, Bitcoin’s dominance now sits at 64%, while Ethereum holds 9.3%. The Altcoin Season Index reads just 23/100, confirming that altcoins are far from leading the market narrative.

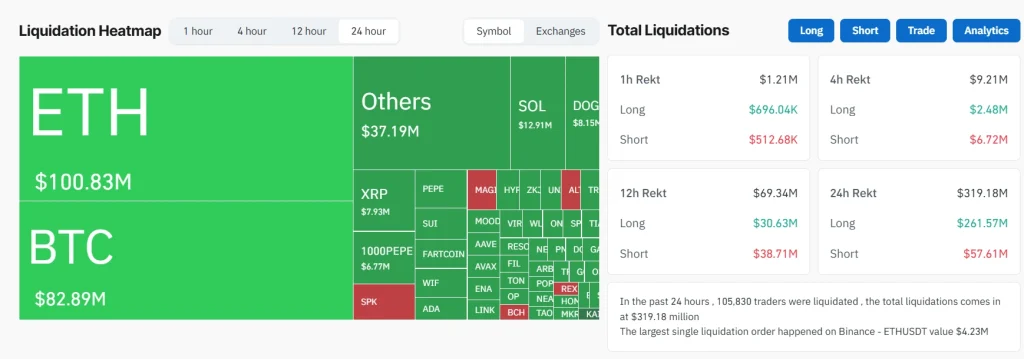

Liquidations Spike as Leverage Traders Face the Heat?

According to CoinGlass , in the past 24 hours, over 105,830 traders were liquidated, wiping out a massive $319.18 million in positions. ETH traders suffered the most, with $100.83M in liquidations, followed by BTC with $82.89M. This indicates a major shift in trader sentiment, possibly due to surprise market moves and increased volatility.

The largest individual liquidation occurred on Binance’s ETH/USDT pair, valued at $4.23M. These figures highlight the risks of high leverage in choppy market conditions and point to a growing disconnect between trader expectations and market direction.

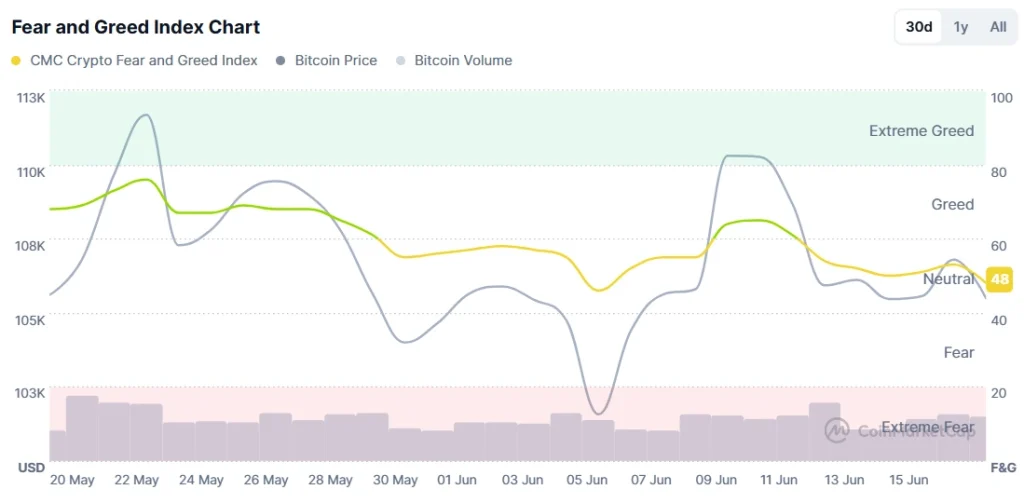

Fear & Greed Index Reflects Market Uncertainty

The Fear & Greed Index has dipped from the Greed zone earlier this month, sliding to a neutral score of 48. This decline comes in tandem with Bitcoin’s price retracing from highs above $111k to lows near $105k over the past two weeks. Notably, the index briefly dipped below the neutral threshold around June 5. Further, coinciding with the sharpest drop in Bitcoin price, and again showed hesitation around June 13–15, reflecting investor hesitation to commit in either direction.

Even though BTC volume remained relatively stable, the sentiment remained constrained in the Neutral zone. The sentiment swing, combined with heightened liquidation pressure, paints a picture of a market waiting for a decisive catalyst.

Wondering how BTC price could close the year? Read our Bitcoin (BTC) Price Prediction 2025, 2026-2030

FAQs

A reading of 48 reflects a neutral sentiment, meaning investors are neither overly fearful nor greedy.

The spike in liquidations stems from high-leverage positions being wiped out during sudden price swings, as geopolitical and regulatory uncertainty shattered the market confidence.

The crypto market has faced a downturn amid Israel-Iran war complications, Trump’s tariff threats, Stable coin bill, and growing liquidations.

Institutions Stack Solana Ahead of SOL ETF—Will This Be the Catalyst for the Price to Reach $1000?

The post Institutions Stack Solana Ahead of SOL ETF—Will This Be the Catalyst for the Price to Reach...

Best Crypto to Buy Now: ETH vs BTC—Whales Already Picked a Side

The post Best Crypto to Buy Now: ETH vs BTC—Whales Already Picked a Side appeared first on Coinpedia...

Cardano’s ADA Price Tests Patience as XRP Airdrop Hype Builds?

The post Cardano’s ADA Price Tests Patience as XRP Airdrop Hype Builds? appeared first on Coinpedia ...