Ethereum Price Ready to Soar? $5B Liquidation at $2400 Says It All

The post Ethereum Price Ready to Soar? $5B Liquidation at $2400 Says It All appeared first on Coinpedia Fintech News

In the past 45 days, the Ethereum price has shown strong consolidation above the 200-day EMA band, bolstering the bullish outlook for its price. It now seems ready for a significant upward move. Interestingly, while smart money those holding between 1 K to 10K ETH is significantly accumulating , while retail investors are busy selling in panic.

A recent post highlighted that the last 24 hours’ top bridged netflows and top stablecoins supply changes are clearly indicative of money flooding into Ethereum. Meanwhile, this influx is further supported by the accelerating adoption of ETH highlighted by the recent move of 38 entities that have pushed the strategic ETH reserve past $3 billion.

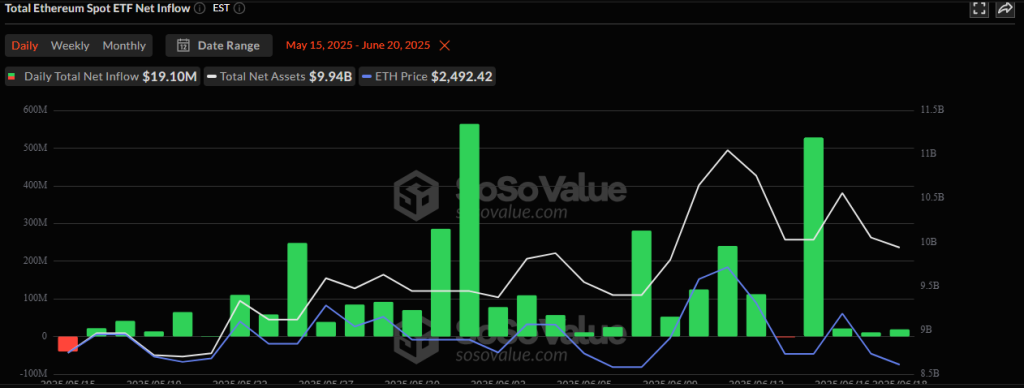

As the stacking of whales and institutions keeps on, the ETH ETFs are also rising with most sessions in green, and even experts like Ted Pillows are extremely optimistic for an inevitable breakout in Ethereum.

The current optimism is more than ever, and speculation is rising that 2025 would see an increase in institutional appetite by a multi-fold increase, as soon as the SEC gives approval for ETH staking. Keep reading to know more.

A Blast Could Be Massive In Ethereum Price

In the last 45 days, the price action has been stuck in a clear range, despite significant money flowing into it. Some have likened this situation to the ongoing conflict between Israel and Iran, and there is some truth to that analogy.

Yet, during the unresolved conflict to date, ETH ETF inflows have been still surging continuously for weeks. Also, the ETH liquidation heatmap reveals a 5.10 billion liquidation leverage around the $2400 level.

That is because the odds of the market have been suppressed lately, which seems higher. So that many retailers could offload in panic while institutions could load their bags for massive returns.

And hedge funds ‘ record shorting of ETH on CME could be a significant proof of this suppression, which we have all been witnessing on ETH’s chart.

Since institutional investors seem to have gotten on board in the past 45 days, now the plane is about to take off to its destination.

Where an expert Crypto GEMS highlighted a descending triangle pattern formed in multi-year time in ETH/BTC, a break here could give targets above $8000 in the Ethereum price.

While in the ETH/USD pair, CryptoRover found an ascending triangle, which is a trend continuation pattern indicating a blast ahead is likely.

Don’t Miss Your Shot—How This Presale Could Outpace ETH and SOL in the Coming Bull Run

The post Don’t Miss Your Shot—How This Presale Could Outpace ETH and SOL in the Coming Bull Run appe...

ChatGPT XRP Price Prediction: Big Surge Coming?

The post ChatGPT XRP Price Prediction: Big Surge Coming? appeared first on Coinpedia Fintech NewsXR...

XRP News: $MRT Presale Kickstarts Today, Analysts Predicts Martini Market Could Become The Polymarket of XRP Ledger

The post XRP News: $MRT Presale Kickstarts Today, Analysts Predicts Martini Market Could Become The ...

(@cryptogems555)

(@cryptogems555)