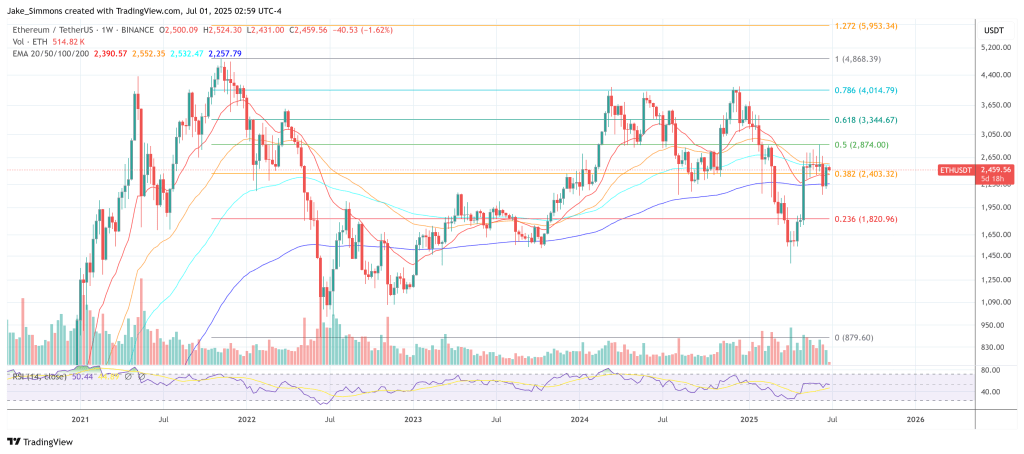

Big Money Buys Ethereum as Retail FOMOs Into Bitcoin, What Happens Next?

Bitcoin and Ethereum both posted modest gains in the past week, with BTC rising 6.2% and ETH up by 9.6%. However, momentum appears to have paused at the start of the new week.

As of Monday, Bitcoin trades just above $107,000 after a slight 0.6% daily dip, while Ethereum has remained flat over the past 24 hours. Analysts have turned to blockchain data and macro signals for cues on where the market may head next.

Bitcoin and Ethereum Onchain Trend

Recent insights from CryptoQuant Quicktake platform contributor Amr Taha provide some context behind the price action. In a detailed post , Taha noted that Ethereum inflows to Binance have continued for five consecutive days, a trend that could suggest either rising sell pressure or repositioning by major players.

At the same time, data from Bitcoin’s short-term holder (STH) Net Position Realized Cap shows a notable reversal, increasing from negative $49 billion to over $5 billion.

This pattern is typically associated with increased activity from retail investors, especially during periods of upward price movement. Taha noted:

Historically, spikes in (STH) occur near potential market tops, as retail investors tend to FOMO into Bitcoin rallies.

While this doesn’t necessarily signal a reversal, it has often preceded short-term corrections or periods of sideways consolidation. Bitcoin’s steady climb in June, despite occasional pullbacks, appears to have encouraged smaller investors to re-enter the market .

In the case of Ethereum, another CryptoQuant analyst, “crypto sunmoon,” pointed to continued accumulation by long-term holders during last month’s price consolidation.

This suggests a different dynamic is at play on the Ethereum side, with more patient capital building positions amid ongoing price suppression. Long-term holder accumulation often indicates growing confidence in an asset’s future, even if current market conditions appear lackluster.

US Policy and Macro Risk Add Layers to Market Outlook

Beyond market behavior, external factors may also shape crypto price action. Amr Taha highlighted recent political developments in the United States, particularly former President Donald Trump’s announcement of a proposed Senate bill promising wide-reaching tax cuts.

The bill, which excludes taxes on tips, overtime, and Social Security income, could lead to an increase in consumer liquidity. If passed, this could impact investor appetite across both traditional and digital markets by temporarily boosting household spending power.

However, not everybody is convinced of the bill’s long-term implications. Tesla CEO Elon Musk warned that the measure, if not accompanied by spending cuts, could expand the federal deficit and lead to economic instability over time.

Large fiscal imbalances often have ripple effects on monetary policy, potentially affecting interest rates, inflation expectations, and risk sentiment , all of which can influence investor behavior in crypto markets. Taha concluded:

Geopolitical disturbances can significantly impact investor sentiment. In response, investors might reconsider their positions in asset markets, possibly moving away from riskier assets and equities toward more stable options like bonds or safe-haven currencies.

Featured image created with DALL-E, Chart from TradingView

XRP Breaks Out Across The Board—But One Thing’s Missing

XRP has slipped the leash that has restrained it since the mid-January peak at $3.40, with the lates...

Bitcoin Shopping Spree: Strategy Continues Accumulation With $530M Purchase

Strategy (previously MicroStrategy), the leading corporate holder of Bitcoin (BTC), is on the verge ...

Ethereum Just Got Its MicroStrategy—Tom Lee Bets On Soaring ETH Price

Nearly three years after the Merge formally switched Ethereum to proof-of-stake on 15 September 2022...