MicroStrategy Reveals Portfolio Risks as Bitcoin Holdings Top $64.4 Billion

- MicroStrategy holds 597K BTC worth $64.4B with $22B in unrealized gains but warns of key risks.

- Public firms with Bitcoin surged from 64 in 2024 to 151 in 2025 amid favorable regulation.

- Top holders like Tesla, Galaxy, and Mara diversify BTC strategies from mining to direct buys.

MicroStrategy has disclosed big risks linked to its expansive Bitcoin portfolio, which now exceeds $64.4 billion in value. According to a Form 8-K filing submitted to the U.S. Securities and Exchange Commission (SEC) in July 2025, the company reported holding 597,000 BTC as of June 30, 2025.

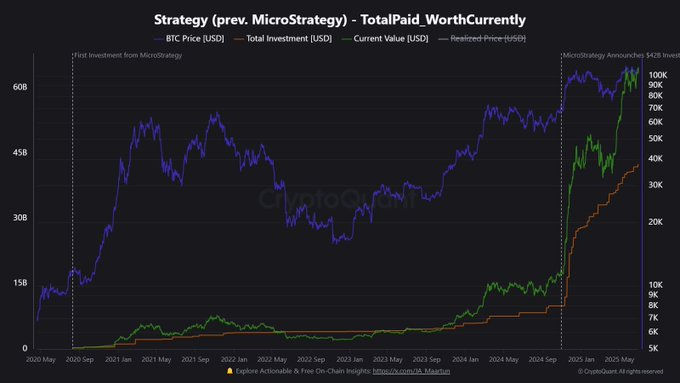

These assets were acquired for $42.4 billion over a five-year period beginning in 2020. While the unrealized profit appears substantial, the firm cited major concerns surrounding liquidity, market volatility, and regulatory uncertainties that could impact future performance.

MicroStrategy’s Bitcoin strategy began in mid-2020 and has remained aggressive through periods of high volatility. The company’s total investment climbed, with major spikes in 2023 and 2024. A key point came in mid-2024 when MicroStrategy invested an additional $4.2 billion in Bitcoin. Following that announcement, both Bitcoin’s price and the portfolio’s value surged, signaling favorable market timing.

Chart data reviewed from CryptoQuant shows the current value of MicroStrategy’s holdings (green line) closely following Bitcoin’s price movement (blue line). This value has consistently risen above the cumulative investment (orange line) during bull markets. As of mid-2025, the portfolio is experiencing strong unrealized gains amid Bitcoin’s return to near-record highs.

Despite these gains, the company’s SEC filing noted that price volatility remains a core risk. The filing also flagged concerns regarding potential difficulties in liquidating large portions of its holdings without disrupting market conditions.

Expansion of Corporate Bitcoin Treasuries

Companies holding Bitcoins in their balance sheets have grown by more than 200% in the past year. In 2024, 64 companies had exposure to Bitcoin , and this reached 151 in June 2025. This recent trend is linked to revisions in the United States policy appreciating Bitcoin as a strategic asset, increasing clarity of international taxes, and increasing corporate orientations toward digital assets.

Companies are using various methods. Firms purchase directly or depend on mining operations or dollar-cost averaging. The variety of strategies points to Bitcoin’s increasing popularity as a long-term investment.

Leading Public Bitcoin Holders in 2025

MicroStrategy , now branded as Strategy Inc., remains the largest corporate Bitcoin holder, with holdings estimated between 576,230 and 592,345 BTC. Mara Digital Holdings ranks second with up to 49,678 BTC valued at $4.8 billion. Japan’s Metaplanet holds 11,111 BTC worth $1.15 billion.

Other major holders include Tesla (11,509 BTC), Galaxy Digital (15,449 BTC), and Hut 8 Mining (10,237 BTC). Coinbase and Block Inc. also appear among the top corporate Bitcoin custodians.

Status Unveils First Gasless L2 on Linea With 100% Community Yield Allocation Mechanism

Status unveils the first gasless L2 on Linea, redistributing 100% of yield and app fees to the commu...

LILPEPE Enters Fifth Presale Phase Following Rapid Sell-Out of Stage Four

MultiBank Group opens early access waitlist for its $MBG Token, a utility token backed by $29B in as...

Bitcoin Records New ATH of $118,670, Ethereum Crosses $3,000

Bitcoin $BTC has successfully touched the $118,357 mark, setting a new all-time high while the wider...