Bitcoin Analyst Builds BTC’s Bullish Case After Binance Volume Spike, Fed Liquidity Surge

The price of Bitcoin started the weekend—and the new month—in the worst possible way after falling below the $115,000 mark on Friday, August 1. This price decline seems to be worsening, as the premier cryptocurrency now sits beneath the $113,000 level following United States President Donald Trump’s recent nuclear threat.

This recent movement has sparked market-wide conversations about the possibility of Bitcoin already reaching the price top in the current cycle. However, the consensus seems to be that the price of BTC still has the potential to embark on at least another leg up before finally reaching its cycle peak.

BTC Could Revisit Former Highs In Near Term: Analyst

In a Quicktake post on the CryptoQuant platform, on-chain analyst Amr Taha built a bullish case for the price of Bitcoin following recent shifts in the Bitcoin market and the broader macro dynamics. In the BTC market context, the crypto pundit highlighted the changes in the coin’s spot volume on Binance, the world’s largest cryptocurrency exchange by trading volume.

Data from CryptoQuant shows that Binance registered over $7.6 billion daily BTC spot volume, marking one of the most significant increases in recent weeks. However, this notable spike in trading activity coincided with a dip in Bitcoin’s price from above $118,000 to around $113,000, signaling increased volatility and trader repositioning.

Taha noted that, from a historical perspective, spot volume spikes of this magnitude—like the $7 billion surge seen on June 22—have often been correlated with local bottoms or major price reversals. Hence, the latest jump in the Bitcoin spot volume could represent renewed investor demand and be ultimately bullish for the market leader.

In the macroeconomic context, Taha highlighted that the US Federal Reserve’s net liquidity also witnessed a significant increase on Friday, jumping from $6 trillion to $6.17 trillion. For more context, net liquidity is typically considered a significant macro driver for risk assets like Bitcoin.

As such, a net liquidity spike implies more fiat money is circulating in the financial system, which can flow into equities, cryptocurrencies, and other risk-on assets. Hence, increases in the Fed’s net liquidity have historically coincided with bullish shifts across markets, as seen during late 2023 and early 2024.

Ultimately, Taha concluded that the combination of the rise in Bitcoin spot volume on Binance and the Fed’s net liquidity could set the stage for bullish continuation for the flagship cryptocurrency.

Bitcoin Price At A Glance

As of this writing, the price of BTC stands at around $112,600, reflecting an over 1% decline in the past 24 hours.

DOGE Holds Above $0.18 as RSI Signals 70% Rally Potential: Can Dogecoin Outperform in Q3?

Despite recent bearish pressure in the crypto market, Dogecoin (DOGE) is showing signs of resilience...

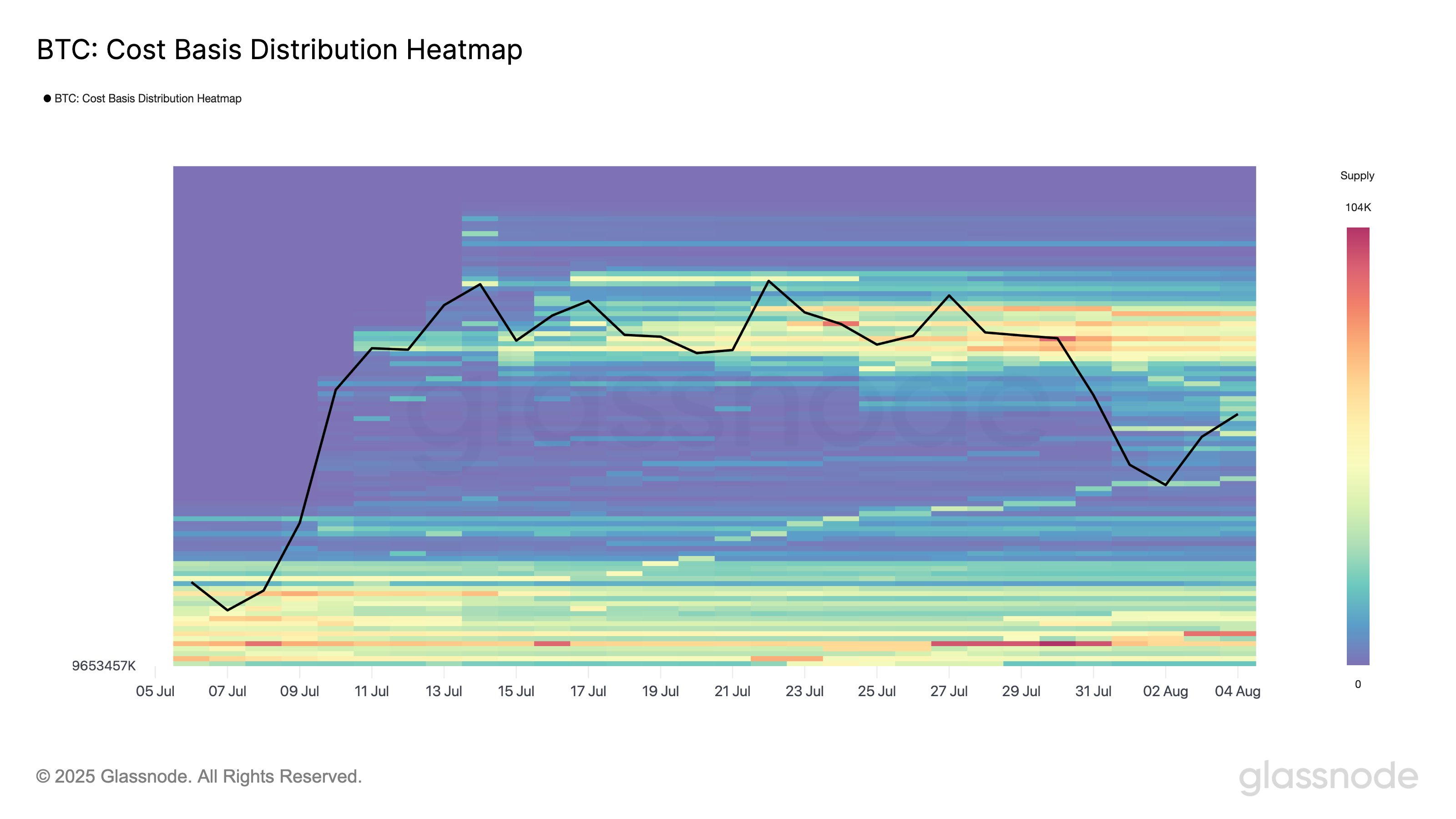

Bitcoin Top Buyers Aren’t Selling: $118,000+ Supply Remains Firm

On-chain data shows Bitcoin investors who purchased near the price top are choosing to hold even aft...

Network Stability Or Miner Pullback? Bitcoin Mining Difficulty Stagnates In 2025

Bitcoin mining difficulty has hit the brakes in 2025. For the first time in the network’s history, d...