Bitcoin’s Reign Will Continue, Popular American Entrepreneur Says

According to Anthony Pompliano, Bitcoin is still the clear leader in the crypto market and it’s not likely to give up that spot soon. He made the point during an appearance on CNBC’s Squawk Box , where he pushed back against the old “blockchain, not Bitcoin” line that was popular in the 2016-2017 cycle.

He said Bitcoin has proven itself, and he framed the debate as one about what people want to own, not just what the technology can do.

Bitcoin Maintains Market Lead

Pompliano argued that the idea blockchain alone would outshine Bitcoin has been tested and found wanting. Based on reports from his CNBC interview, he stressed that while blockchain has useful cases, Bitcoin holds a unique position as an asset that many want to own outright.

He called the split in investor goals a key reason markets feel more volatile, and he pointed to the years after 2016-2017 as evidence that Bitcoin kept growing in influence.

Investors Are Choosing Different Paths

Some people want yield; others want the asset itself. Pompliano noted both groups exist and that this split matters. He said some big holders are now converting coins into BTC ETFs.

He explained that institutional-style custody and the rules around ETFs make those funds attractive to traditional investors who can’t buy or hold Bitcoin directly.

ETF Demand Tied To Security And AccessAccording to Pompliano, ETF funds are held by professional custodians, which makes them harder to steal than coins in personal wallets. That, he said, explains why large holders might move into ETFs even if they own Bitcoin already.

But he didn’t predict that everyone would follow that path. He described the move as sensible for some, while also saying a core of the Bitcoin community will keep pushing for self-custody.

Custody Choices Are Changing

Custody Choices Are Changing

The custody conversation is shifting from purely ideological to practical. Pompliano compared Bitcoin to the S&P 500 in the sense that it’s becoming a mainstream store of value for some investors.

Still, many will keep the “not your keys, not your coins” stance and hold private keys themselves, he added, keeping a cultural split alive inside the market.

Pompliano warned that splitting capital across ETFs, infrastructure bets, and direct holdings can add to price swings.

He said the current market offers enormous opportunity for different strategies, but that same diversity of bets can push volatility higher. That’s a simple trade-off, he suggested: more ways to invest can mean more movement in price.

Featured image from Unsplash, chart from TradingView

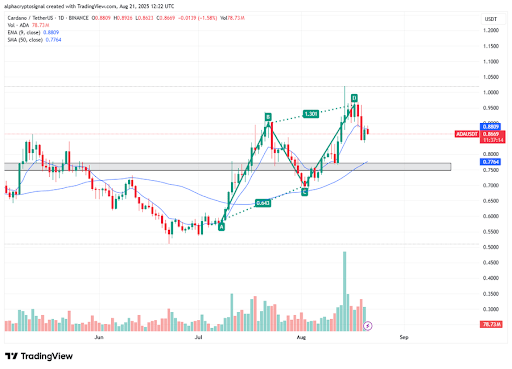

Cardano Price Squeezed Between Support And Resistance – Market Awaits Next Leg

Cardano’s price is caught in a tight range, holding above key support while facing resistance overhe...

How High Can Shiba Inu Climb In 2025? Analyst Gives Candid Outlook

In a video published earlier this week titled “SHIBA INU — HOW HIGH WILL PRICE BE IN 2025?!! MY HONE...

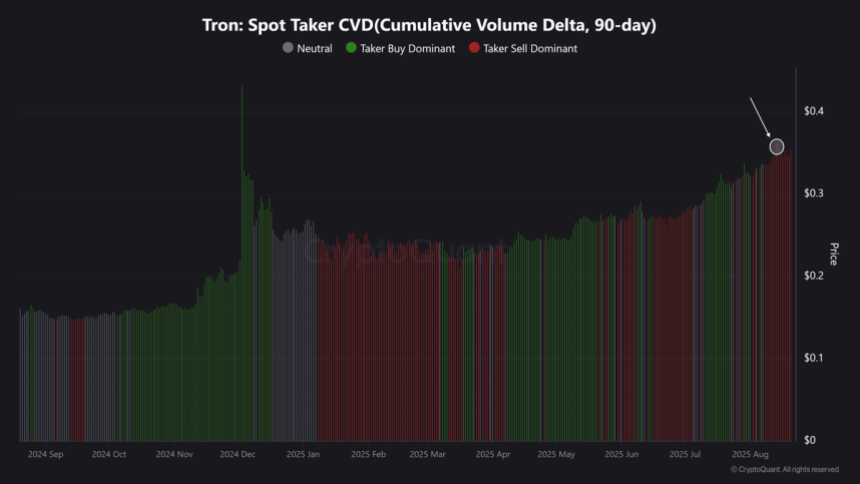

TRON Spot Market Signals Relief – Seller Dominance Weakens After Cycle High

Tron (TRX) has entered a period of consolidation following its impressive surge to multi-year highs ...