Bitcoin on Edge: Whale Moves and Short-Term Losses Signal Potential Shake-Up

Bitcoin continues to face challenges sustaining its momentum after retreating from its recent all-time high above $124,000. At the time of writing, the asset trades around $111,090, reflecting a 10.5% decline from its peak and a 4.2% drop over the past week.

The pullback highlights growing uncertainty among traders as buying pressure weakens, even while some on-chain indicators suggest potential accumulation.

One such signal comes from Binance, the world’s largest cryptocurrency exchange by trading volume. Analyst Crazzyblockk, a contributor to CryptoQuant’s QuickTake platform, examined a metric called the Binance Buying Power Ratio.

According to the analyst, this ratio, measuring the inflow of stablecoins relative to Bitcoin outflows from Binance, has recently climbed sharply, moving into positive territory . The implication is that traders are sending stablecoins into the exchange (potential buying power) while withdrawing Bitcoin, likely for long-term storage.

Binance Buying Power Ratio Signals Accumulation

Crazzyblockk explained that this pattern points to a buildup of liquidity while simultaneously reducing the Bitcoin supply available for sale on Binance. In his words:

Stablecoins in, BTC out. This combination of accumulating ‘dry powder’ and securing assets off-exchange is a classic sign of a market preparing for a bullish move.

The surge in buying power ratio coincides with Bitcoin’s current consolidation phase , suggesting that some traders may be preparing for a rebound.

Historically, an increase in stablecoin inflows has often preceded heightened trading activity, with many market participants using these reserves to enter positions once favorable conditions emerge.

At the same time, large Bitcoin outflows from exchanges can reflect a broader trend of long-term holding behavior. Investors who transfer coins to private or institutional-grade wallets often intend to store them securely, limiting immediate selling pressure.

If sustained, this dual trend of stablecoin accumulation and Bitcoin withdrawals could support the market by reducing available supply and preparing liquidity for upward moves.

Bitcoin Short-Term Holders Show Signs of Weakness

While Binance metrics suggest optimism, another CryptoQuant analyst, Darkfost, highlighted a more cautious indicator: the Spent Output Profit Ratio (SOPR) for short-term holders (STHs). This metric measures whether coins moved on-chain are being sold at a profit or loss.

Darkfost noted that the STH SOPR has now fallen below 1, with its monthly average sitting at the neutral point. In practical terms, this means that many recent buyers are no longer selling at a profit, and some are even taking losses. He wrote:

Historically, when STH SOPR reaches this level, two scenarios are common. Either the market rebounds quickly, or short-term holders panic, leading to further losses. During this cycle, the second scenario has often played out—though these periods have consistently created opportunities for medium- to long-term investors.

The comparison to late 2021, when Bitcoin last peaked at $69,000 before entering a prolonged correction , shows the weight of this signal. A persistent decline in SOPR could indicate rising pressure from traders seeking to exit, even as long-term holders demonstrate greater conviction.

Featured image created with DALL-E, Chart from TradingView

XRP Price Holds Macro Consolidation Zone, Wave 3 Surge Could Send Price To $5

After the Bitcoin price retracement, XRP seems to have entered into another bearish trend that has s...

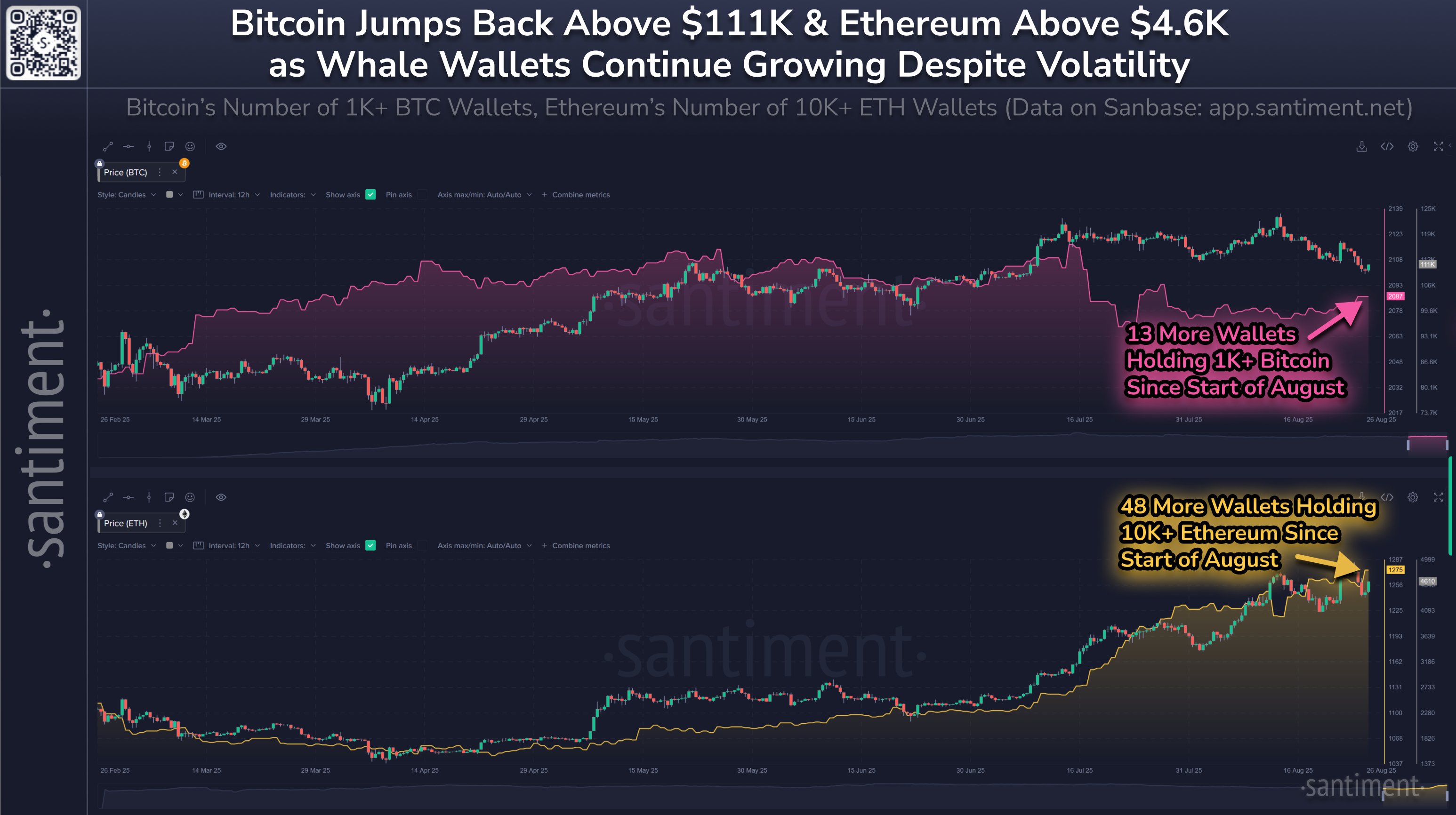

Bitcoin & Ethereum Whale Populations Quietly Growing, On-Chain Data Reveals

On-chain data from Santiment shows both Bitcoin and Ethereum whale address counts grew in August, si...

New Hedge Fund Falconedge To Devote Nearly 100% Of IPO Funds For A Bitcoin Treasury

Falconedge, a newly established hedge fund advisory firm that emerged from Falcon Investment Managem...