As WLFI Freezes Wallets, Traders Flock To Unich’s Trustless Pre-Market

World Liberty Financial just showed crypto what happens when “decentralized” projects can freeze wallets at will. After blacklisting 272 wallets including Justin Sun’s $3 billion holdings, the Trump-backed token crashed 40% while investors watched helplessly. This drama pushed traders toward platforms where code, not company decisions, controls their assets – like Unich Pre-Market, where smart contracts handle everything and nobody can lock your funds.

WLFI’s Wallet Freeze Creates Trust Crisis in Crypto Trading

The whole mess started when WLFI’s compliance team decided to freeze hundreds of wallets, claiming they were protecting users from phishing attacks. Justin Sun, who dropped $75 million into the project, found his tokens locked after moving just $9 million between his own wallets. He wasn’t selling, just doing what crypto holders do every day – moving funds around for security. But World Liberty Financial saw red flags and hit the freeze button.

The timing couldn’t be worse. WLFI had just launched trading at $0.32 on Binance before tumbling to $ 0.18 within days. While the team burned 47 million tokens trying to stop the bleeding, freezing major holders’ wallets only made things worse.

Bruno Skvorc from Polygon went public with his frustration after receiving an email that his wallet was flagged as “high risk” – after they’d already taken his money during the sale. He called it straight: “This is the new age mafia. There is no one to complain to, no one to argue with, no one to sue.”

What really stings is how arbitrary these freezes seem. Some wallets got blocked for being “8 hops away” from a risky address – like freezing your bank account because someone six degrees of separation from you might have done something sketchy. The crypto community noticed the hypocrisy immediately: if World Liberty Financial can freeze anyone’s tokens whenever they want, they’re no different from traditional banks.

This is exactly why traders are flocking to Unich Pre-Market, where smart contracts eliminate the middleman entirely – no compliance team can wake up and decide to freeze your assets.

Unich Pre-Market Proves Trustless Trading Works

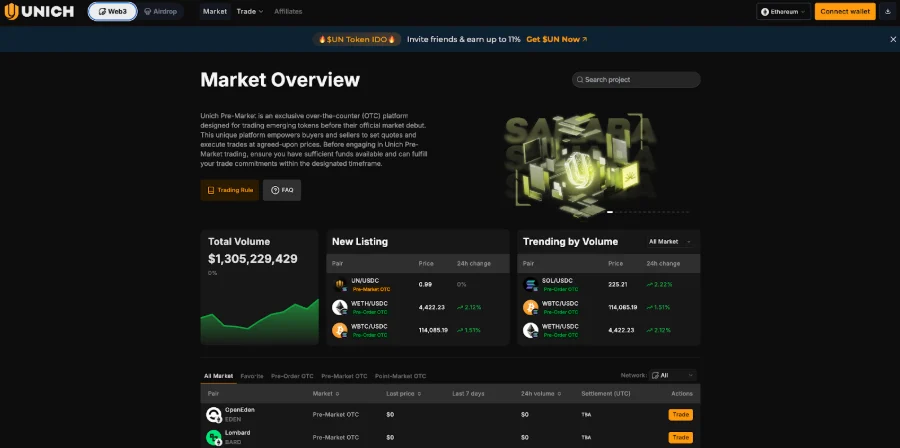

While WLFI investors begged for their tokens back, Unich Pre-Market kept processing trades the way crypto was meant to work – with zero ability to freeze anyone’s assets. The platform hit $1.2 billion in total OTC volume over six months by solving the exact trust problem WLFI just created.

The mechanics are refreshingly simple. When you trade pre-TGE tokens on Unich, both sides deposit funds that get held by code, not people. If someone tries to back out after token generation, the smart contract automatically compensates the other party. No compliance team making judgment calls, no sudden wallet freezes, just transparent rules enforced by blockchain.

What really sets Unich apart is their Cashout Order feature – traders can exit positions before TGE by transferring trades to other participants. You maintain control of your capital instead of being locked in until someone decides you’re allowed to move your own money.

Ironically, WLFI itself was one of the biggest tokens on Unich Pre-Market before its TGE, generating over $5 million in trading volume . This shows Unich enabled traders who saw WLFI’s potential to safely pre-buy and pre-sell the token before its TGE, without worrying about getting scammed or losing their deposits – exactly the kind of protection WLFI investors now wish they had.

Right now, Unich is offering those interested in the project a chance to join its journey through the Unich IDO , with $UN tokens starting at just $0.15 . What’s notable is that $UN is already trading between $0.85–$0.95 on the Pre-Market – just below its $0.99 ATH.

The 6x massive gap between IDO and Pre-Market prices also tells you everything – actual users who know the platform inside out are accumulating hard. It shows organic demand from daily users who bet the price will blast past that $0.99 once major exchanges list it.

With confirmed exchange listings coming Q3-Q4 2025 , early IDO participants are getting tokens at pre-public prices while the market has already shown where fair value sits.

Conclusion

WLFI’s wallet freeze controversy reveals a fundamental truth: calling something decentralized doesn’t make it so. When projects can freeze funds at will, they’re just traditional finance with extra steps. The exodus to platforms like Unich shows traders voting with their wallets for genuine trustless systems.

For those looking to be part of this shift, the ongoing Unich token sale offers a rare entry into infrastructure that’s already proven its worth – where your keys truly mean your coins, no exceptions.

This article is not intended as financial advice. Educational purposes only.

Bitcoin Hyper Tipped as Next Crypto to Explode in 2025 as Analysts Praise Layer-2 Model

Bitcoin Hyper’s $15.2M presale, Solana-compatible Layer-2 design, and 73% APY staking have analysts ...

New Coreon–Datai Partnership Aims to Unlock Real-Time Blockchain Intelligence

Recently, Datai Network and Coreon MCP have declared a strategic alliance that would make the data o...

Dogecoin Price And Shiba Inu Momentum Slow While Rollblock is Ranked the Best New Crypto Buy

Dogecoin and Shiba Inu struggle for momentum, while Rollblock’s $15M in wagers, 50K users, and 30% A...