Solana Treasury Trend Accelerates: Pantera’s Helius Push Holdings Past $3B

Institutional investment in Solana (SOL) has entered a new phase, with corporate treasuries and leading funds accelerating their exposure to the blockchain.

Pantera Capital, Galaxy Digital, and Helius Medical Technologies have emerged as the most prominent players, collectively pushing Solana holdings above $3.8 billion.

This surge in capital mirrors early adoption cycles once seen in Bitcoin and Ethereum, fueling speculation that Solana could evolve into a critical layer of global finance and overall crypto adoption.

Pantera Leads With $1.1 Billion Solana Bet

Pantera Capital has placed its biggest-ever bet on a single crypto asset: $1.1 billion in Solana . CEO Dan Morehead called Solana the “fastest and best-performing blockchain,” citing its ability to process nine billion transactions per day, more than all global capital markets combined.

Morehead, who previously focused on Bitcoin and Ethereum, said the firm now sees Solana as its most promising long-term bet. “Our biggest position is Solana,” he emphasized, signaling a strong shift in institutional conviction toward the network.

Helius and Galaxy Add Firepower

Helius Medical Technologies has added a corporate twist to the Solana treasury strategy.

Backed by Pantera and Summer Capital, Helius secured $500 million through an oversubscribed funding round, with an option to expand its treasury to $1.25 billion via stapled warrants. The adoption reflects a broader trend of public companies integrating Solana into their balance sheets.

Meanwhile, Galaxy Digital aggressively acquired $1.55 billion worth of SOL in just five days, including a single $306 million purchase transferred to custody platform Fireblocks.

This buildup coincided with Galaxy’s $1.65 billion investment in Forward Industries, further expanding Solana’s increasing presence in institutional finance.

A Defining Moment for Solana

With Pantera’s $1.1 billion stake, Helius’s scaling plan, and Galaxy’s quick accumulation, Solana is seeing unprecedented institutional inflows. The trend mirrors Bitcoin’s early treasury adoption and Ethereum’s rise as the foundation of decentralized finance.

For Solana, the challenge is to maintain this momentum through ecosystem growth, developer retention, and macroeconomic resilience. If successful, the blockchain could establish itself as the next major category-defining digital asset, greatly increasing Solana’s (SOL) market position.

Cover image from ChatGPT, SOLUSD chart from Tradingview

Ethereum Price Need Breakout – Key Hurdles Before Rally Can Continue

Ethereum price started a fresh decline below $4,620. ETH is now trading below $4,620 and might exten...

Bitcoin Bull Score Sees Sharp Jump, No Longer Signals Bear Phase

CryptoQuant’s Bitcoin Bull Score Index has jumped from 20 to 50 in just four days, suggesting a swif...

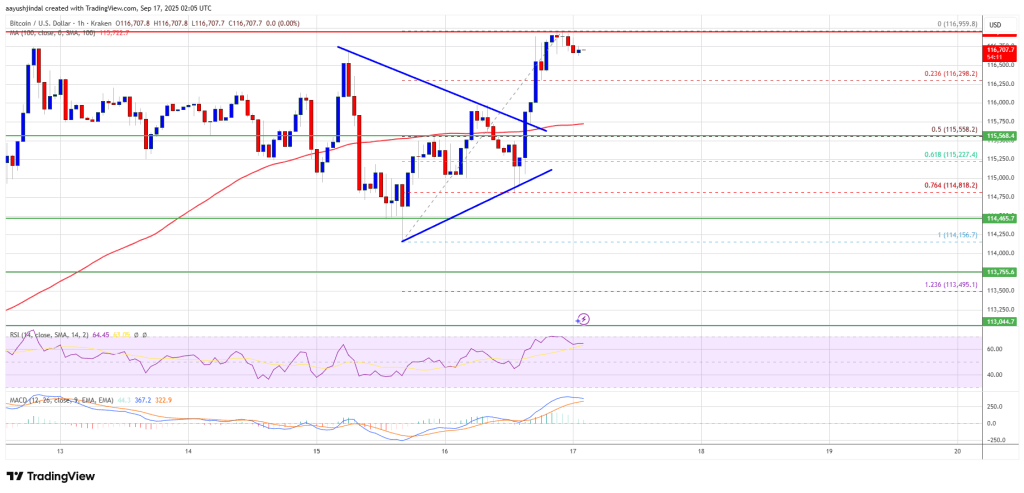

Bitcoin Price Back at Resistance – Fed Meeting Could Trigger Big Move

Bitcoin price is moving higher above $116,200. BTC is now consolidating and might gain bullish momen...