FalconX Moves 413K Solana Worth $98M – Impact On SOL Price

According to on-chain alerts, FalconX pulled 413,075 SOL from major exchanges over an eight-hour stretch, valued at about $98.4 million. The tokens were moved off Binance, OKX, Coinbase and Bybit into wallets linked to the brokerage, reports have disclosed.

FalconX Withdrawals Raise Eyebrows

Blockchain trackers flagged the transfers as significant because they happened across multiple venues in a short window.

FalconX is the largest digital asset prime brokerage , the company’s website shows.

Lookonchain and other analytics firms have flagged the pattern as consistent with institutional activity, where assets are moved into custody or cold storage rather than kept on exchange accounts ready for sale.

Large withdrawals cut the pool of SOL sitting on exchanges. That matters because less exchange supply can tighten available coins for buyers, especially if demand holds or rises. Traders watch that metric closely. It is one of several data points that can change short-term odds for price swings.

Looks like another institution is buying massive $SOL .

In the past 8 hours, #FalconX has withdrawn 413,075 $SOL ($98.4M) from #Binance , #OKX , #Coinbase , and #Bybit . https://t.co/BbJHB6YKtf pic.twitter.com/BibDGcoD3x

— Lookonchain (@lookonchain) September 17, 2025

Analysts Note Caution On Attribution

Based on reports, the wallets involved have been attributed to FalconX, a known institutional broker, but such labels are built from analysis of patterns, prior transfers, and public filings.

What This Could Mean For Solana’s PriceA withdrawal of roughly $98.4 million worth of SOL can add upward pressure if buyers keep coming. Less supply on exchanges tends to reduce immediate sell liquidity.

If demand spikes, prices can react sharply. That said, price depends on many things: order book depth, macro drivers, derivatives flows and how other large holders behave.

Market analysts tend to associate large exchange outflows with probable accumulation phases. For Solana, a move of this magnitude illustrates how institutional custody activity can affect views on short-term availability and supply.

The scale and timing of FalconX’s activity guarantee that traders will be looking closely at order books over the next few days.

Historical evidence also indicates that large withdrawals of tokens occasionally lead to heightened market activity. If transfers of this nature keep going ahead, Solana’s on-exchange liquidity profile may get tighter still, setting the stage for price to respond more rapidly to trading volume.

In the meantime, attention is centered on how market demand compares to this diminished on-exchange supply.

Featured image from Unsplash, chart from TradingView

Bitcoin Set Up For ‘Promising’ Q4, Next Two Weeks Could Be Decisive

As the overall market continues to move sideways, Bitcoin (BTC) is attempting to reclaim its local r...

Coinbase Vs. State Regulators: Crypto Exchange Fights Legal Fragmentation

US-based crypto exchange Coinbase has made a significant appeal to the Department of Justice (DOJ) r...

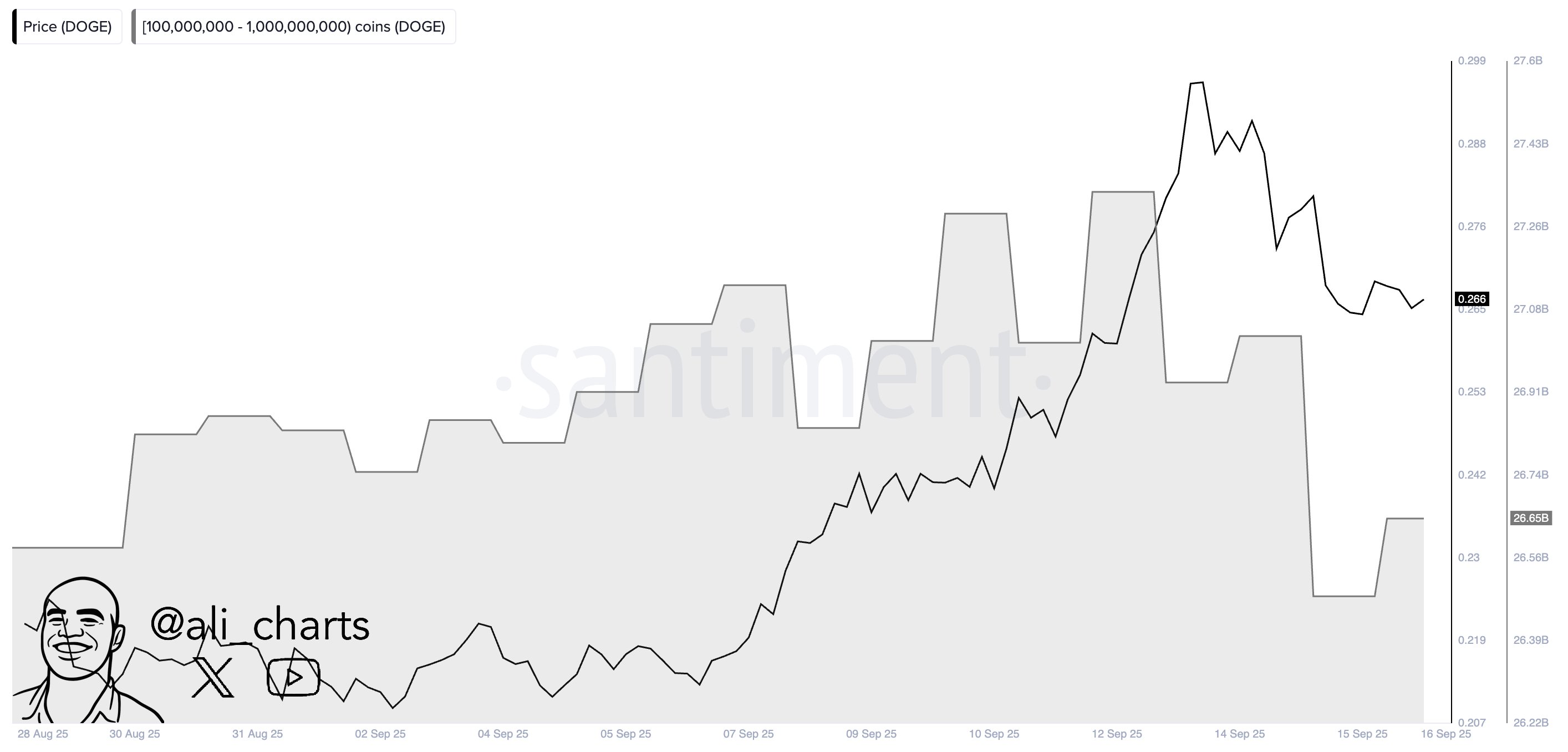

Dogecoin Down 13% As Whales Distribute $181 Million In DOGE

On-chain data shows the Dogecoin whales have gone on a notable selling spree recently, potentially e...