ADA Holds $0.90 Support As Hoskinson Says Cardano Will ‘Break The Internet’

Charles Hoskinson has affirmed that Cardano (ADA) will steal the crypto spotlight as the altcoin attempts to hold a crucial level as support. Some analysts believe the cryptocurrency is preparing for a massive rally in the coming months.

ADA Holds Key Support Zone

Following Thursday’s market rally, Cardano has seen its price retrace 4% in the last 24 hours, failing to reclaim the range high for the second time over the past week. The altcoin has been trading between $0.72-$0.96 since July, hitting a local high of $1.01 last month.

Despite the dip, ADA has held the $0.85-$90 zone as support, attempting to stabilize around this area throughout Friday morning. Analyst Sebastian suggested that the cryptocurrency must “start setting a new higher high, otherwise we could find ourselves in a head and shoulders pattern, which could result in a bigger retrace.”

Cardano has been trading above an ascending support trendline since early August, bouncing from this key level twice this month. To the analyst, ADA’s trend will remain bullish as long as the price holds the trendline.

On the contrary, a breakdown from this level could see the altcoin retrace to the macro support zone, between $0.50-$0.60. Market Watcher Altcoin Gordon pointed out that ADA recently broke out of its multi-month descending resistance after reclaiming the $0.85 level last week.

Since then, the cryptocurrency has retested the trendline area as support, confirming the breakout. To Gordon, if the price continues to hold above this level, Cardano could see “a HUGE move to the upside.”

Meanwhile, analyst Crypto Kid asserted that Q4 seasonality could see the altcoin repeat its 2024 end-of-year playbook. Notably, ADA broke out of its nine-month downtrend line during the November 2024 run, rallying 270% to its three-year high of $1.32.

Now, the cryptocurrency displays a similar price action, retesting this level in the weekly timeframe multiple times over the past two months. “I’m betting on ADA repeating its history by breaking out October/November this year,” the analyst wrote.

Cardano ETFs To Fuel Q4 Rally?

In a late Thursday post, Cardano’s founder Charles Hoskinson also shared a bold outlook, affirming that it is “going to break the internet.” Despite not offering more details, the community noted that the recent growing momentum of crypto-based Exchange-Traded Funds (ETFs) could propel ADA’s rally.

On Friday, Grayscale Investments launched its Grayscale CoinDesk Crypto 5 ETF (GDLC), the first multi-asset crypto ETF launched in the US. The investment product holds the five largest cryptocurrencies by market capitalization: Bitcoin, Ether, XRP, Solana, and Cardano.

The Securities and Exchange Commission (SEC) approved the digital asset manager’s request to convert its Grayscale Digital Large Cap (GDLC) Fund into an ETF earlier this week. Since the announcement, investors consider the odds of a spot ADA ETF approval are higher.

According to data from the prediction platform Polymarket, the chances of the SEC approving the investment product in 2025 have increased from 79% on Wednesday to 91%. Notably, the regulatory agency delayed the deadline for Grayscale’s spot Cardano Exchange-Traded Fund in August, postponing the final decision date to October 26, 2025.

Many expect that most spot crypto-based ETFs will be approved at the start of Q4, which could fuel a “spicy end-of-year” for many altcoins, including ADA.

As of this writing, Cardano is trading at $0.89, a 1% decline in the weekly timeframe.

Bitcoin Price Drops To $115K After Rate-Cut Rally — But BTC Far From Capitulation

On Thursday, September 18, the Bitcoin price enjoyed some form of rejuvenation following the outcome...

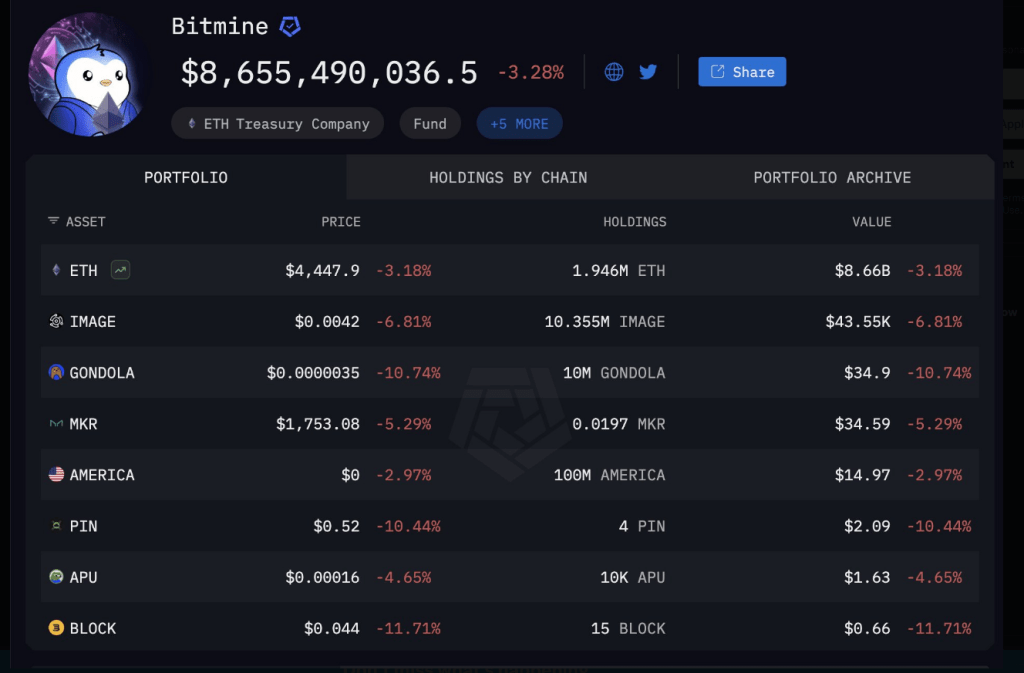

Bitmine’s Ethereum Appetite Grows With Fresh $70 Million Buy

BitMine Immersion Technologies has added nearly $70 million worth of Ethereum to its holdings, pushi...

Analyst Says XRP Price Not Reaching $10+ Due To Market Cap Is Irrelevant

The arguments for the XRP being able to reach $10+ or not have ranged from how high the market cap w...