XRP Faces Critical Technical Level At $2.73 — Why It Matters

Over the last week, XRP slipped below the psychological $3 support level as it lost about 7.02% of its price value. Since then, the altcoin has maintained a steady price consolidation around the $2.78-$2.79 region, without retesting the newly formed resistance level. Meanwhile, recent on-chain data has provided some cautionary market insights, highlighting a key support zone.

XRP Bulls Must Avoid Crash Below $2.73 – Here’s Why

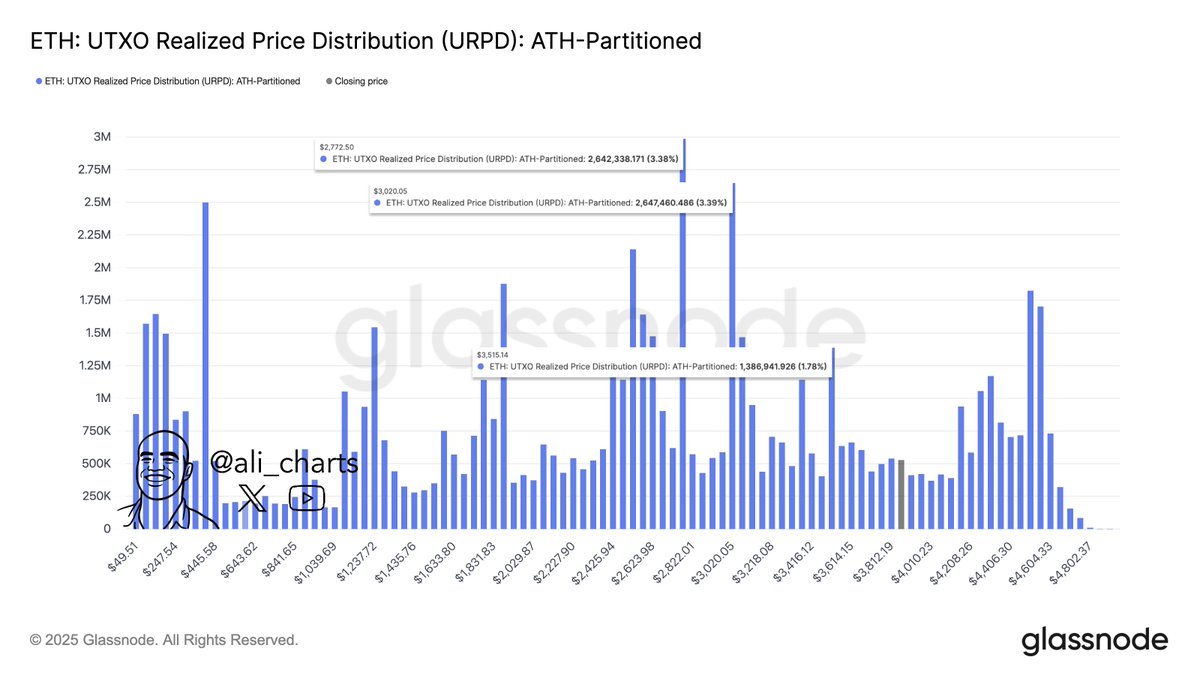

In an X post on September 27, crypto analyst Ali Martinez revealed the existence of a price gap sitting between the $2.73 and $2.51 price levels. Central to Martinez’s revelation is the UTXO Realized Price Distribution (URPD) metric, which specifies how much XRP was last transacted at different price levels, but in relation to its all-time high.

As an extension of its primary function, the indicator quantifies trading activity across different price levels, therefore highlighting potential support and resistance zones. According to the chart shared by Martinez, there is considerable trading activity across several XRP’s price zones. However, there is a price range closest to its current value at $2.78, within which there has been very little trading activity.

This price range, set between $2.51 and $2.73, comprises relatively less market activity, creating what Martinez describes as a price gap, where little support or resistance exists. The higher boundary of the price gap is at the $2.73 level, where about 1.60 billion XRP were transacted. A fall below this price floor would likely result in a straight decline towards $2.51, as any little support lies between both price regions. Notably, XRP last touched $2.51 in July.

XRP Price Outlook

As of this writing, XRP is valued at about $2.78 despite a modest 0.78% gain in the last day. Meanwhile, the altcoin’s daily trading volume is down by 58.95% and valued at $3.02 billion.

According to CoinCodex, XRP is currently facing bearish sentiment, with traders showing caution amid subdued market conditions. Meanwhile, the Fear and Greed Index sits at 33, signaling fear and a lack of strong buying momentum. Over the past 30 trading sessions, XRP has recorded 13 red days, underscoring the weakness in recent performance

Despite this, price predictions suggest little volatility ahead, with no significant change expected in the next five days or over the coming month. This indicates that XRP may remain range-bound as investors await clearer market signals or catalysts. With sentiment leaning negative, short-term traders may exercise caution, while long-term holders continue to monitor for potential shifts in broader crypto market dynamics.

Bitcoin And Ethereum Defy Price Slump With Strong Exchange Outflows

The crypto market faced in recent months, as both Bitcoin and Ethereum broke below important support...

Bitcoin To $200K? Galaxy Digital CEO Reveals The ‘Biggest Bull Catalyst’

The price of Bitcoin has had a mixed performance so far in 2025, falling to a low of around $74,000 ...

Ethereum Price Lags Below $4,000—Support Levels To Watch

The Ethereum price has been one of the best performers in the cryptocurrency market in the third qua...