Expect Sharp Corrections Before Bitcoin Reclaims New Highs – Lessons from Nvidia

Bitcoin is up 71% over the past year, but investors still feel frustrated with the recent performance of the world’s largest cryptocurrency.

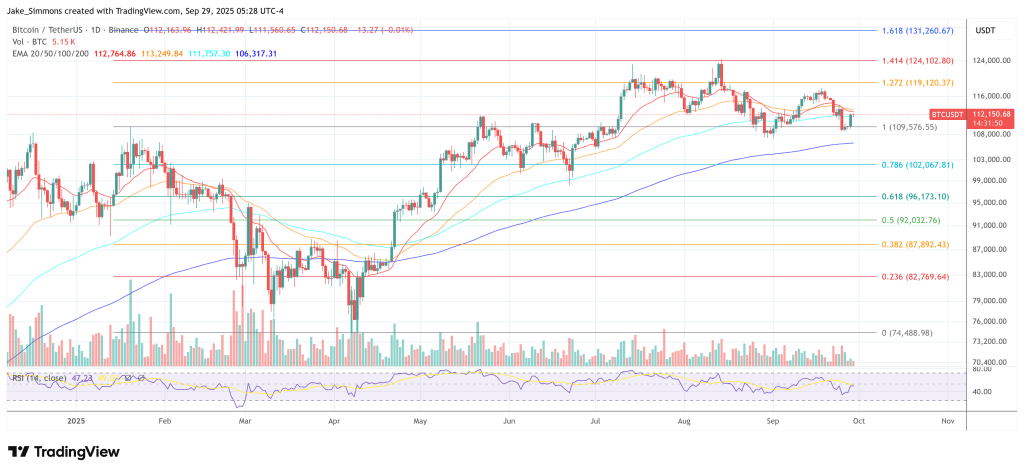

That’s because Bitcoin is down nearly 10% from its all-time high of $124,000 last month, currently trading around $112,000 .Overall, Bitcoin remains one of the best-performing assets in history. However, lately, it seems to be stuck in a slump.

Is this a bug in Bitcoin’s code? At least one analyst, Jordi Visser, believes the pullbacks are actually part of steady growth and warns that more pullbacks could become common even as Bitcoin continues to rise.

This brings us to Bitcoin Hyper ($HYPER) , which could be one of the next crypto to explode given the bullish context bubbling up.

The Nvidia Parallel

Visser compares Nvidia, the semiconductor giant whose stock skyrocketed during the AI boom. Less than three years after ChatGPT’s rise, Nvidia’s stock surged by over 1,000%.

Yet during that ascent, it weathered five corrections of 20% or more before reclaiming higher highs.

The comparison makes sense, according to Visser, because Bitcoin isn’t just a digital currency or a speculative investment – it’s becoming part of the larger AI and tech conversation.

As AI transforms traditional industries and replaces old business models, investors may start to view $BTC as both a hedge against disruption and the native digital store of value for the next wave of innovation.

Visser has written about this before , highlighting how AI and crypto innovation aren’t simply a progression of technology, but a fundamental reworking of core institutions, such as banking (through crypto) and production itself (through AI).

In that telling, capital might flow into Bitcoin alongside AI-favored equities, tying its trajectory to momentum in the tech sector.

Possible Pathways Forward

Visser’s outlook doesn’t preclude further upside; his prediction about Bitcoin’s connection with AI actually adds weight to Bitcoin’s long-term outlook. Still, Visser warns that deep pullbacks may punctuate the rally.

On the technical side, EMAs still paint a bullish picture, despite recent narrowing.

A similar narrowing of the EMA bands occurred before the surge in $BTC’s price in July, building up to August’s ATH.

Stablecoins, Bitcoin, DeFi – crypto’s many use cases increasingly point to a continued crypto revolution. Corrections aside, Bitcoin could be set for continued long-term growth as blockchain and AI tech feed on each other.That makes projects like Bitcoin Hyper, with a problem-solving Bitcoin Layer 2, even more critical.

Bitcoin Hyper ($HYPER) – Faster, Cheaper Bitcoin Transactions for Ecosystem Growth

Bitcoin Hyper ($HYPER) tackles some of Bitcoin’s biggest limitations head-on. Bitcoin processes an average of 7 transactions per second; by leveraging the Solana Virtual Machine, Hyper processes several thousand.

Bitcoin suffers from congestion and low throughput, but Hyper relies on Solana’s greater scalability. With the SVM and a Bitcoin Canonical Bridge, all the tools and features that investors typically find on Solana are now open to Bitcoin. That means meme coins, DeFi, native staking – the whole works.

Bitcoin Hyper actually provides a hybrid architecture, utilizing a bridge to the SVM for wrapped Bitcoin, while reserving final transaction settlement for Layer 1. You can learn how to buy $HYPER with our guide.

Given the broader market and some traders’ frustration with Bitcoin’s performance, it’s not surprising that $HYPER is attracting significant presale investment as investors learn more about what Hyper is . The presale has already surpassed $18.8M, with tokens priced at just $0.012995.

Don’t overlook Bitcoin Hyper’s potential – read more at the official website.

Jordi Visser offers a bullish Bitcoin picture, at least for the long term. Corrections won’t derail an ongoing bull run – they’re likely vital components of it.Suppose Bitcoin follows the pattern of Nvidia and undergoes multiple steep pullbacks en route to higher highs. In that case, it won’t necessarily herald a collapse, but could actually indicate just how far Bitcoin Hyper —and Bitcoin itself—could go.

Authored by Aaron Walker for NewsBTC – https://www.newsbtc.com/news/expect-sharp-corrections-before-bitcoin-reclaims-new-highs-lessons-from-nvidia

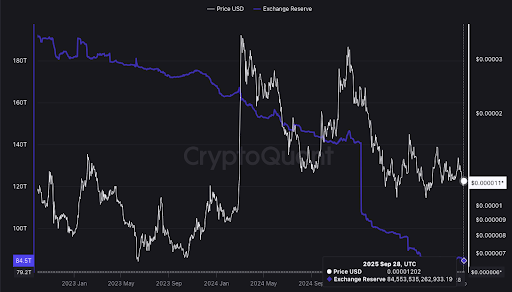

Shiba Inu Exchange Reserves Fall Below $1 Billion Amid Withdrawal Spree, What This Means For Price

Shiba Inu (SHIB) is witnessing a significant shift on centralized exchanges, as fresh on-chain data ...

XRP Explosion Ahead? Analysts Outline Longevity And Bold $200 Target

According to reports from Egrag Crypto, a statistical model now being applied to XRP points to a wid...

Bitcoin Could Go To Zero, Hedge Fund CEO Warns

Charles Edwards, founder and CEO of Capriole Investments, has issued his starkest warning yet on qua...