Top 3 Cryptos Under $0.40 to Buy Before 2026 for Maximum Token Appreciation

When looking for outsized gains, many seasoned investors now tilt toward cryptos under $0.40. These tokens often have more room for percentage growth than large-cap assets. In this article, we compare three such names: Pepecoin (PEPE), Dogecoin (DOGE), and Mutuum Finance (MUTM) . We examine each token’s current status, strengths, and where MUTM’s design may offer a powerful contrast to traditional meme plays.

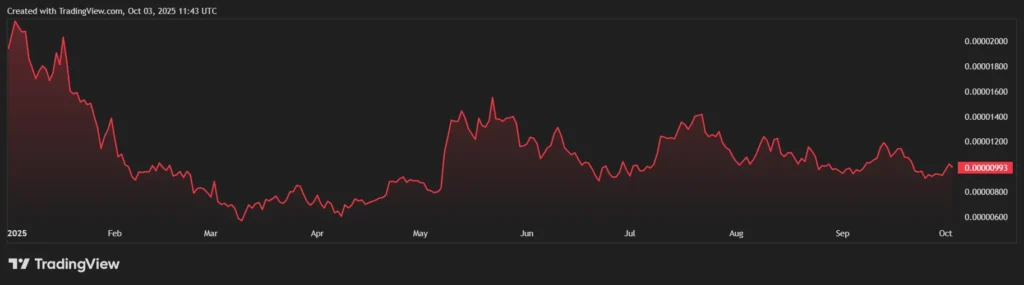

Pepecoin (PEPE)

Pepecoin, often styled PEPE, trades at around $0.000010 USD, with a market cap of about $4.5 billion. It has become one of the major meme coins in 2025, riding high liquidity and social hype.

But despite its popularity, PEPE has structural constraints. Its massive circulating supply limits how far prices can stretch without huge inflows. Also, its monetization model is largely dependent on trading volume and sentiment rather than built-in utility or revenue mechanisms, making it vulnerable to narrative cycles and volatility.

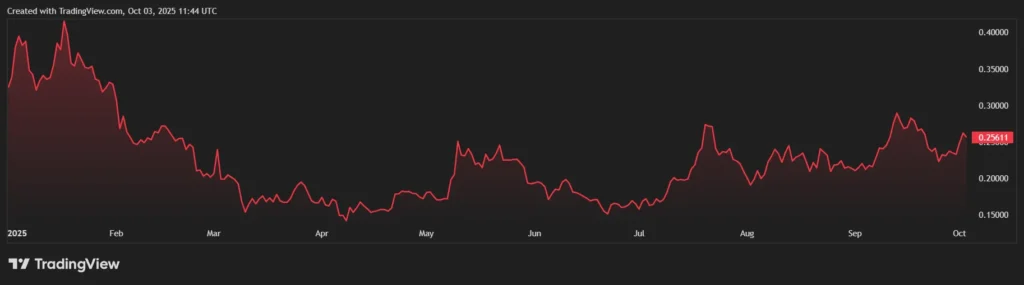

Dogecoin (DOGE)

Dogecoin maintains strong institutional recognition and an active community. It currently trades around $0.24-$0.26, with a market capitalization in the $30–$40 billion range. Thanks to its brand, mainstream exposure, and widespread listings, DOGE has legitimacy.

Yet DOGE also faces headwinds. Its tokenomics allow a perpetual supply (no cap), which dilutes long-term value. Its core appeal is social momentum rather than built-in protocol mechanics or revenue architecture. As valuations rise, the challenge becomes delivering sustained upside rather than seasonal pumps.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is a decentralized, non-custodial lending and borrowing protocol built on Ethereum. Every deposit, loan, or staking action is designed to feed into token demand, making utility central to its model rather than an afterthought.

The presale began at $0.01 in Phase 1, giving early participants a rare low-entry opportunity. After five structured stages, MUTM now trades at $0.035 in Phase 6, marking approximately 250% token appreciation for those who joined at the very beginning. So far, the project has raised over $17 million, allocated more than 750 million tokens, and onboarded a growing community of 16,800 holders, signaling strong and sustained investor interest.

Phase 6 is already more than halfway sold, with Phase 7 set at $0.04 and the official launch price locked at $0.06. This clear, step-by-step progression is important because it establishes predictable appreciation and fuels urgency for new participants. Those who entered at Phase 1 are positioned for up to 600% MUTM value by listing, while even current entrants at $0.035 still stand to nearly double their token appreciation by the time the token goes live, an increasingly rare dynamic in today’s crowded presale market.

Utility vs Meme

Analysts point out the decisive advantage: utility-driven mechanics vs meme-based hype. While PEPE and DOGE largely rely on social momentum, MUTM embeds demand loops into its protocol. As the platform scales borrowing and lending activity, that usage creates natural demand pressure.

Additionally, MUTM’s structured presale phases give clarity and predictable appreciation, in contrast to meme coins which can spike or tumble based on news. Many view MUTM as echoing the early path of successful DeFi protocols: build core utility, reward liquidity, and convert users from day one.

Dual Lending Markets, LTV & APY

MUTM’s dual design supports both Peer-to-Contract (P2C) pooled liquidity for mainstream tokens like ETH and stablecoins, and Peer-to-Peer (P2P) isolated agreements for riskier or less liquid assets. This structure gives the protocol flexibility to cater to both high-liquidity blue chips and more speculative tokens without letting one segment jeopardize the other. P2C pools provide the backbone for predictable lending activity, while P2P agreements enable more customized, isolated credit deals, making MUTM adaptable to different market segments and risk appetites.

Every loan on the platform is overcollateralized and governed by strict Loan-to-Value (LTV) ratios to maintain solvency and minimize systemic risk. For example, at a 75% LTV, a user who deposits $1,000 worth of ETH can borrow up to $750 in another asset, but if the collateral value falls below the threshold, automated liquidation mechanisms step in to stabilize the protocol. Borrowers can also select between variable interest rates, responsive to liquidity utilization and stable rates, which offer cost certainty at a slight premium. On the other side, liquidity suppliers earn yield (APY) from borrower interest payments, creating a clear and sustainable incentive loop that underpins the platform’s lending economy.

Beta Platform, Security & Incentives

One key differentiator that sets Mutuum Finance (MUTM) apart from many other early-stage projects is its commitment to launching a fully functional beta version of its protocol at the same time as the token listing. Instead of forcing investors to wait months for real utility, the team aims to let users supply liquidity, borrow against collateral, and interact with the platform’s core lending features from day one. This immediate usability bridges the gap between speculation and real activity, helping generate on-chain volume and meaningful token demand right out of the gate.

Security has been a priority. Mutuum Finance passed a CertiK audit (90/100 Token Scan), and runs a $50,000 bug bounty across multiple tiers. In addition, the presale includes transparency tools, live dashboards to track allocations and returns, a Top 50 leaderboard rewarding major contributors, and a $100,000 giveaway to incentivize early participation.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

This article is not intended as financial advice. Educational purposes only.

Top Crypto Gainers Attracting Investor Interest: RDNT, TRAC, PIPE, DASH, ZKC, BEL, XION, ZEN, DCR, and SKL

The data listed crypto assets that performed better today, meaning they are seeing increased demand ...

From Presales to Power Plays: Bitcoin, Avalanche and BullZilla Lead the Top Cryptos to Buy Today

BullZilla’s presale is exploding, join its earliest round to maximize gains. Plus insights on Bitcoi...

MEXC Lists ENSO Finance – DeFi Infrastructure Protocol Widens Its Network

Enso Finance (ENSO) is initiated on MEXC exchange October 14, 2025, and allows a wider range of bloc...