BNB Price Nears $1,500 Record High as 16% Rally and CZ’s Comments Fuel Bullish Momentum

The BNB price has staged a powerful recovery, surging over 16% to trade past $1,350, outpacing Bitcoin and Ethereum as optimism builds around an imminent spot ETF approval and renewed confidence in the Binance ecosystem.

The rally comes after a sharp sell-off triggered by geopolitical tensions earlier this month, followed by an aggressive rebound fueled by whale accumulation and institutional inflows.

According to CoinGlass , daily trading volume jumped 55% to $10.7 billion, while open interest rose 25%, signaling fresh leveraged positions betting on continued upside momentum.

BNB’s sharp turnaround mirrors broader market stabilization but with stronger conviction. Traders are now eyeing a move toward $1,450–$1,500, a region that would mark a new all-time high for the fourth-largest cryptocurrency by market capitalization.

CZ Attributes BNB Price Rally to Genuine Market Demand

Binance founder Changpeng Zhao (CZ) weighed in on the rally, emphasizing that BNB’s recent strength comes from organic market demand, not artificial liquidity support.

“BNB has no market makers,” he stated, adding that the price recovery reflects the community’s belief, builder activity, and deflationary mechanisms that continue to burn tokens.

CZ also praised BNB Chain ecosystem contributors such as Venus and Binance, who “took hundreds of millions out of their own pockets to protect users” during the recent volatility, a move he described as a demonstration of “different value systems.”

His comments helped solidify investor sentiment, with analysts noting that CZ’s transparency about internal market structure has reassured traders that BNB’s rally is fundamentally driven rather than speculative. The token’s deflationary model and sustained ecosystem utility continue to underpin long-term confidence.

Can BNB Break $1,500 Next?

From a technical standpoint, BNB’s breakout above $1,236 resistance has activated bullish momentum, with the RSI hovering near 65, showing strong but not overbought conditions.

MACD crossover and robust volume spikes point to further upside potential. A close above $1,349 (the October 7 high) could propel the token toward $1,400–$1,452, with the next key psychological milestone at $1,500.

Support remains firm at $1,192–$1,220, providing a cushion against short-term volatility. Analysts caution that while BNB’s momentum is strong, profit-taking around the $1,350–$1,400 zone could lead to brief consolidation before the next leg higher.

Cover image from ChatGPT, BNBUSD chart from Tradingview

XRP Price Faces Wall – Recovery Hits Resistance As Market Momentum Fades Again

XRP price started a fresh increase above $2.450. The price is now showing positive signs but faces a...

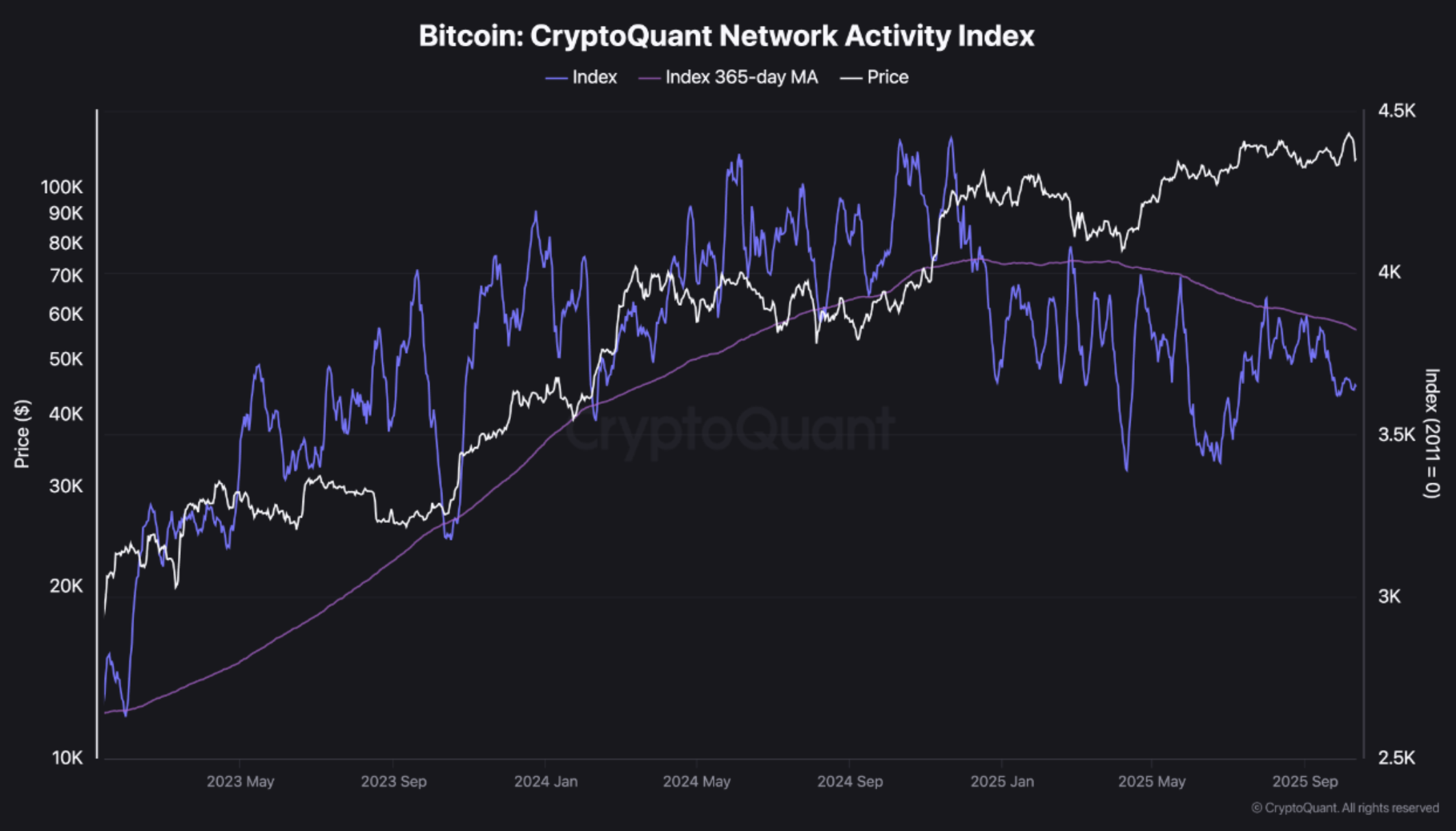

Bitcoin On-Chain Activity Slumps Below 365-Day Average – Is Momentum Losing Steam?

Following Bitcoin’s (BTC) brutal sell-off on October 9, which saw the top cryptocurrency by market c...

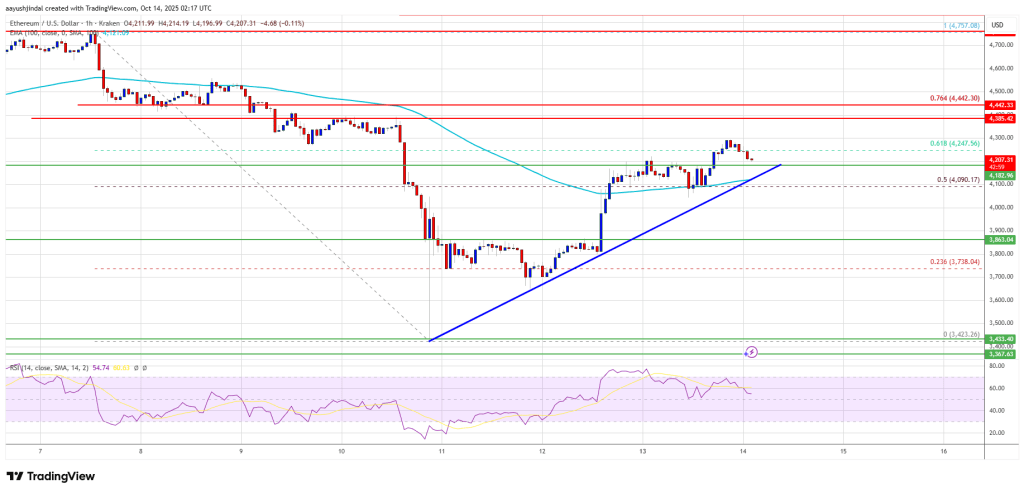

Ethereum Shows Strength – Bulls Aim Higher As ETH Eyes Potential Outperformance

Ethereum price started a fresh recovery above $4,120. ETH is now showing positive signs and might ri...