Is the Crypto Bear Market Here? Whales Go Short, Fears Spike Big

The post Is the Crypto Bear Market Here? Whales Go Short, Fears Spike Big appeared first on Coinpedia Fintech News

The crypto market is flashing warning signals today, with the total market cap slipping to $3.83 trillion, down 0.62%. Major indices by CoinMarketCap reflect caution, the CMC 20 index sits nearly flat at $243.75, and the fear & greed index has plunged straight into fear at 37. Moreover, the altcoin season is cooling off at 38/100. Even the average crypto RSI is only 47.93, hinting at waning momentum.

With market-moving news such as the NY FED manufacturing index, the Philly FED manufacturing report, and NAHB housing manufacturing all dropping this week, volatility is on the cards. Today’s landscape feels tense, and rightfully so, the U.S. government just moved 667 BTC, worth about $75M to a fresh wallet. Overlay this with the recent action of an “insider whale” who’s scaled his short to over $500M, expecting a deeper plunge.

Whale Moves and Government Activity

When whales act, the market listens. As per SwanDesk , the so-called “insider whale” responsible for last week’s flash crash has aggressively doubled down, pushing his short position past $500 million. The whale is betting heavily against the market in anticipation of further declines.

This level of conviction rarely happens without a seismic shift behind the scenes. At the same time, the U.S. government shifting 667 BTC is not something to ignore. Historically, such transfers often precede sales that put heavy selling pressure, and investors are understandably nervous about a sudden dump that could accelerate bearish momentum.

Exchange Outflows and Liquidations

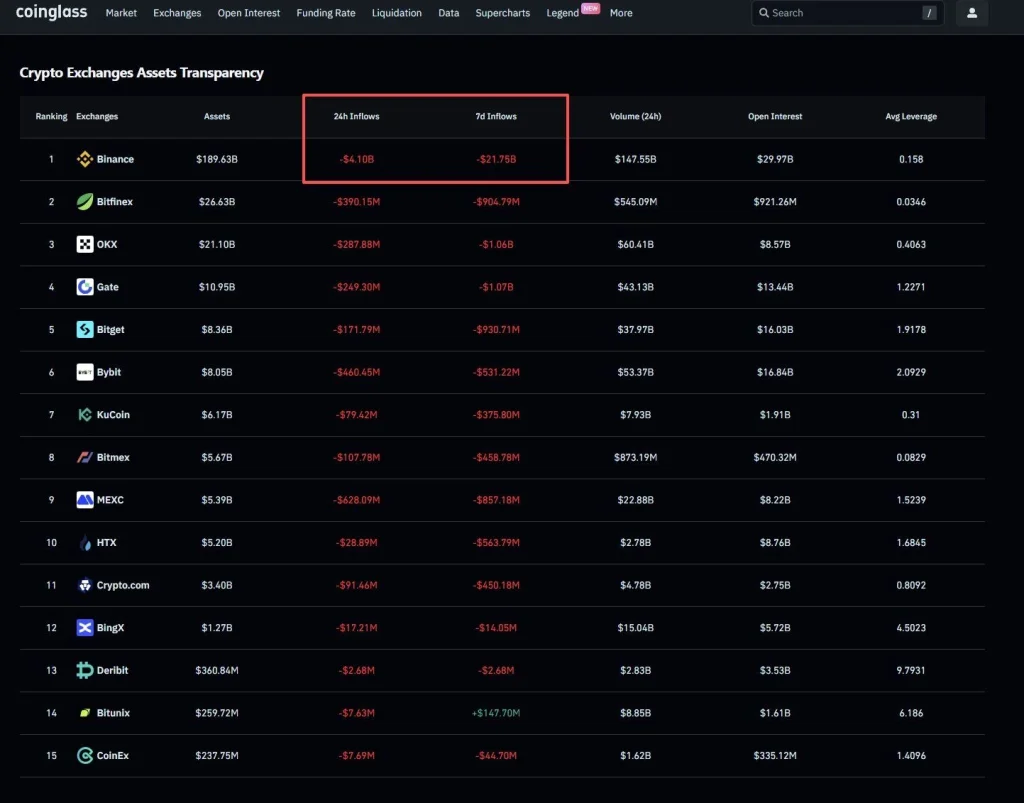

As per CoinGlass , centralized crypto exchanges are registering significant outflows, a classic sign of uncertainty and loss of confidence. Binance experienced a staggering $4.1B net outflow in 24 hours, with many major platforms showing similar patterns. This data supports the narrative that large players are either exiting to sidestep further losses or preparing to sell off elsewhere.

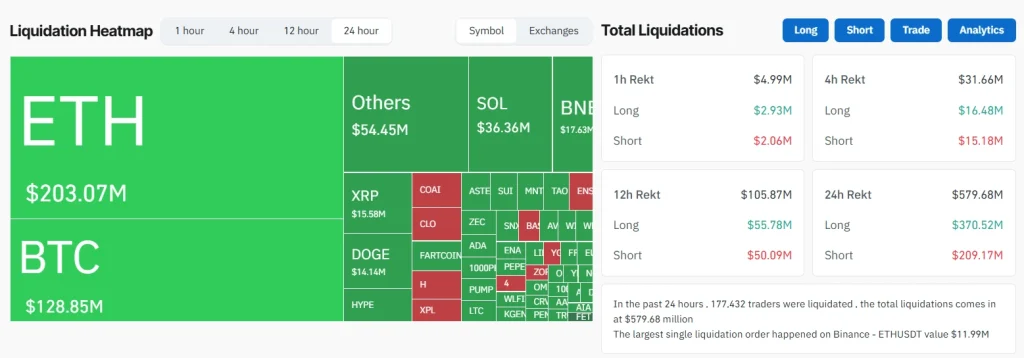

Successively, the liquidation map shows nearly $580 million in positions were wiped out over the past day, with ETH and BTC leading the pack ($203M and $129M, respectively). Most of these liquidations are of long positions, which tells me that bullish traders are getting caught out, fueling even more cautious sentiment.

Bearish Indicators and Market Sentiment

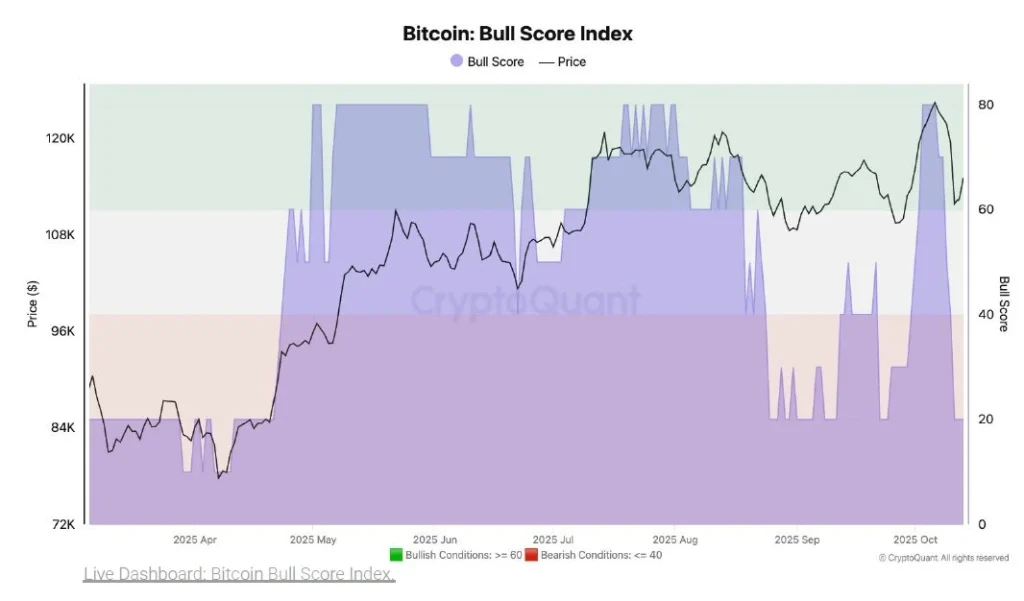

CryptoQuant’s Bull Score Index has not just cooled, it’s collapsed. From a robust 80 last week, it now languishes at 20. Historically, readings below 40 have aligned with bearish market phases. Across sentiment gauges, fear is in control: the fear & greed index points at 37, and altcoin momentum has dropped sharply. Recent price action isn’t just a blip, there’s a sense of persistent risk aversion rippling through all corners of the crypto world.

Macro Events and Risks Ahead

It’s not just internal crypto factors that have traders on edge. With whales and the government positioning for downside, and liquidations stacking up, any hawkish event could tip this shaky market over into a bear phase.

FAQs

Government wallet moves often foreshadow institutional sales. Such dumps can trigger accelerated market declines, especially when sentiment is already fragile.

No signal is ever “guaranteed”. However, when a whale commits $500M+ in shorts, it’s usually based on information or conviction about an imminent downturn, which adds weight to bearish indicators.

XRP, Cardano, And BNB Slide In Market Reset: PepetoStands Out As The Best Crypto Move, With Staking

The post XRP, Cardano, And BNB Slide In Market Reset: PepetoStands Out As The Best Crypto Move, With...

‘Ripple Does Not Control XRP’, Says CEO Brad Garlinghouse at DC Fintech Week

The post ‘Ripple Does Not Control XRP’, Says CEO Brad Garlinghouse at DC Fintech Week appeared first...

Pi Network News: Did Binance’s CZ Indirectly Explain Why Pi Coin Isn’t Listed Yet?

The post Pi Network News: Did Binance’s CZ Indirectly Explain Why Pi Coin Isn’t Listed Yet? appeared...